-

Former AFCON champions Ghana bow out as minnows Comoros qualify

Former AFCON champions Ghana bow out as minnows Comoros qualify

-

Poland, Britain reach BJK Cup quarter-finals

-

At summit under Trump shadow, Xi and Biden signal turbulence ahead

At summit under Trump shadow, Xi and Biden signal turbulence ahead

-

Lebanon said studying US truce plan for Israel-Hezbollah war

-

Xi warns against 'protectionism' at APEC summit under Trump cloud

Xi warns against 'protectionism' at APEC summit under Trump cloud

-

Nigerian UN nurse escapes jihadist kidnappers after six years

-

India in record six-hitting spree to rout South Africa

India in record six-hitting spree to rout South Africa

-

George tells England to prepare for rugby 'war' against Springboks

-

Pogba's Juve contract terminated despite doping ban reduction

Pogba's Juve contract terminated despite doping ban reduction

-

Ukraine slams Scholz after first call with Putin in two years

-

Michael Johnson's Grand Slam Track series to have LA final

Michael Johnson's Grand Slam Track series to have LA final

-

Kagiyama, Yoshida put Japan on top at Finland Grand Prix

-

Alcaraz eyeing triumphant Davis Cup farewell for Nadal after ATP Finals exit

Alcaraz eyeing triumphant Davis Cup farewell for Nadal after ATP Finals exit

-

Xi, Biden at Asia-Pacific summit under Trump trade war cloud

-

India go on record six-hitting spree against South Africa

India go on record six-hitting spree against South Africa

-

France skipper Dupont says All Blacks 'back to their best'

-

Trump pressures US Senate with divisive cabinet picks

Trump pressures US Senate with divisive cabinet picks

-

Bagnaia strikes late in Barcelona practice to edge title rival Martin

-

High-ball hero Steward ready to 'front up' against South Africa

High-ball hero Steward ready to 'front up' against South Africa

-

Leader of Spain flood region admits 'mistakes'

-

Swiatek, Linette take Poland past Spain into BJK Cup quarter-finals

Swiatek, Linette take Poland past Spain into BJK Cup quarter-finals

-

Leftist voices seek to be heard at Rio's G20 summit

-

Wales coach Jenkins urges players to 'get back on the horse'

Wales coach Jenkins urges players to 'get back on the horse'

-

Zverev reaches ATP Finals last four, Alcaraz out

-

Boeing strike will hurt Ethiopian Airlines growth: CEO

Boeing strike will hurt Ethiopian Airlines growth: CEO

-

Springboks skipper Kolisi wary of England's 'gifted' Smith

-

End of a love affair: news media quit X over 'disinformation'

End of a love affair: news media quit X over 'disinformation'

-

US finalizes up to $6.6 bn funding for chip giant TSMC

-

Scholz urges Ukraine talks in first call with Putin since 2022

Scholz urges Ukraine talks in first call with Putin since 2022

-

Zverev reaches ATP Finals last four, Alcaraz on brink of exit

-

Lebanon rescuer picks up 'pieces' of father after Israel strike

Lebanon rescuer picks up 'pieces' of father after Israel strike

-

US retail sales lose steam in October after hurricanes

-

Zverev reaches ATP Finals last four with set win against Alcaraz

Zverev reaches ATP Finals last four with set win against Alcaraz

-

Kerevi back for Australia against Wales, Suaalii on bench

-

Spate of child poisoning deaths sparks S.Africa xenophobia

Spate of child poisoning deaths sparks S.Africa xenophobia

-

Comedian Conan O'Brien to host Oscars

-

Rozner overtakes McIlroy and Hatton for Dubai lead

Rozner overtakes McIlroy and Hatton for Dubai lead

-

Mourners bid farewell to medic killed in east Ukraine

-

Gore says 'absurd' to hold UN climate talks in petrostates

Gore says 'absurd' to hold UN climate talks in petrostates

-

Hamas says 'ready for ceasefire' as Israel presses Gaza campaign

-

Amorim says Man Utd is 'where I'm supposed to be'

Amorim says Man Utd is 'where I'm supposed to be'

-

Japan hammer Indonesia to edge closer to World Cup spot

-

Jeff Beck guitar collection to go under the hammer in January

Jeff Beck guitar collection to go under the hammer in January

-

Veteran Ranieri has 'no time for mistakes' on Roma return

-

Van Nistelrooy says he will 'cherish' Man Utd memories in farewell message

Van Nistelrooy says he will 'cherish' Man Utd memories in farewell message

-

IAEA chief tours sensitive Iran nuclear plants

-

Pompeii rejects 'mass tourism' with daily visitor limit

Pompeii rejects 'mass tourism' with daily visitor limit

-

Jailed Russian poet could be 'killed' in prison, warns wife

-

French court orders release of Lebanese militant held since 1984

French court orders release of Lebanese militant held since 1984

-

Global stocks struggle after Fed signals slower rate cuts

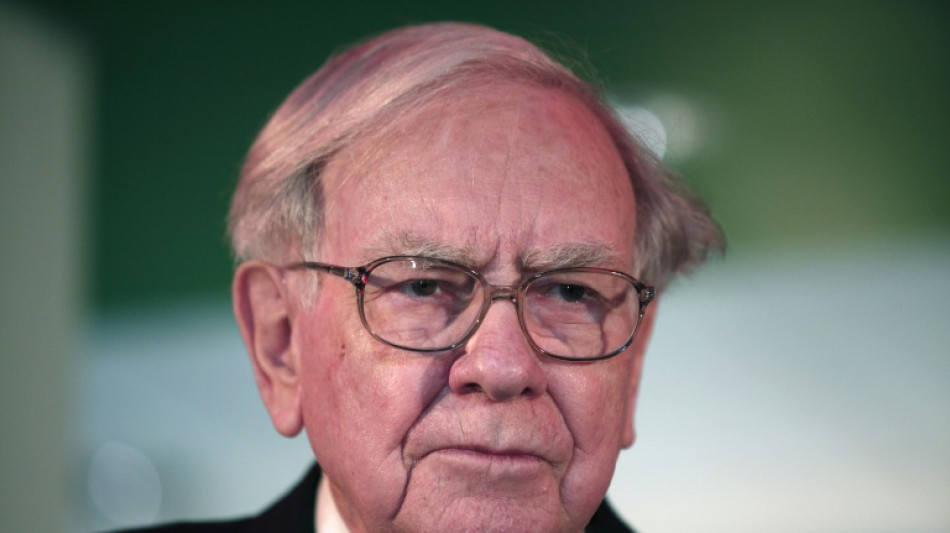

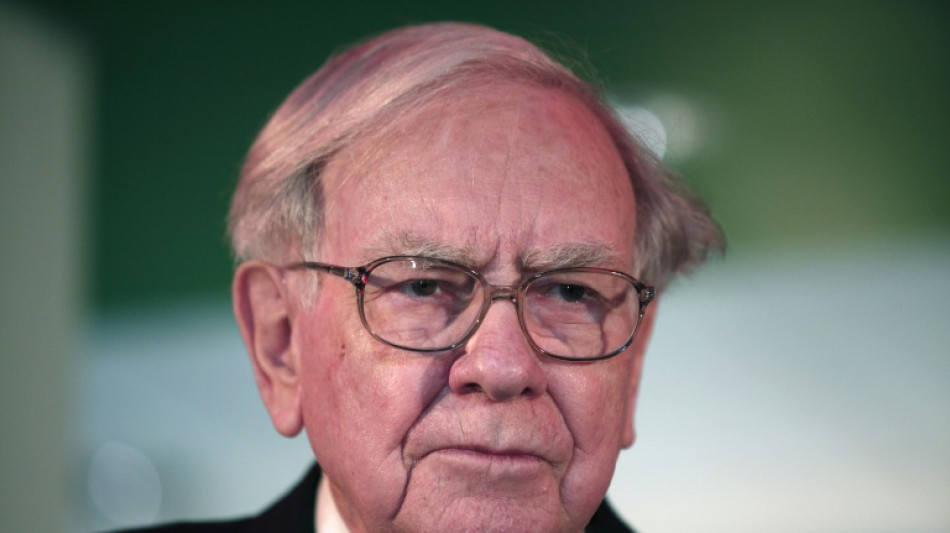

Chinese electric carmaker BYD plummets after Buffett sale

Shares in Chinese electric carmaker BYD plunged on Wednesday after its largest backer, Warren Buffett's Berkshire Hathaway, reduced its stake amid speculation of a potential exit.

Hong Kong-listed shares of the EV manufacturer fell by as much as 13 percent, a day after a regulatory filing showed Berkshire reducing its holdings from 20.04 percent to 19.92 percent.

It ended the day 7.9 percent lower, while its Shenzhen-listed stock finished 7.4 percent down.

The sale of around 1.33 million securities was valued at approximately $47 million.

Electronic carmakers in China were left scrambling after the government response to coronavirus outbreaks this year disrupted supply chains, with plants across the country suspending production for weeks.

While the Shenzhen-based firm reported strong earnings this week, rumours have swelled that the legendary American investor behind Berkshire may be looking to offload his entire stake.

Berkshire first bought 225 million BYD shares in 2008 and has been the biggest stakeholder in the company, now China's largest EV manufacturer and a major rival to Tesla.

Berkshire sold around 6.3 million shares in BYD between June 30 and August 24, Bloomberg News reported, citing filings from both companies.

BYD told Chinese media that there was "no need to over-interpret" the stake sale, adding that the company was operating normally and had no major moves to disclose.

On Monday, the Shenzhen-based company reported that net income had tripled to 3.6 billion yuan ($521 million) from a year earlier, overcoming supply chain disruptions caused by the pandemic and China's economic slowdown.

BYD said in a filing that it achieved record output and sales in the first half, with revenue jumping 66 percent year-on-year to 151 billion yuan.

The carmaker added that it was leading the domestic new energy vehicle sector with 24.7 percent market share in the first six months, citing data from the China Automobile Association.

"Investors could interpret this as the beginning of Berkshire closing its position in BYD," Bridget McCarthy, a market research analyst at hedge fund Snow Bull Capital, told Bloomberg.

"I would expect arguably one of the world's greatest investors to take some profits after over a decade, especially on his highest-returning investment, percentage-wise."

Some analysts have argued that BYD's strong fundamentals, coupled with Beijing's push to develop its domestic green energy sector, means the company still has room to grow.

"Despite the short term share price struggle, there is value to invest in the company with its solid business model in the medium to long term," Andy Wong, fund manager at LW Asset Management Advisors in Hong Kong, said.

Last month, a stake identical to the size of Berkshire's holdings was entered into Hong Kong's Central Clearing and Settlement System.

Hong Kong requires anyone who owns more than five percent of a listed company to notify the stock exchange when initiating a trade that changes the stake percentage into the next whole number.

A.Moore--AT