-

US lawmaker accuses Azerbaijan in near 'assault' at COP29

US lawmaker accuses Azerbaijan in near 'assault' at COP29

-

Tuchel's England have 'tools' to win World Cup, says Carsley

-

Federer hails 'historic' Nadal ahead of imminent retirement

Federer hails 'historic' Nadal ahead of imminent retirement

-

Ukraine vows no surrender, Kremlin issues nuke threat on 1,000th day of war

-

Novo Nordisk's obesity drug Wegovy goes on sale in China

Novo Nordisk's obesity drug Wegovy goes on sale in China

-

Spain royals to visit flood epicentre after chaotic trip: media

-

French farmers step up protests against EU-Mercosur deal

French farmers step up protests against EU-Mercosur deal

-

Rose says Europe Ryder Cup stars play 'for the badge' not money

-

Negotiators seek to break COP29 impasse after G20 'marching orders'

Negotiators seek to break COP29 impasse after G20 'marching orders'

-

Burst dike leaves Filipino farmers under water

-

Markets rally after US bounce as Nvidia comes into focus

Markets rally after US bounce as Nvidia comes into focus

-

Crisis-hit Thyssenkrupp books another hefty annual loss

-

US envoy in Lebanon for talks on halting Israel-Hezbollah war

US envoy in Lebanon for talks on halting Israel-Hezbollah war

-

India to send 5,000 extra troops to quell Manipur unrest

-

Sex, drugs and gritty reality on Prague's underworld tours

Sex, drugs and gritty reality on Prague's underworld tours

-

Farmers descend on London to overturn inheritance tax change

-

Clippers upset Warriors, Lillard saves Bucks

Clippers upset Warriors, Lillard saves Bucks

-

Acquitted 'Hong Kong 47' defendant sees freedom as responsibility

-

Floods strike thousands of houses in northern Philippines

Floods strike thousands of houses in northern Philippines

-

Illegal farm fires fuel Indian capital's smog misery

-

SpaceX set for Starship's next flight, Trump expected to attend

SpaceX set for Starship's next flight, Trump expected to attend

-

Texans cruise as Cowboys crisis deepens

-

Do the Donald! Trump dance takes US sport by storm

Do the Donald! Trump dance takes US sport by storm

-

Home hero Cameron Smith desperate for first win of 2024 at Australian PGA

-

Team Trump assails Biden decision on missiles for Ukraine

Team Trump assails Biden decision on missiles for Ukraine

-

Hong Kong court jails 45 democracy campaigners on subversion charges

-

Several children injured in car crash at central China school

Several children injured in car crash at central China school

-

Urban mosquito sparks malaria surge in East Africa

-

Djibouti experiments with GM mosquito against malaria

Djibouti experiments with GM mosquito against malaria

-

Pulisic at the double as USA cruise past Jamaica

-

Many children injured after car crashes at central China school: state media

Many children injured after car crashes at central China school: state media

-

Asian markets rally after US bounce as Nvidia comes into focus

-

Tens of thousands march in New Zealand Maori rights protest

Tens of thousands march in New Zealand Maori rights protest

-

Five takeaways from the G20 summit in Rio

-

China, Russia ministers discuss Korea tensions at G20: state media

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

-

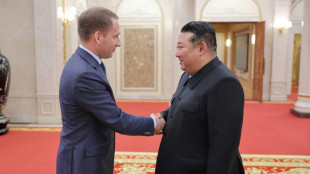

Russian delegations visit Pyongyang as Ukraine war deepens ties

Russian delegations visit Pyongyang as Ukraine war deepens ties

-

S.Africa offers a lesson on how not to shut down a coal plant

-

Italy beat Swiatek's Poland to reach BJK Cup final

Italy beat Swiatek's Poland to reach BJK Cup final

-

Japan, UK to hold regular economic security talks

-

Divided G20 fails to agree on climate, Ukraine

Divided G20 fails to agree on climate, Ukraine

-

Can the Trump-Musk 'bromance' last?

-

US to call for Google to sell Chrome browser: report

US to call for Google to sell Chrome browser: report

-

Macron hails 'good' US decision on Ukraine missiles

-

Italy eliminate Swiatek's Poland to reach BJK Cup final

Italy eliminate Swiatek's Poland to reach BJK Cup final

-

Trump expected to attend next Starship rocket launch: reports

-

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

-

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

Meta quarterly profit jumps but it sees volatility in ad market

Meta on Wednesday reported that its quarterly profit more than doubled from last year's figure as it looks ahead at a volatile ad market and lawsuits accusing it of profiting from "children's pain."

"Meta earnings looked pretty good," said independent tech analyst Rob Enderle.

"They have clearly cut back on the bleeding surrounding their metaverse efforts and the company appears to be on a more even keel right now."

The tech giant said it made a profit of $11.6 billion as ad revenue climbed 23 percent to $34 billion when compared to the same period a year earlier.

"We had a good quarter for our community and business," said Meta chief executive Mark Zuckerberg.

The number of people using Facebook monthly rose slightly to 3.05 billion in a year-over-year comparison while monthly active users of Meta's "family" of apps was 3.96 billion in a 7 percent increase from the same quarter in 2022, the company reported.

Meta said it had trimmed costs, with layoffs and other belt-tightening measures started last year providing "greater efficiency."

Meta had suffered a rough 2022 amid a souring economic climate and Apple's data privacy changes, which allowed users to block ad targeting, the pillar of Meta's business.

Meta's vow of austerity on spending brought an unprecedented round of cost-cutting that saw the company lay off tens of thousands of workers since last November.

Meta shares, which closed the formal trading day down, fell more than three percent further in after-hours trades to $289.50.

Chief financial officer Susan Li said during an earnings call that Meta is seeing "volatility" in an ad market that started to soften when the conflict between Israel and Hamas began.

"It's hard for us to attribute demand softness directly to any specific geopolitical event," Li said.

"We have seen broader demand softness follow other regional conflicts in the past, such as in the Ukraine war, so this is something that we're continuing to monitor."

- Lawsuit peril -

Analyst Enderle maintained that Meta is at risk from lawsuits poised to damage its image and its wallet.

Dozens of US states this week accused Meta of profiting "from children's pain," damaging their mental health and misleading people about the safety of its platforms.

"In seeking to maximize its financial gains, Meta has repeatedly misled the public about the substantial dangers of its Social Media Platforms," argued a joint lawsuit filed in federal court in California.

The states accused Meta of exploiting young users by creating a business model designed to maximize time they spend on the platform despite harm to their health.

In total more than 40 states are suing Meta, though some opted to file in local courts rather than join in the federal case.

Meta said the states were singling it out unfairly instead of working with social media companies to develop universal standards for the whole industry.

"This landmark lawsuit could herald a seismic shift in how social media platforms approach product features and user engagement," said Insider Intelligence principal analyst Jeremy Goldman.

"That said, even as tech stocks face uncertainty, Meta's consistent performance cements its leadership in the digital realm."

Meanwhile, the European Union is seeking details on measures Meta has taken to stop the spread of "illegal content and disinformation" in light of the conflict between Israel and Hamas.

- The AI race -

The tech giant is putting artificial intelligence into digital assistants and smart glasses as it seeks to gain lost ground in the AI race.

"I'm proud of the work our teams have done to advance AI and mixed reality with the launch of Quest 3, Ray-Ban Meta smart glasses, and our AI studio," Zuckerberg said in the earnings release.

The second-generation Meta Ray-Ban smart glasses made in a partnership with EssilorLuxottica have a starting price of $299.

"Smart glasses are the ideal form factor for you to let AI assistants see what you're seeing and hear what you're hearing," Zuckerberg said.

Meta has taken a more cautious approach than its rivals Microsoft, OpenAI and Google to push out AI products, prioritizing small steps and making its in-house models available to developers and researchers.

"The majority of the world's population will have their first experience of generative artificial intelligence with us," Meta chief technology officer Andrew "Boz" Bosworth told AFP in a recent interview.

Meta recently unveiled AI-infused chatbots with personalities, along with tools for creating images or written content using spoken prompts.

A.Moore--AT