-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Biden commutes almost all federal death sentences

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

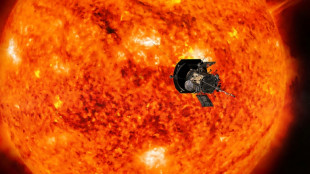

NASA solar probe to make its closest ever pass of Sun

-

France's new government to be announced Monday evening: Elysee

France's new government to be announced Monday evening: Elysee

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

-

Bangladesh launches $5bn graft probe into Hasina's family

Bangladesh launches $5bn graft probe into Hasina's family

-

US probes China chip industry on 'anticompetitive' concerns

-

Biden commutes sentences for 37 of 40 federal death row inmates

Biden commutes sentences for 37 of 40 federal death row inmates

-

Clock ticks down on France government nomination

-

'Devastated' Australian tennis star Purcell provisionally suspended for doping

'Devastated' Australian tennis star Purcell provisionally suspended for doping

-

Mozambique on edge as judges rule on disputed election

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Philippines says to acquire US Typhon missile system

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Police arrest suspect who set woman on fire in New York subway

-

China vows 'cooperation' over ship linked to severed Baltic Sea cables

China vows 'cooperation' over ship linked to severed Baltic Sea cables

-

Australian tennis star Purcell provisionally suspended for doping

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Luxury Western goods line Russian stores, three years into sanctions

-

Wallace and Gromit return with comic warning about AI dystopia

Wallace and Gromit return with comic warning about AI dystopia

-

Philippine military says will acquire US Typhon missile system

-

Afghan bread, the humble centrepiece of every meal

Afghan bread, the humble centrepiece of every meal

-

Honda and Nissan expected to begin merger talks

-

'Draconian' Vietnam internet law heightens free speech fears

'Draconian' Vietnam internet law heightens free speech fears

-

Israeli women mobilise against ultra-Orthodox military exemptions

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Tens of thousands protest in Serbian capital over fatal train station accident

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Daniels throws five TDs as Commanders down Eagles, Lions and Vikings win

-

'Who's next?': Misinformation and online threats after US CEO slaying

'Who's next?': Misinformation and online threats after US CEO slaying

-

Only 12 trucks delivered food, water in North Gaza Governorate since October: Oxfam

-

Hochul Signs Step Therapy Reform Measures Into Law

Hochul Signs Step Therapy Reform Measures Into Law

-

CORRECTION FROM SOURCE: Greenlane Appoints Rob Shields as Chief Growth Officer

Tortoise Capital Completes Merger of Tortoise Power and Energy Infrastructure Fund, Inc. (NYSE: TPZ), Tortoise Pipeline & Energy Fund, Inc. (NYSE: TTP), and Tortoise Energy Independence Fund, Inc. (NYSE: NDP) and Conversion to Actively Managed ETF

Tortoise Capital Advisors, L.L.C. (Tortoise Capital), a fund manager focused on energy investing, today announced the completion of a strategic merger of three closed-end funds and conversion to an actively managed exchanged-traded fund (ETF).

Tortoise Power and Energy Infrastructure Fund, Inc. (NYSE:TPZ), Tortoise Pipeline & Energy Fund, Inc. (NYSE:TTP), and Tortoise Energy Independence Fund, Inc. (NYSE:NDP) have merged into a newly formed ETF, with TPZ emerging as the surviving strategy.

The Tortoise Power and Energy Infrastructure Fund (NYSE:TPZ) is adopting the accounting and performance history of the closed-end fund, offering continuity to existing shareholders while enhancing liquidity and accessibility. The ETF will maintain TPZ's focus on uncovering high-quality investment opportunities within the energy sector, targeting growth while striving to provide a high level of current income and efficient access to the U.S. energy landscape.

As of Dec. 20, 2024, the combined assets of the three transitioning funds totaled approximately $282.8 million. Under the terms of the conversion, shares of TTP and NDP were exchanged for shares of the ETF based on the respective net asset values (NAV) of each fund, as of Dec. 20, 2024. The exchange ratios were as follows:

TPZ: 1.00000000

TTP: 2.40891304

NDP: 2.04519311

"This merger achieved our objective of providing investors with net asset value. In addition, this conversion reflects our commitment to providing innovative solutions tailored to the needs of modern investors," said Tom Florence, CEO of Tortoise Capital. "By transitioning to an actively managed ETF, we've enhanced access and flexibility while preserving the strategy's legacy of delivering competitive income and exposure to the rapidly evolving energy sector."

The newly formed ETF represents a significant step forward for Tortoise Capital, combining the strengths of three closed-end funds into a single, streamlined investment vehicle. The ETF's strategy will continue to focus on high-quality energy investments, benefiting from the dynamic growth of the energy sector while seeking to deliver competitive income to investors.

About Tortoise Capital

With approximately $9.9 billion in assets under management as of Nov. 30, 2024, Tortoise Capital's record of investment experience and research dates back more than 20 years. As an early investor in midstream energy, Tortoise Capital believes it is well-positioned to be at the forefront of the global energy evolution that is under way. Based in Overland Park, Kansas, Tortoise Capital Advisors, L.L.C. is an SEC-registered investment adviser who manages funds that invest primarily in publicly traded companies in the energy and power infrastructure sectors-from production to transportation to distribution. For more information about Tortoise Capital, visit www.TortoiseAdvisors.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains certain statements that may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Although the funds and Tortoise Capital Advisors believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in the fund's reports that are filed with the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Other than as required by law, the funds and Tortoise Capital Advisors do not assume a duty to update this forward-looking statement.

Safe Harbor Statement

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

IMPORTANT INFORMATION

Tortoise Capital Advisors, L.L.C. is the investment adviser to Tortoise Power and Energy Infrastructure Fund, Inc. (NYSE: TPZ), Tortoise Pipeline & Energy Fund, Inc. (NYSE: TTP), and Tortoise Energy Independence Fund, Inc. (NYSE: NDP).

The fund's investment objective, risks, charges and expenses must be considered carefully before investing. The summary and statutory prospectus contains this and other important information about the fund and may be obtained by calling (855) 994-4437 or visiting www.tortoiseadvisors.com. Read it carefully before investing.

Shares of exchange-traded funds (ETFs) are not individually redeemable and owners of the shares may acquire those shares from the ETF and tender those shares for redemption to the ETF in Creation Units only, see the ETF prospectus for additional information regarding Creation Units. Investors may purchase or sell ETF shares throughout the day through any brokerage account, which will result in typical brokerage commissions.

Investing involves risk. Principal loss is possible. The fund is registered as a non-diversified, open-end management investment company under the 1940 Act. Accordingly, there are no regulatory limits under the 1940 Act on the number or size of securities that we hold, and we may invest more assets in fewer issuers compared to a diversified fund. An investment in MLP securities involves some risks that differ from the risks involved in an investment in the common stock of a corporation, including risks relating to the ownership structure of MLPs, the risk that MLPs might lose their partnership status for tax purposes and the risk that MLPs will not make distributions to holders (including us) at anticipated levels or with the expected tax character.

The Fund's strategy of concentrating its assets in the power and energy infrastructure industries means that the performance of the Fund will be closely tied to the performance of these particular market sectors.

We may invest a portion of our assets in fixed income securities rated "investment grade" by nationally recognized statistical rating organizations ("NRSROs") or judged by our investment adviser, Tortoise Capital Advisors, L.L.C. (the "Adviser"), to be of comparable credit quality. Non-investment grade securities are rated Ba1 or lower by Moody's, BB+ or lower by S&P or BB or lower by Fitch or, if unrated, are determined by our Adviser to be of comparable credit quality. Investments in the securities of non-U.S. issuers may involve risks not ordinarily associated with investments in securities and instruments of U.S. issuers, including different accounting, auditing and financial standards, less government supervision and regulation, additional tax withholding and taxes, difficulty enforcing rights in foreign countries, less publicly available information, difficulty effecting transactions, higher expenses, and exchange rate risk.

Restricted securities (including Rule 144A securities) are less liquid than freely tradable securities because of statutory and contractual restrictions on resale. This lack of liquidity creates special risks for us. Rule 144A provides an exemption from the registration requirements of the Securities Act of 1933 (the "1933 Act"), for the resale of certain restricted securities to qualified institutional buyers, such as the Fund. We cannot guarantee that our covered call option strategy will be effective. There are several risks associated with transactions in options on securities. For example, the significant differences between the securities and options markets could result in an imperfect correlation between these markets. Certain securities may trade less frequently than those of larger companies that have larger market capitalizations. Nothing in this article should be considered a solicitation to buy or an offer to sell any shares of the portfolio in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. Nothing contained in this communication constitutes tax, legal or investment advice. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation.

Quasar Distributors, LLC, Distributor

Media Contacts

Margaret Kirch Cohen/Richard Chimberg

Newton Park PR

+1 847-507-2229

+1 617-312-4281

[email protected]

[email protected]

SOURCE: Tortoise Capital

F.Ramirez--AT