-

Djibouti experiments with GM mosquito against malaria

Djibouti experiments with GM mosquito against malaria

-

Pulisic at the double as USA cruise past Jamaica

-

Many children injured after car crashes at central China school: state media

Many children injured after car crashes at central China school: state media

-

Asian markets rally after US bounce as Nvidia comes into focus

-

Tens of thousands march in New Zealand Maori rights protest

Tens of thousands march in New Zealand Maori rights protest

-

Five takeaways from the G20 summit in Rio

-

China, Russia ministers discuss Korea tensions at G20: state media

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

-

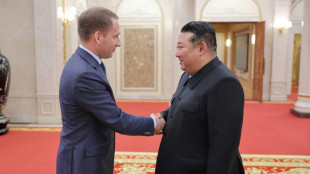

Russian delegations visit Pyongyang as Ukraine war deepens ties

Russian delegations visit Pyongyang as Ukraine war deepens ties

-

S.Africa offers a lesson on how not to shut down a coal plant

-

Italy beat Swiatek's Poland to reach BJK Cup final

Italy beat Swiatek's Poland to reach BJK Cup final

-

Japan, UK to hold regular economic security talks

-

Divided G20 fails to agree on climate, Ukraine

Divided G20 fails to agree on climate, Ukraine

-

Can the Trump-Musk 'bromance' last?

-

US to call for Google to sell Chrome browser: report

US to call for Google to sell Chrome browser: report

-

Macron hails 'good' US decision on Ukraine missiles

-

Italy eliminate Swiatek's Poland to reach BJK Cup final

Italy eliminate Swiatek's Poland to reach BJK Cup final

-

Trump expected to attend next Starship rocket launch: reports

-

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

-

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

-

Thousands march to New Zealand's parliament in Maori rights protest

Thousands march to New Zealand's parliament in Maori rights protest

-

China's Xi urges G20 to help 'cool' Ukraine crisis

-

Church and state clash over entry fee for Paris's Notre Dame

Church and state clash over entry fee for Paris's Notre Dame

-

Holders Spain strike late to beat Switzerland in Nations League

-

Stocks, dollar hesitant as traders brace for Nvidia earnings

Stocks, dollar hesitant as traders brace for Nvidia earnings

-

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

-

Biden in 'historic' pledge for poor nations ahead of Trump return

Biden in 'historic' pledge for poor nations ahead of Trump return

-

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

-

Five dead in new Israeli strike on Beirut's centre

Five dead in new Israeli strike on Beirut's centre

-

Where's Joe? G20 leaders have group photo without Biden

-

US permission to fire missiles on Russia no game-changer: experts

US permission to fire missiles on Russia no game-changer: experts

-

Tropical storm Sara kills four in Honduras and Nicaragua

-

Germany, Finland warn of 'hybrid warfare' after sea cable cut

Germany, Finland warn of 'hybrid warfare' after sea cable cut

-

Spanish resort to ban new holiday flats in 43 neighbourhoods

-

Hong Kong to sentence dozens of democracy campaigners

Hong Kong to sentence dozens of democracy campaigners

-

Russian extradited to US from SKorea to face ransomware charges

-

Phone documentary details Afghan women's struggle under Taliban govt

Phone documentary details Afghan women's struggle under Taliban govt

-

G20 wrestles with wars, 'turbulence' in run-up to Trump

-

Kane hoping to extend England career beyond 2026 World Cup

Kane hoping to extend England career beyond 2026 World Cup

-

Gazans rebuild homes from rubble in preparation for winter

-

'Vague' net zero rules threaten climate targets, scientists warn

'Vague' net zero rules threaten climate targets, scientists warn

-

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

-

G20 wrestles with wars, climate in run-up to Trump

G20 wrestles with wars, climate in run-up to Trump

-

'Agriculture is dying': French farmers protest EU-Mercosur deal

-

Beyonce to headline halftime during NFL Christmas game

Beyonce to headline halftime during NFL Christmas game

-

Rescuers struggle to reach dozens missing after north Gaza strike

-

Russia vetoes Sudan ceasefire resolution at UN

Russia vetoes Sudan ceasefire resolution at UN

-

G20 host Brazil launches alliance to end 'scourge' of hunger

Banks slow to limit coal financing: NGO

Banks lent almost $470 billion to the coal industry between 2021 and 2023, according to a study published Thursday by German environmental group Urgewald, which criticised the scale of financing amid rising global temperatures.

Of the 638 banks surveyed, only 140 -- or about one in five -- had significantly reduced their exposure to the coal sector since 2016, the report found.

Some 75 banks by contrast saw their investments in coal increase in the same period, according to the study led by the German NGO and partner organisations.

Commercial banks were not reducing the amount they put into the coal industry at a rate sufficient to hit the Paris climate goal to limit global warming to 1.5C degrees above preindustrial times, Urgewald said.

"Without an end to coal financing, it is difficult to imagine that we can get out of coal in time," said Urgewald's finance lead Katrin Ganswindt, calling for more regulation in the area.

In 2023, the banks financed the coal industry to the tune of $136 billion, only 20 percent less than in 2016, according to the study.

More than 90 percent of the financing came from institutions in China, the United States, Japan, Canada, India, Britain and Indonesia.

US banks in particular had seen their investments in coal rise by 22 percent between 2021 and 2023 to $19.8 billion, Urgewald said.

Meanwhile, European banks reduced the amount they gave to the coal industry by 51 percent in the same period to a total of $6.5 billion.

The study comes just after ministers from the G7 developed economies agreed a timeframe for phasing out coal-fired power plants.

The representatives from the United States, Canada, France, Italy, Germany, Britain, Japan set a goal to end their use in the mid-2030s.

In Europe, banks are under increasing pressure from investors and supervisors alike to divest from polluting sectors.

In January, the European Central Bank said that most banks it oversees had not brought their portfolios in line with the Paris targets, leaving them exposed to greater climate risks.

O.Brown--AT