-

NASA eyes SpaceX, Blue Origin to cut Mars rock retrieval costs

NASA eyes SpaceX, Blue Origin to cut Mars rock retrieval costs

-

Eyeing green legacy, Biden declares new US national monuments

-

Venezuela's Gonzalez Urrutia says son-in-law detained in new clampdown

Venezuela's Gonzalez Urrutia says son-in-law detained in new clampdown

-

Invisible man: German startup bets on remote driver

-

Turkey threatens military operation against Syrian Kurdish fighters

Turkey threatens military operation against Syrian Kurdish fighters

-

Second accused in Liam Payne drug death surrenders: Argentine police

-

Disinformation experts slam Meta decision to end US fact-checking

Disinformation experts slam Meta decision to end US fact-checking

-

Freewheeling Trump sets out US territorial ambitions

-

'Snowball's chance in hell' Canada will merge with US: Trudeau

'Snowball's chance in hell' Canada will merge with US: Trudeau

-

Daglo, feared Darfuri general accused by US of genocide

-

Trump Jr. in Greenland on 'tourist' trip as father eyes territory

Trump Jr. in Greenland on 'tourist' trip as father eyes territory

-

Chat leaves Racing by 'mutual consent' after Christmas party incident

-

TVs get smarter as makers cater to AI lifestyles

TVs get smarter as makers cater to AI lifestyles

-

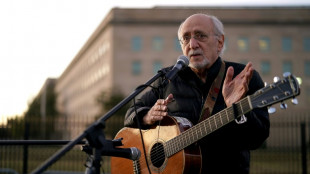

Peter Yarrow of Peter, Paul and Mary dead at 86

-

Dyche accepts Everton job under scrutiny from new owners

Dyche accepts Everton job under scrutiny from new owners

-

US urged to do more to fight bird flu after first death

-

Trump says NATO members should raise defense spending to 5% of GDP

Trump says NATO members should raise defense spending to 5% of GDP

-

X's 'Community Notes': a model for Meta?

-

Freewheeling Trump sets out territorial ambitions

Freewheeling Trump sets out territorial ambitions

-

England skipper Stokes undergoes hamstring operation

-

Inflation concerns pull rug out from Wall Street rally

Inflation concerns pull rug out from Wall Street rally

-

Ban for Wolves striker Cunha cut after offer to buy new glasses for security guard

-

Olmo situation could affect future signings: Barca's Raphinha

Olmo situation could affect future signings: Barca's Raphinha

-

US sanctions top Hungary minister over 'corruption'

-

Frigid temps hit US behind major winter storm

Frigid temps hit US behind major winter storm

-

Former Cambodian opposition MP shot dead in Bangkok: Thai media

-

US says Sudan's RSF committed 'genocide' in Darfur

US says Sudan's RSF committed 'genocide' in Darfur

-

UK government urges cricket chiefs to 'deliver on own rules' after Afghanistan boycott calls

-

Barca's Olmo absence 'better' for us: Athletic coach Valverde

Barca's Olmo absence 'better' for us: Athletic coach Valverde

-

Jean-Marie Le Pen, architect of French far-right surge, dies at 96

-

Spurs boss Postecoglou not in favour of VAR stadium announcements

Spurs boss Postecoglou not in favour of VAR stadium announcements

-

Meta abruptly ends US fact-checks ahead of Trump term

-

Quake in China's Tibet kills 126 with tremors felt in Nepal, India

Quake in China's Tibet kills 126 with tremors felt in Nepal, India

-

Trump Jr in Greenland on 'tourist' day trip as father eyes territory

-

Postecoglou wants trophy for Son as Spurs extend contract

Postecoglou wants trophy for Son as Spurs extend contract

-

Loeb limps home as teenager wins Dakar stage

-

US trade deficit widens in November on imports jump

US trade deficit widens in November on imports jump

-

Macron irks allies, left with Africa 'forgot to say thank you' jibe

-

Key dates in the rise of the French far right

Key dates in the rise of the French far right

-

Meta announces ending fact-checking program in the US

-

Liverpool's Slot says contract issues not affecting Alexander-Arnold's form

Liverpool's Slot says contract issues not affecting Alexander-Arnold's form

-

Ghana's John Mahama sworn in after presidential comeback

-

Hundreds of young workers sue McDonald's UK alleging harassment

Hundreds of young workers sue McDonald's UK alleging harassment

-

Jabeur beats Collins to step up comeback ahead of Melbourne

-

Eurozone inflation rises, likely forcing slower ECB rate cuts

Eurozone inflation rises, likely forcing slower ECB rate cuts

-

France remembers Charlie Hebdo attacks 10 years on

-

Microsoft announces $3 bn AI investment in India

Microsoft announces $3 bn AI investment in India

-

French far-right figurehead Jean-Marie Le Pen dies at 96

-

South Korea investigators get new warrant to arrest President Yoon

South Korea investigators get new warrant to arrest President Yoon

-

French far-right figurehead Jean-Marie Le Pen dies

| JRI | -1.88% | 12.22 | $ | |

| BCC | -1.69% | 118.22 | $ | |

| BCE | -0.34% | 23.86 | $ | |

| RIO | -0.33% | 58.19 | $ | |

| SCS | -2.14% | 11.2 | $ | |

| AZN | -0.3% | 66.64 | $ | |

| CMSC | -1.12% | 23.23 | $ | |

| NGG | -0.46% | 58.6 | $ | |

| BTI | -0.52% | 36.78 | $ | |

| RBGPF | -4.54% | 59.31 | $ | |

| GSK | 0.38% | 34.09 | $ | |

| RYCEF | 1.53% | 7.2 | $ | |

| RELX | 0.72% | 45.98 | $ | |

| CMSD | -1.15% | 23.46 | $ | |

| BP | 2.54% | 31.83 | $ | |

| VOD | -0.71% | 8.41 | $ |

Strawberry Fields REIT Wraps up 2024 and Begins 2025 With Strong Deal Flow

Strawberry Fields REIT, Inc. (NYSE AMERICAN:STRW) (the "Company") announced that on January 2, 2025 it completed the acquisition of six Healthcare Facilities, comprised of 354 licensed beds, located in Kansas (the "Facilities") for $24,000,000.

The Facilities are currently leased under an existing master lease agreement to a group of third-party tenants. Under the master lease, the tenants initial annual rents are $2.4 million on a triple net basis.

In addition to the Kansas deal, on December 31,2024 the Company completed the acquisition of a 100 bed Skilled Nursing Facility in Oklahoma for $5.0 million. Under the lease, the tenants initial annual rents are $0.5 million on a triple net basis. Additionally, as the Company previously announced, it closed the acquisition of eight skilled nursing facilities in Missouri for $87.5 million. Total deal-flow for December and January is $116.5 million.

Moishe Gubin, the Company's Chairman & CEO, noted: "The end of December and early January have been very busy for Strawberry Fields REIT. Completing the acquisition of 15 facilities for over $115 million and entering into two new states is very exciting. As we head into 2025, we look forward to continuing to grow the Company in existing and new states with our disciplined investment approach."

About Strawberry Fields REIT

Strawberry Fields REIT, Inc., is a self-administered real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing and certain other healthcare-related properties. The Company's portfolio includes 130 healthcare facilities with an aggregate of 14,500+ beds, located throughout the states of Arkansas, Illinois, Indiana, Kansas, Kentucky, Michigan, Missouri, Ohio, Oklahoma, Tennessee and Texas. The 130 healthcare facilities comprise 118 skilled nursing facilities, 10 assisted living facilities, and two long-term acute care hospitals.

Safe Harbor Statement

Certain statements in this press release may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Those forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief or expectations, including, but not limited to, statements regarding: future financing plans, business strategies, growth prospects and operating and financial performance; expectations regarding the making of distributions and the payment of dividends; and compliance with and changes in governmental regulations.

Words such as "anticipate(s)," "expect(s)," "intend(s)," "plan(s)," "believe(s)," "may," "will," "would," "could," "should," "seek(s)" and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These statements are based on management's current expectations and beliefs and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained. Factors which could have a material adverse effect on our operations and future prospects or which could cause actual results to differ materially from our expectations include, but are not limited to: (i) the COVID-19 pandemic and the measures taken to prevent its spread and the related impact on our business or the businesses of our tenants; (ii) the ability and willingness of our tenants to meet and/or perform their obligations under the triple-net leases we have entered into with them, including, without limitation, their respective obligations to indemnify, defend and hold us harmless from and against various claims, litigation and liabilities; (iii) the ability of our tenants to comply with applicable laws, rules and regulations in the operation of the facilities we lease to them; (iv) the ability and willingness of our tenants to renew their leases with us upon their expiration, and the ability to reposition our facilities on the same or better terms in the event of nonrenewal or in the event we replace an existing tenant, as well as any obligations, including indemnification obligations, we may incur in connection with the replacement of an existing tenant; (v) the availability of and the ability to identify (a) tenants who meet our credit and operating standards, and (b) suitable acquisition opportunities, and the ability to acquire and lease the respective facilities to such tenants on favorable terms; (vi) the ability to generate sufficient cash flows to service our outstanding indebtedness; (vii) access to debt and equity capital markets; (viii) fluctuating interest rates; (ix) the ability to retain our key management personnel; (x) the ability to maintain our status as a real estate investment trust ("REIT"); (xi) changes in the U.S. tax law and other state, federal or local laws, whether or not specific to REITs; (xii) other risks inherent in the real estate business, including potential liability relating to environmental matters and illiquidity of real estate investments; and (xiii) any additional factors included under "Risk Factors" in our Annual Report Form 10-K dated March 19, 2024, including in the section entitled "Risk Factors" in Item 1A of Part I of such report, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC.

Forward-looking statements speak only as of the date of this press release. Except in the normal course of our public disclosure obligations, we expressly disclaim any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any statement is based.

Investor Relations:

Strawberry Fields REIT, Inc.

[email protected]

+1 (773) 747-4100 x422

SOURCE: Strawberry Fields REIT, Inc.

Y.Baker--AT