-

Spain royals visit flood epicentre after chaotic trip

Spain royals visit flood epicentre after chaotic trip

-

France's Gisele Pelicot says 'macho' society must change attitude on rape

-

G20 leaders talk climate, wars -- and brace for Trump's return

G20 leaders talk climate, wars -- and brace for Trump's return

-

US lawmaker accuses Azerbaijan in near 'assault' at COP29

-

Tuchel's England have 'tools' to win World Cup, says Carsley

Tuchel's England have 'tools' to win World Cup, says Carsley

-

Federer hails 'historic' Nadal ahead of imminent retirement

-

Ukraine vows no surrender, Kremlin issues nuke threat on 1,000th day of war

Ukraine vows no surrender, Kremlin issues nuke threat on 1,000th day of war

-

Novo Nordisk's obesity drug Wegovy goes on sale in China

-

Spain royals to visit flood epicentre after chaotic trip: media

Spain royals to visit flood epicentre after chaotic trip: media

-

French farmers step up protests against EU-Mercosur deal

-

Rose says Europe Ryder Cup stars play 'for the badge' not money

Rose says Europe Ryder Cup stars play 'for the badge' not money

-

Negotiators seek to break COP29 impasse after G20 'marching orders'

-

Burst dike leaves Filipino farmers under water

Burst dike leaves Filipino farmers under water

-

Markets rally after US bounce as Nvidia comes into focus

-

Crisis-hit Thyssenkrupp books another hefty annual loss

Crisis-hit Thyssenkrupp books another hefty annual loss

-

US envoy in Lebanon for talks on halting Israel-Hezbollah war

-

India to send 5,000 extra troops to quell Manipur unrest

India to send 5,000 extra troops to quell Manipur unrest

-

Sex, drugs and gritty reality on Prague's underworld tours

-

Farmers descend on London to overturn inheritance tax change

Farmers descend on London to overturn inheritance tax change

-

Clippers upset Warriors, Lillard saves Bucks

-

Acquitted 'Hong Kong 47' defendant sees freedom as responsibility

Acquitted 'Hong Kong 47' defendant sees freedom as responsibility

-

Floods strike thousands of houses in northern Philippines

-

Illegal farm fires fuel Indian capital's smog misery

Illegal farm fires fuel Indian capital's smog misery

-

SpaceX set for Starship's next flight, Trump expected to attend

-

Texans cruise as Cowboys crisis deepens

Texans cruise as Cowboys crisis deepens

-

Do the Donald! Trump dance takes US sport by storm

-

Home hero Cameron Smith desperate for first win of 2024 at Australian PGA

Home hero Cameron Smith desperate for first win of 2024 at Australian PGA

-

Team Trump assails Biden decision on missiles for Ukraine

-

Hong Kong court jails 45 democracy campaigners on subversion charges

Hong Kong court jails 45 democracy campaigners on subversion charges

-

Several children injured in car crash at central China school

-

Urban mosquito sparks malaria surge in East Africa

Urban mosquito sparks malaria surge in East Africa

-

Djibouti experiments with GM mosquito against malaria

-

Pulisic at the double as USA cruise past Jamaica

Pulisic at the double as USA cruise past Jamaica

-

Many children injured after car crashes at central China school: state media

-

Asian markets rally after US bounce as Nvidia comes into focus

Asian markets rally after US bounce as Nvidia comes into focus

-

Tens of thousands march in New Zealand Maori rights protest

-

Five takeaways from the G20 summit in Rio

Five takeaways from the G20 summit in Rio

-

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

Defiant Lebanese harvest olives in the shadow of war

-

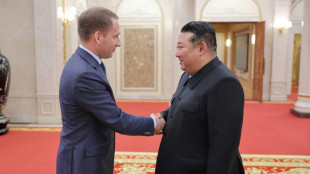

Russian delegations visit Pyongyang as Ukraine war deepens ties

-

S.Africa offers a lesson on how not to shut down a coal plant

S.Africa offers a lesson on how not to shut down a coal plant

-

Italy beat Swiatek's Poland to reach BJK Cup final

-

Japan, UK to hold regular economic security talks

Japan, UK to hold regular economic security talks

-

Divided G20 fails to agree on climate, Ukraine

-

Can the Trump-Musk 'bromance' last?

Can the Trump-Musk 'bromance' last?

-

US to call for Google to sell Chrome browser: report

-

Macron hails 'good' US decision on Ukraine missiles

Macron hails 'good' US decision on Ukraine missiles

-

Italy eliminate Swiatek's Poland to reach BJK Cup final

Climate change risk stirs oil market

From forest fires to hurricanes and other natural disasters: climate change risk is increasingly influencing oil prices, just as the world is struggling to shift away from high-polluting fossil fuels.

Hurricane Beryl became the latest weather phenomenon to jangle market nerves, boosting crude prices as it passed through Texas earlier this month.

Texas accounts for some 42 percent of total US crude oil production, according to Energy Information Administration data. It also possesses the largest number of crude oil refineries among US states.

"Almost half of the total US petroleum refining capacity is located along the Gulf, with Texas accounting for one-third of total US refining capacity," Exinity analyst Han Tan told AFP.

And industry experts fear Beryl could herald a "super charged" hurricane season this year, according to Tan.

The World Meteorological Organization has warned that Beryl's early formation and swift intensification could foreshadow similarly severe storms in the future.

Earlier this year meanwhile, oil market sentiment was jarred in May as forest fires broke out in Canada.

Traders took flight as out-of-control wildfires threatened to spread to the crude-producing hub of Fort McMurray, the nation's largest oil sands mining facility.

- 'More visible and more extreme' -

Traders, more used to pricing in geopolitical turmoil, are now also weighing up the risks arising from the climate crisis.

"Climate change and its effect is a major source of risk in the oil markets, and I expect that that risk will only increase in the coming years as the effects of climate change become more visible and extreme," Rystad Energy analyst Jorge Leon told AFP.

"Geopolitical risk is –- at least partly -– manageable by different actors. For example, international diplomacy could prevent a war.

"However, climate risk is less manageable in the short and medium run. In the long run, you can manage it by trying to reduce emissions," he added.

At the same time, climate disruption is also having an increasingly visible impact on the operations of oil and gas companies, which are frequently slammed by environmentalists over their role in global warming.

"Climate change has been and will be affecting production," summarised Tamas Varga, analyst at PVM Oil Associates.

He added that it also impacted refinery utilisation rates because "hot weather leads to malfunctioning" of the facilities.

Many European refineries were designed in the 1960s and 1970s to withstand colder rather than warmer temperatures, according to Tan.

Fossil fuels -- coal, gas and oil -- are responsible for over 75 percent of global greenhouse gas emissions, according to estimates from the United Nations.

At the COP28 UN climate conference in Dubai last December, almost 200 countries agreed to a call for a transition away from fossil fuels and a tripling of renewable energy capacity this decade.

However, the text crucially stopped short of a direct call for phasing out fossil fuels, while there were major concessions to the oil and gas industry and producer countries.

- 'Economics can't find solution' -

Analysts argue that the oil market participants are simply focused on generating profit rather than saving the environment.

That throws the onus onto the world's politicians and regulators, they add.

"Investors can't be rationally expected to reverse the phenomenon when they try to maximise profits," SwissQuote analyst Ipek Ozkardeskaya told AFP.

"Unless financial costs of climate damages outweigh the financial benefits, the economics can't find the solution to the climate problem."

"So, the ball is in politicians' hands. Only concrete, sharp and worldwide regulatory changes with meaningful financial impact/incentives... could shift capital toward clean and sustainable energies."

D.Johnson--AT