-

Everton boss Dyche unconcerned by Maupay jibe

Everton boss Dyche unconcerned by Maupay jibe

-

FBI probes potential accomplices in New Orleans truck ramming

-

Secret lab developing UK's first quantum clock: defence ministry

Secret lab developing UK's first quantum clock: defence ministry

-

Premier League chief fears Club World Cup's impact on Man City and Chelsea

-

US mulls new restrictions on Chinese drones

US mulls new restrictions on Chinese drones

-

Wall Street dons early green after Asia starts year in red

-

Rosita Missoni of Italy's eponymous fashion house dies age 93

Rosita Missoni of Italy's eponymous fashion house dies age 93

-

27 sub-Saharan African migrants die off Tunisia in shipwrecks

-

UK grime star Stormzy banned from driving for nine months

UK grime star Stormzy banned from driving for nine months

-

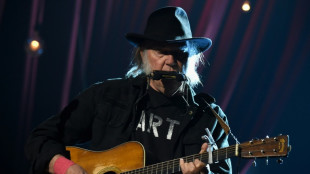

Neil Young dumps Glastonbury alleging 'BBC control'

-

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

-

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

Electric cars took 89% of Norway market in 2024

-

Stock markets begin new year with losses

-

Rival South Korea camps face off as president holds out

Rival South Korea camps face off as president holds out

-

French downhill ace Sarrazin out of intensive care

-

Djokovic cruises past Monfils as rising stars impress in Brisbane

Djokovic cruises past Monfils as rising stars impress in Brisbane

-

Montenegro mourns after gunman kills 12

-

Sales surge in 2024 for Chinese EV giant BYD

Sales surge in 2024 for Chinese EV giant BYD

-

Agnes Keleti, world's oldest Olympic champion, dies at 103

-

Asian stocks begin year on cautious note

Asian stocks begin year on cautious note

-

Andreeva, Mpetshi Perricard showcase Australian Open potential

-

South Korea police raid Jeju Air, airport over fatal crash

South Korea police raid Jeju Air, airport over fatal crash

-

Perera's 46-ball ton gives Sri Lanka consolation T20 win over New Zealand

-

Afghan refugees suffer 'like prisoners' in Pakistan crackdown

Afghan refugees suffer 'like prisoners' in Pakistan crackdown

-

Coach tight-lipped on whether Rohit will play in final Australia Test

-

Blooming hard: Taiwan's persimmon growers struggle

Blooming hard: Taiwan's persimmon growers struggle

-

South Korea's impeached president resists arrest over martial law bid

-

Knicks roll to ninth straight NBA win, Ivey hurt in Pistons victory

Knicks roll to ninth straight NBA win, Ivey hurt in Pistons victory

-

'Numb' New Orleans grapples with horror of deadly truck attack

-

Asia stocks begin year on cautious note

Asia stocks begin year on cautious note

-

FBI probes 'terrorist' links in New Orleans truck-ramming that killed 15

-

2024 was China's hottest year on record: weather agency

2024 was China's hottest year on record: weather agency

-

Perera smashes 46-ball ton as Sri Lanka pile up 218-5 in 3rd NZ T20

-

South Korea police raid Muan airport over Jeju Air crash that killed 179

South Korea police raid Muan airport over Jeju Air crash that killed 179

-

South Korea's Yoon resists arrest over martial law bid

-

Sainz set to step out of comfort zone to defend Dakar Rally title

Sainz set to step out of comfort zone to defend Dakar Rally title

-

New Year's fireworks accidents kill five in Germany

-

'I'm Still Here': an ode to Brazil resistance

'I'm Still Here': an ode to Brazil resistance

-

New Orleans attack suspect was US-born army veteran

-

Australia axe Marsh, call-up Webster for fifth India Test

Australia axe Marsh, call-up Webster for fifth India Test

-

5 Tips for Protecting Your Children’s Health

-

What are the risks of taking out a personal loan?

What are the risks of taking out a personal loan?

-

DirectTrust(R) Announces 2025 Accreditation Criteria Versions for All Accreditation Programs

-

BOK Financial Corporation announces Fourth Quarter 2024 Earnings Conference Call

BOK Financial Corporation announces Fourth Quarter 2024 Earnings Conference Call

-

Firstleaf Reveals Its New Award-Winning Wines And Trend Forecast

-

Radius Pharmaceuticals Announces Licensing Agreement with Pharmanovia to Register and Commercialize Abaloparatide in China and Select Asia Pacific Territories

Radius Pharmaceuticals Announces Licensing Agreement with Pharmanovia to Register and Commercialize Abaloparatide in China and Select Asia Pacific Territories

-

BlackBerry Unveils Strategic Relaunch of QNX Brand to Reinforce Leadership in Automotive and General Embedded Industries

-

AURI Inc., Announces European Market Crypto Processing

AURI Inc., Announces European Market Crypto Processing

-

Gladstone Investment Corporation Acquires the Ricardo Defense Business

No Santa rally for stocks as equities slide

Global stock markets mostly fell Monday in jittery holiday trading ahead of a potentially tumultuous 2025 when Donald Trump returns to the White House.

Wall Street's three main indices slid at the start of trading, adding to losses on Friday that have put paid to Wall Street's usual holiday-period "Santa Claus rally".

"We can't drive major conclusions in a holiday-shortened and thin-trading-volume week, but last week's price action looked pretty close to the narrative of rotation from tech to non-tech stocks that many investors expect to be the theme of next year," noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

US tech stocks had led the losses Friday, with Elon Musk's electric car giant Tesla shedding around five percent and AI chipmaker Nvidia off around two percent.

Shares in Tesla fell another two percent at the start of trading on Monday, while Nvidia slid 1.6 percent.

Briefing.com analyst Patrick O'Hare said there was no news catalyst for the weakness.

"The selling interest, then, has profit-taking activity written on it with a P.S. presumably of rebalancing interest," he said.

"The thing is, there isn't a rebalancing push in the stock market this morning. The weakness is broad based."

Weighing on sentiment were worries about slower-than-hoped US interest rate cuts and possible higher import tariffs once Trump is inaugurated on January 20.

Yields on US government debt dipped on Monday, but have pushed higher at the longer-dated maturities on worries about the higher inflation and interest rates, with the yield on 10-year bonds hitting 4.63 percent recently.

"If yields continue to hold at these levels, or push higher towards 5.0 percent, then this will be a strong headwind for equity prices, as investors choose the relative safety of a near-guaranteed 5 percent return on funds in US Treasuries, compared with the uncertainty of stocks, many of which are trading at or near all-time highs, while being historically overvalued by many measures," said Trade Nation analyst David Morrison.

In Europe, the main indices in Frankfurt, London and Paris were all lower in afternoon trading.

In Asia, Tokyo closed down almost one percent Monday, its last day of trading until January 6.

Nissan dropped as much as 6.7 percent on worries about its mooted merger with fellow Japanese automaker Honda.

Overall the Nikkei 225 index gained almost 20 percent in 2024, finally surpassing the high seen before Japan's asset bubble burst in the 1990s.

In Seoul, Jeju Air shares fell as much as 15 percent after one of its planes crashed in South Korea on Sunday, killing 179 people.

Another Jeju Air flight had to return after encountering a landing gear problem on Monday, the airline said.

Korean authorities ordered an inspection of all Boeing 737-800 aircraft operated by the country's carriers.

Shares in Boeing fell 5.3 percent as trading got underway in New York.

South Korea was also hit with further political turmoil, with authorities issuing an arrest warrant for suspended President Yoon Suk Yeol after his declaration of martial law.

Oil prices rose.

- Key figures around 1430 GMT -

New York - Dow: DOWN 1.0 percent at 42,559.36 points

New York - S&P 500: DOWN 1.1 percent at 5906.33

New York - Nasdaq Composite: DOWN 1.3 percent at 19,460.41

London - FTSE 100: DOWN 0.4 percent at 8,117.34

Paris - CAC 40: DOWN 0.3 percent at 7,332.74

Frankfurt - DAX: DOWN 0.4 percent at 19,909.14

Tokyo - Nikkei 225: DOWN 1.0 percent at 39,894.54 points (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 20,041.42 (close)

Shanghai - Composite: UP 0.2 percent at 3,407.33

Euro/dollar: DOWN at $1.0400 from $1.0429 on Friday

Pound/dollar: DOWN at $1.2562 from $1.2579

Dollar/yen: DOWN at 157.50 yen from 157.89 yen

Euro/pound: DOWN at 82.82 pence from 82.87 pence

West Texas Intermediate: UP 0.9 percent at $71.24 per barrel

Brent North Sea Crude: UP 0.7 percent at $74.29 per barrel

burs-rl/js

A.Ruiz--AT