-

Forest beat third-tier Exeter on penalties after huge FA Cup scare

Forest beat third-tier Exeter on penalties after huge FA Cup scare

-

Real Madrid late show exposes Man City's decline

-

Guardiola laments lack of Man City composure in Madrid collapse

Guardiola laments lack of Man City composure in Madrid collapse

-

Unhappy Mbangula gives Juve advantage over PSV in Champions League play-offs

-

Real Madrid stun Man City as PSG down Brest in Champions League

Real Madrid stun Man City as PSG down Brest in Champions League

-

Fury as US Open chiefs announce mixed doubles revamp

-

AP reporter barred from White House event over 'Gulf of America'

AP reporter barred from White House event over 'Gulf of America'

-

Bellingham strikes late as Real Madrid pile misery on Man City

-

Mbangula gives Juve advantage over PSV in Champions League play-offs

Mbangula gives Juve advantage over PSV in Champions League play-offs

-

Classy Guirassy puts Dortmund in driving seat against Sporting

-

AI feud: How Musk and Altman's partnership turned toxic

AI feud: How Musk and Altman's partnership turned toxic

-

US TV record 127.7 million watched Eagles win Super Bowl

-

A gifted footballer, Sam Kerr's reputation takes hit after London trial

A gifted footballer, Sam Kerr's reputation takes hit after London trial

-

WHO facing 'new realities' as US withdrawal looms

-

Zelensky offers land swaps as Russia heartens Trump with prisoner release

Zelensky offers land swaps as Russia heartens Trump with prisoner release

-

Trump insists US to own Gaza, Jordan king pushes back

-

US inflation fight to take time in 'highly uncertain' environment: Fed official

US inflation fight to take time in 'highly uncertain' environment: Fed official

-

Scott says Trump meeting was 'positive' for PGA-LIV deal

-

Israel says to resume Gaza fighting if hostages not released Saturday

Israel says to resume Gaza fighting if hostages not released Saturday

-

Jordan king vows to take sick Gaza kids, rejects Trump plan to remove Palestinians

-

Dozens evacuated as fire breaks out in 50-floor building in Buenos Aires

Dozens evacuated as fire breaks out in 50-floor building in Buenos Aires

-

Bumrah ruled out of India's Champions Trophy squad

-

Dembele stars again as PSG beat Brest in Champions League play-off first leg

Dembele stars again as PSG beat Brest in Champions League play-off first leg

-

Russia frees American as Trump envoy sees 'goodwill' over Ukraine

-

Eagles offensive coordinator Moore hired as Saints coach

Eagles offensive coordinator Moore hired as Saints coach

-

World number one Sabalenka dumped out of Qatar Open

-

Ford CEO says Trump policy uncertainty creating chaos

Ford CEO says Trump policy uncertainty creating chaos

-

Israel says to resume Gaza fighting if no hostages released Saturday

-

South Africa to face Argentina in London Rugby Championship clash

South Africa to face Argentina in London Rugby Championship clash

-

'Senile insanity': Ukrainians outraged at Trump's Russia comment

-

Ohtani excites with pitching video as MLB Dodgers begin work

Ohtani excites with pitching video as MLB Dodgers begin work

-

Jordan to take sick Gaza kids as Trump pushes takeover plan

-

Israel says to resume Gaza fighting if no hostages released

Israel says to resume Gaza fighting if no hostages released

-

Crew open against Toluca, Miami with Atlas in Leagues Cup

-

US Fed chair says in no rush to tweak interest rate policy

US Fed chair says in no rush to tweak interest rate policy

-

Dam fine: beavers save Czech treasury $1 million

-

Rodgers hopes to make Bayern 'hurt' at Celtic

Rodgers hopes to make Bayern 'hurt' at Celtic

-

Canada, Mexico, EU slam 'unjustified' Trump steel tariffs

-

Altman says OpenAI 'not for sale' after Musk's $97 bn bid

Altman says OpenAI 'not for sale' after Musk's $97 bn bid

-

Trump says US disaster relief agency should be 'terminated'

-

Everton's Moyes aims to bridge gap to mighty Liverpool

Everton's Moyes aims to bridge gap to mighty Liverpool

-

At least $53 billion needed to rebuild Gaza, UN estimates

-

Trump blasts judges, fueling fear of constitutional clash

Trump blasts judges, fueling fear of constitutional clash

-

Fans snap up tickets for Black Sabbath reunion and Ozzy Osbourne's farewell gig

-

US foreign aid halt to have major hit on poorest countries: report

US foreign aid halt to have major hit on poorest countries: report

-

US farmers say Trump let them down with spending freeze

-

US star Vonn eyes Olympic hurrah after bowing out of world champs

US star Vonn eyes Olympic hurrah after bowing out of world champs

-

Chelsea's Boehly buys stake in Hundred cricket franchise Trent Rockets

-

Pope told to 'stick to Church' after Trump migrant critique

Pope told to 'stick to Church' after Trump migrant critique

-

Shiffrin bags record-equalling 15th world medal after Johnson combo

Art's Way Announces Fiscal 2024 Results, Led By Strong Year From Modular Building Segment And Improved Liquidity Despite Difficult AG Conditions

ARMSTRONG, IA / ACCESS Newswire / February 11, 2025 / Art's-Way Manufacturing Co., Inc. (Nasdaq:ARTW) (the "Company"), a diversified, international manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for fiscal 2024.

Agricultural Products: Our Agricultural Products segment's net sales for the 2024 fiscal year were $14,663,000 compared to $22,467,000 during the 2023 fiscal year, a decrease of $7,804,000, or 34.7%. Commodity prices in the agricultural market dropped below five-year averages in fiscal 2024, which lead to a meaningful decrease in demand for our agricultural products. This demand decrease was not isolated to our company, instigating mass layoffs and major production cuts in fiscal 2024 for many in our industry. Another factor in the sales decrease we experienced was the amount of inventory on dealer lots at the end of fiscal 2023. Many dealers were oversaturated with inventory related to excess demand in 2023 from high commodity prices and supply chains' inability to keep up. This turned drastically in the first quarter of fiscal 2024, as increasing interest rates and declining commodity prices decreased expected net farm income. Gross profit percentage in the Agricultural Products segment for the 2024 fiscal year was 28.3% compared to 29.3% for the 2023 fiscal year. We continued to see inflationary pressure in fiscal 2024. Steel prices rose through the summer of fiscal 2024 but leveled off and dropped near the end of the year. We continued to see price increases from insurance groups and other manufacturing expense companies, which led to an increase in our overhead costs. These factors and the overall sales decrease contributed to the drop in gross profit percentage. We put a focus on cost reductions on two of our highest volume products in fiscal 2024, which we expect to bear fruit in fiscal 2025.

Modular Buildings: Our Modular Buildings segment's net sales for the 2024 fiscal year were $9,836,000 compared to $7,814,000 for the 2023 fiscal year, an increase of $2,022,000, or 25.9%. While our agricultural products building sales suffered under the same adverse market conditions of our Agricultural Products segment, we saw increased demand in the research markets for our modular products, which led to a 124% increase in research sales. Our Modular Building segment's gross profit percentage for the 2024 fiscal year was 32.1% compared to 25.6% during the 2023 fiscal year. Our project performance in fiscal 2024 exceeded expectations as our workforce was consistently under budget on production disciplines. We are also historically more efficient when our shop is busy and perform better on research projects as we often have more contingency built in than traditional ag modulars. Our project management team continued to build on fiscal 2023 strides to increase profitability on projects and to provide better service to our customers. This focus translated to some of the best results we have seen in this operating segment, and we believe our sales funnel leading into fiscal 2025 can deliver similar performance.

Discontinued Operations: On June 7, 2023 we announced we would be discontinuing our Tools segment with the last day of normal operations occurring on July 14, 2023. Just over a year later, on October 21, 2024, we completed the sale of the remaining real estate associated with our Tools segment for $1,800,000. The Company's assets and liabilities from this segment were gone prior to November 30, 2024 and will no longer report discontinued operations in our current year financials moving forward. Our discontinued operations generated approximately $1,271,000 from operating, investing and financing activities mainly related to closing activities and the sale of the real estate. Our Tools segment reported net income of $402,000 for the twelve months ending November 30, 2024 compared to net loss of $496,000 in the same period of fiscal 2023.

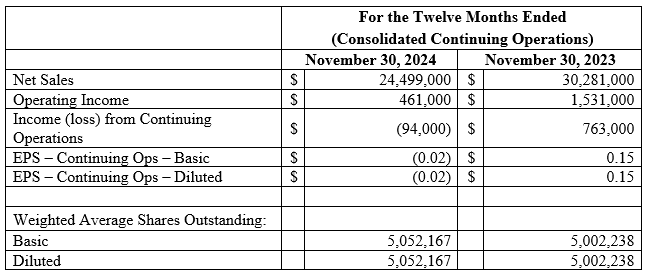

Operating income (continuing operations): Our consolidated operating income from continuing operations for the 2024 fiscal year was $461,000 compared to operating income of $1,531,000 for the 2023 fiscal year. Our Agricultural Products segment had an operating loss of $1,510,000, and our Modular Buildings segment had operating income of $1,971,000.

Net income (loss) per share (continuing operations): Loss per basic and diluted share from continuing operations for the 2024 fiscal year was $(0.02), compared to net income of $0.15 per share for the 2023 fiscal year.

Consolidated net income (continuing and discontinued operations): Consolidated net income for the 2024 fiscal year was $307,000 compared to net income of $267,000 in the 2023 fiscal year.

Backlog: The Company's backlog of orders varies on a daily basis. The Company's Agricultural Products segment had a net backlog of approximately $3,486,000 as of February 4, 2025 compared to $4,364,000 on February 4, 2024. The overall agriculture economy remained stagnant for our fall early order program after three years of increased demand. High interest rates and low commodity prices are still affecting demand as we roll into fiscal 2025, however, we have seen better than expected demand for our grinder mixers. The Company's Modular Buildings segment had approximately $2,393,000 backlog as of February 4, 2025, compared to $6,170,000 on that date in 2024. The Modular Buildings segment has strong leads in the engineering phase that we expect to reach contract phase, which could bring us to similar revenue results as were achieved during fiscal 2024. The Company expects that its order backlogs will continue to fluctuate as orders are received, filled, or canceled, and, due to dealer discount arrangements it may enter into from time to time. Accordingly, these figures are not necessarily indicative of future revenue.

Marc McConnell, Chairman, President and CEO of Art's Way states, "Fiscal 2024 was a year of considerable challenges and transition at Art's Way, yet one that demonstrated the benefits of our diversification strategy. Amid a significant down cycle in the farm equipment industry, we experienced a reduction in demand along with our industry peers. Meanwhile we benefited greatly from the tremendous growth and operational performance in our Modular Buildings segment. We responded to challenges in our Agricultural Products segment by focusing closely on cost reductions, reducing debt, and improving cashflow while maintaining our emphasis on quality, innovation, and customer experience. We are confident these measures position the company for improving markets in the future and are pleased to report that our current debt level represents a historical low.

Going forward we have meaningful reason for optimism in both business segments for 2025 and beyond. There are positive indications in the dairy and livestock markets that could drive demand for our products serving those markets. We also carry positive momentum into the new year in our Modular Buildings segment that we believe we can sustain. On a consolidated basis we anticipate that solid demand, reduced overhead expenses, improved liquidity and reduced interest expense from debt reduction will result in improved profitability and cashflow in fiscal 2025."

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 130 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact: Marc McConnell, Chairman, President and Chief Executive Officer.

712-208-8467

[email protected]

Or visit our website at www.artsway.com/

Cautionary Note Regarding Forward-Looking Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts are forwarding-looking statements. In some cases, forward-looking statements may be identified by the use of words such as "may," "should," "anticipate," "believe," "expect," "plan," "future," "intend," "could," "estimate," "predict," "hope," "potential," "continue," "foresee," or the negative of these terms or other similar expressions. Forward-looking statements in this release generally relate to our expectations regarding: (i) the Company's business position; (ii) potential growth in the Company's business segments and sales, including positive momentum in its Modular Buildings segment; (iii) future results, including but not limited to, expectations regarding demand, the impact of higher interest rates, inventory requirements, revenue and margins; (iv) the Company's beliefs about indications in the dairy and livestock markets and how such indications may affect future demand for the Company's products; (v) the Company's expectations regarding how cost reduction efforts may benefit future performance; (vi) the Company's beliefs regarding backlog, contracting projects, and completion of projects, including revenues resulting therefrom; and (vii) the benefits of the Company's business model and strategy. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of its customers; its ability to operate at lower expense levels; its ability to complete projects in a timely and efficient manner in accordance with customer specifications; its ability to renew or obtain financing on reasonable terms; its ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and its effect on our supply chain and demand for its products, domestic and international economic conditions; its ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by its operating segments; obstacles related to liquidation of product lines and controlling costs; and other factors detailed from time to time in the Company's Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. The Company cautions readers not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co.

View the original press release on ACCESS Newswire

M.White--AT