-

US falling behind on wind power, think tank warns

US falling behind on wind power, think tank warns

-

US news giant CNN eyes 200 job cuts, streaming overhaul

-

Sacklers, Purdue to pay $7.4 bn over opioid crisis: NY state

Sacklers, Purdue to pay $7.4 bn over opioid crisis: NY state

-

Rubio chooses Central America for first trip amid Panama Canal pressure

-

Germany knife attack on children reignites pre-vote migrant debate

Germany knife attack on children reignites pre-vote migrant debate

-

AC Milan defender Emerson facing two-month injury layoff

-

'Shattered souls': tears as UK child killer sentenced to life

'Shattered souls': tears as UK child killer sentenced to life

-

China's Shenzhen to host Billie Jean King Cup Finals

-

Wall Street's AI-fuelled rally falters, oil slumps

Wall Street's AI-fuelled rally falters, oil slumps

-

Trump tells Davos elites: produce in US or pay tariffs

-

Progressive politics and nepo 'babies': five Oscar takeaways

Progressive politics and nepo 'babies': five Oscar takeaways

-

American Airlines shares fall on lackluster 2025 profit outlook

-

Sudan's army, paramilitaries trade blame over oil refinery attack

Sudan's army, paramilitaries trade blame over oil refinery attack

-

France to introduce new sex education guidelines in schools

-

'Brave' Keys deserves to be in Melbourne final, says Swiatek

'Brave' Keys deserves to be in Melbourne final, says Swiatek

-

'Shattered souls': tears as horror of stabbing spree retold at UK court

-

'Emilia Perez' lauded in Hollywood but criticized in Mexico

'Emilia Perez' lauded in Hollywood but criticized in Mexico

-

Bayern's Davies ruled out 'for time being' with hamstring tear

-

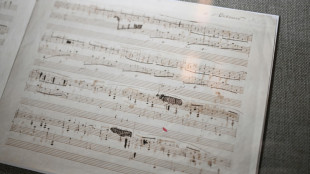

Poland says purchased rare 'treasure' Chopin manuscript

Poland says purchased rare 'treasure' Chopin manuscript

-

Calls for calm, Pope on AI, Milei on Musk: What happened at Davos Thursday

-

Ukraine orders children to evacuate from northeastern towns

Ukraine orders children to evacuate from northeastern towns

-

Hibatullah Akhundzada: Afghanistan's reclusive Taliban leader

-

Argentina's record points scorer Sanchez retires from rugby

Argentina's record points scorer Sanchez retires from rugby

-

Shiffrin set for World Cup skiing return at Courchevel

-

'No conversation needed' for Farrell about Lions tour selection

'No conversation needed' for Farrell about Lions tour selection

-

Wall Street's AI-fuelled rally falters

-

Drinking water in many French cities contaminated: study

Drinking water in many French cities contaminated: study

-

West Africa juntas tighten screws on foreign mining firms

-

Spain govt to cover full cost of repairing flood-damaged buildings

Spain govt to cover full cost of repairing flood-damaged buildings

-

PSG loan France forward Kolo Muani to Juventus

-

'Emilia Perez' tops Oscar nominations in fire-hit Hollywood

'Emilia Perez' tops Oscar nominations in fire-hit Hollywood

-

Tears, gasps as UK court hears horrific details of stabbing spree

-

St Andrews to host 2027 British Open

St Andrews to host 2027 British Open

-

S.African anti-apartheid activists sue govt over lack of justice

-

Cocaine seizures in Rotterdam down sharply

Cocaine seizures in Rotterdam down sharply

-

Keys shocks Swiatek to set up Sabalenka Australian Open final

-

Formula One drivers face new sanctions for swearing

Formula One drivers face new sanctions for swearing

-

UK to make case to Trump against whisky tariff: finance minister

-

After Musk gesture, activists project 'Heil' on Tesla plant

After Musk gesture, activists project 'Heil' on Tesla plant

-

Career-high 54 for Gilgeous-Alexander as Oklahoma City roll Utah

-

ICC prosecutor seeks arrest of Taliban leaders over persecution of women

ICC prosecutor seeks arrest of Taliban leaders over persecution of women

-

Syria's economy reborn after being freed from Assad

-

Shoppers unaware as Roman tower lurks under French supermarket

Shoppers unaware as Roman tower lurks under French supermarket

-

PSG finally click and fire warning shot to European rivals

-

Saudi crown prince promises Trump $600bn trade, investment boost

Saudi crown prince promises Trump $600bn trade, investment boost

-

Unstoppable Sabalenka playing 'PlayStation tennis' says Badosa

-

Sabalenka to take Badosa shopping after Melbourne rout - and pay

Sabalenka to take Badosa shopping after Melbourne rout - and pay

-

Man City step up rebuild with signing of Marmoush for £59 million

-

Stocks mainly rise after Wall Street's AI-fuelled rally

Stocks mainly rise after Wall Street's AI-fuelled rally

-

Palestinian official says hundreds leave Jenin as Israel presses raid

Wall Street falters as Ukraine war drags on

Wall Street ended a downbeat week with further losses Friday as traders braced for continued economic fallout from Russia's invasion of Ukraine as well as looming Federal Reserve rate hikes, though European indices saw gains.

Oil also rose on Iran supply fears, but remained well below the 14-year peak of near $140 hit Monday brought on by worries of disruptions to supply from Russia, a major producer.

The pound and yen hit multi-year dollar lows before regaining some ground, as traders prepared for the Federal Reserve to most likely hike interest rates next week for the first time since the pandemic, in the first of several moves this year to fight inflation.

While equities rose after Putin said his negotiators had reported "certain positive shifts" in talks with Ukraine, the enthusiasm petered out in New York trading as Washington and Brussels announced new sanctions against Russia and fighting continued.

The Nasdaq closed more than two percent lower and the S&P 500 fell more than one percent.

"This gullible market -- or some indubitable algorithms -- seems willing to take Putin's words as the makings perhaps of an exit path," said Briefing.com analyst Patrick O'Hare.

In Europe, London ended with a gain of 0.8 percent, Paris rose by 0.9 percent and Frankfurt climbed 1.4 percent to post their first weekly rise since the war.

Sentiment there was also brightened by data showing the UK economy rebounded 0.8 percent in January after a 0.2-percent decline in December, as Omicron coronavirus curbs were lifted.

Markets have been rocked ever since Russia shocked the world by invading its neighbor on February 24.

Michael Hewson, chief market analyst at CMC Markets UK warned that "any deterioration in sentiment over the weekend could see these gains reversed in a heartbeat if Russia chooses to escalate further, as well as potentially crossing the red line of chemical, or biological weapons use."

Oil jumped Friday after the European Union revealed talks it is chairing about the revival of the 2015 nuclear accord with crude producer Iran must be paused, days after fresh demands from Russia complicated negotiations.

Oil has been extremely volatile ever since Moscow's invasion, with traders still fretting over Western moves to ban Russian crude.

"It's been a rollercoaster ride for oil this week, and for some, the weekend cannot come quick enough," said Stephen Innes, Managing Partner at SPI Asset Management.

Crude prices have pulled back from nearly $140 at the peak on Monday to around $110 on Friday as hopes rose that other producers will step up production.

"This optimism needs to be tempered by the fact that any increase in output from OPEC would not be enough to offset the loss of Russian supply," said Hewson at CMC Markets.

- Key figures around 2130 GMT -

New York - Dow: DOWN 0.7 percent at 32,944.19 (close)

New York - S&P 500: DOWN 1.3 percent at 4,204.31 (close)

New York - Nasdaq: DOWN 2.2 percent at 12,843.81 (close)

EURO STOXX 50: UP 1.0 percent at 3,686.78 (close)

London - FTSE 100: UP 0.8 percent at 7,155.64 (close)

Frankfurt - DAX: UP 1.4 percent at 13,628.11 (close)

Paris - CAC 40: UP 0.9 percent at 6,260.25 (close)

Brent North Sea crude: UP 3.1 percent at $112.65 per barrel

West Texas Intermediate: UP 3.2 percent at $109.36

Tokyo - Nikkei 225: DOWN 2.1 percent at 25,162.78 (close)

Hong Kong - Hang Seng Index: DOWN 1.6 percent at 20,553.79 (close)

Shanghai - Composite: UP 0.4 percent at 3,309.75 (close)

Euro/dollar: DOWN at $1.0908 from $1.0986 Thursday

Pound/dollar: DOWN at $1.3030 from $1.3086

Euro/pound: DOWN at 83.70 pence from 83.95 pence

Dollar/yen: UP at 117.26 yen from 116.14 yen

burs-rfj-ach/rl/cs/bgs

Th.Gonzalez--AT