-

Wall Street climbs as markets brace for possible govt shutdown

Wall Street climbs as markets brace for possible govt shutdown

-

Pogba wants to 'turn page' after brother sentenced in extortion case

-

Court rules against El Salvador in controversial abortion case

Court rules against El Salvador in controversial abortion case

-

Reggaeton star Daddy Yankee, wife resolve business dispute

-

French court hands down heavy sentences in teacher beheading trial

French court hands down heavy sentences in teacher beheading trial

-

Israel army says troops shot Syrian protester in leg

-

Tien sets-up all-American NextGen semi-final duel

Tien sets-up all-American NextGen semi-final duel

-

Bulked-up Fury promises 'war' in Usyk rematch

-

Major reshuffle as Trudeau faces party pressure, Trump taunts

Major reshuffle as Trudeau faces party pressure, Trump taunts

-

Reggaeton star Daddy Yankee in court, says wife embezzled $100 mn

-

Injured Eze out of Palace's clash with Arsenal

Injured Eze out of Palace's clash with Arsenal

-

Norway's Deila named coach of MLS Atlanta United

-

In Damascus meeting, US drops reward for arrest of Syria's new leader

In Damascus meeting, US drops reward for arrest of Syria's new leader

-

Inter-American Court rules Colombia drilling violated native rights

-

Amazon expects no disruptions as US strike goes into 2nd day

Amazon expects no disruptions as US strike goes into 2nd day

-

Man Utd 'more in control' under Amorim says Iraola

-

Emery insists Guardiola 'still the best' despite Man City slump

Emery insists Guardiola 'still the best' despite Man City slump

-

US confirms billions in chips funds to Samsung, Texas Instruments

-

English Rugby Football Union chairman quits amid pay row

English Rugby Football Union chairman quits amid pay row

-

Wall Street rebounds despite US inflation ticking higher

-

Major reshuffle as Trudeau faces party pressure, Trump attacks

Major reshuffle as Trudeau faces party pressure, Trump attacks

-

Serbia schools to shut amid new protests over station collapse

-

Serbia schools shut amid new protests over station collapse

Serbia schools shut amid new protests over station collapse

-

Gatland remains as Wales boss but must 'change fortunes on the pitch'

-

Argentina's dollar craze cools under greenback-loving Milei

Argentina's dollar craze cools under greenback-loving Milei

-

Medici secret passageway in Florence reopens after refit

-

Anger after Musk backs German far right

Anger after Musk backs German far right

-

Arteta says 'best is yet to come' as he marks five years at Arsenal

-

Pereira happy to achieve Premier League 'target' with Wolves

Pereira happy to achieve Premier League 'target' with Wolves

-

'Dark lull' in German energy transition sparks political debate

-

Russian skaters allowed to compete as neutrals in 2026 Winter Olympics

Russian skaters allowed to compete as neutrals in 2026 Winter Olympics

-

Russian missile barrage on Kyiv kills one, damages embassies

-

No longer Assad's mouthpiece, Syrian media face uncertainty

No longer Assad's mouthpiece, Syrian media face uncertainty

-

US diplomats meet with Syria's new ruler

-

EU, Swiss hail 'historic' new deal resetting relations

EU, Swiss hail 'historic' new deal resetting relations

-

Stocks retreat as US inflation ticks higher

-

Two dead after Lapland tourist bus crash in Finland

Two dead after Lapland tourist bus crash in Finland

-

Fed's favored inflation gauge edges higher in November

-

Ex-IMF chief Rato gets four-year jail term in Spain for tax crimes

Ex-IMF chief Rato gets four-year jail term in Spain for tax crimes

-

Spain orders 25 more Eurofighter jets from Airbus

-

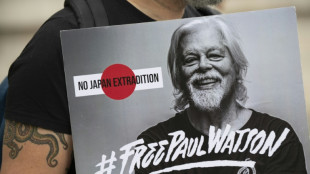

Anti-whaling campaigner Paul Watson arrives in France

Anti-whaling campaigner Paul Watson arrives in France

-

Fed's favored inflation gauge rises again in November

-

Spurs boss Postecoglou blasts 'offensive' personal criticism

Spurs boss Postecoglou blasts 'offensive' personal criticism

-

Seven-year-old dies in stabbing attack at Croatia school

-

'Life is short': Vonn makes comeback in St Moritz

'Life is short': Vonn makes comeback in St Moritz

-

Man Utd's Mount out for 'several weeks' as injury woes return

-

Chilwell likely to be first to ask to leave Chelsea, says Maresca

Chilwell likely to be first to ask to leave Chelsea, says Maresca

-

US hours from government shutdown over Christmas

-

French PM rushes to name new government by Christmas

French PM rushes to name new government by Christmas

-

Russian missile barrage on Kyiv kills one, damages diplomatic missions

Wall Street rebounds despite US inflation ticking higher

Wall Street stocks bounced higher Friday despite data showing an uptick in inflation and a looming US government shutdown.

Data showed the personal consumption expenditures (PCE) price index rose 2.4 percent in the 12 months to November, up from 2.3 percent in October, the Commerce Department said in a statement.

The core reading of PCE price index -- the Federal Reserve's preferred inflation measure -- that excludes highly volatile food and energy prices stayed steady at 2.8 percent.

Wall Street's main stock indices initially fell on the news, continuing a spiral lower after the Federal Reserve on Wednesday signalled fewer cuts than had been expected for 2025 as inflation remains sticky above its two percent target.

However they bounced higher during morning trading.

While the annual inflation measures ticked higher, they dropped month-on-month, providing some relief to investors.

Core prices rose just 0.1 percent from October, compared to monthly increases of 0.2 or 0.3 percent the previous five months, pointing to a slight slowdown in what is sure to be welcome news for the US central bank.

New York Fed President John Williams, a voting member of the Fed committee which sets rates, told CNBC that the data shows "the disinflation process is continuing" and that it offers "a little bit of good news this month".

Jochen Stanzl, Chief Market Analyst at CMC Markets, also called the data "good news," say it will lead to a moderation in the increase in the PCE price index over a longer term.

"Today's PCE data serves as quite a reprieve after this week's sell-off," he said.

Investors were keeping a watch also on developments in Washington.

The House of Representatives has rejected a Republican-led funding bill to avert a government shutdown, with federal agencies due to run out of cash Friday night and cease operations from this weekend.

The legislation would have kept the government open through March and suspended the borrowing limit for president-elect Donald Trump's first two years in office.

O'Hare noted US Treasury yields fell overnight, "driven by some safe-haven trading that stemmed from the ongoing weakness in the stock market and heightened political uncertainty" following the rejection of the government funding bill.

Friday's Wall Street rebound could also be driven by it being a so-called triple witching day when stock, index and index futures contracts expire. With more than $6 trillion in options estimated to expire, trading could prove volatile.

European stocks finished the day lower although they cut their losses as Wall Street rebounded, with data showing tepid retail sales in the UK in the runup to Christmas dampening sentiment.

Oil prices, which have also fallen since the Fed's Wednesday announcement, continued their slide lower.

- Key figures around 1630 GMT -

New York - Dow: UP 1.4 percent at 42,947.20 points

New York - S&P 500: UP 1.4 percent at 5,948.04

New York - Nasdaq Composite: UP 1.4 percent at 19,634.69

London - FTSE 100: DOWN 0.3 percent at 8,084.61 (close)

Paris - CAC 40: DOWN 0.3 percent at 7,274.48 (close)

Frankfurt - DAX: DOWN 0.3 percent at 19,916.56 (close)

Tokyo - Nikkei 225: DOWN 0.3 percent at 38,701.90 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 19,720.70 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,368.07 (close)

Euro/dollar: UP at $1.0414 from $1.0364 on Thursday

Pound/dollar: UP at $1.2576 from $1.2496

Dollar/yen: DOWN at 156.32 yen from 157.35 yen

Euro/pound: DOWN at 82.83 pence from 82.91 pence

West Texas Intermediate: DOWN 0.1 percent at $69.32 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $72.81 per barrel

burs-rl/gv

P.Smith--AT