-

US news giant CNN eyes 200 job cuts, streaming overhaul

US news giant CNN eyes 200 job cuts, streaming overhaul

-

Sacklers, Purdue to pay $7.4 bn over opioid crisis: NY state

-

Rubio chooses Central America for first trip amid Panama Canal pressure

Rubio chooses Central America for first trip amid Panama Canal pressure

-

Germany knife attack on children reignites pre-vote migrant debate

-

AC Milan defender Emerson facing two-month injury layoff

AC Milan defender Emerson facing two-month injury layoff

-

'Shattered souls': tears as UK child killer sentenced to life

-

China's Shenzhen to host Billie Jean King Cup Finals

China's Shenzhen to host Billie Jean King Cup Finals

-

Wall Street's AI-fuelled rally falters, oil slumps

-

Trump tells Davos elites: produce in US or pay tariffs

Trump tells Davos elites: produce in US or pay tariffs

-

Progressive politics and nepo 'babies': five Oscar takeaways

-

American Airlines shares fall on lackluster 2025 profit outlook

American Airlines shares fall on lackluster 2025 profit outlook

-

Sudan's army, paramilitaries trade blame over oil refinery attack

-

France to introduce new sex education guidelines in schools

France to introduce new sex education guidelines in schools

-

'Brave' Keys deserves to be in Melbourne final, says Swiatek

-

'Shattered souls': tears as horror of stabbing spree retold at UK court

'Shattered souls': tears as horror of stabbing spree retold at UK court

-

'Emilia Perez' lauded in Hollywood but criticized in Mexico

-

Bayern's Davies ruled out 'for time being' with hamstring tear

Bayern's Davies ruled out 'for time being' with hamstring tear

-

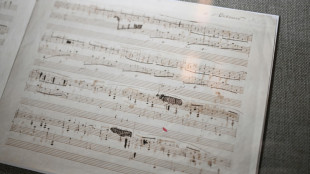

Poland says purchased rare 'treasure' Chopin manuscript

-

Calls for calm, Pope on AI, Milei on Musk: What happened at Davos Thursday

Calls for calm, Pope on AI, Milei on Musk: What happened at Davos Thursday

-

Ukraine orders children to evacuate from northeastern towns

-

Hibatullah Akhundzada: Afghanistan's reclusive Taliban leader

Hibatullah Akhundzada: Afghanistan's reclusive Taliban leader

-

Argentina's record points scorer Sanchez retires from rugby

-

Shiffrin set for World Cup skiing return at Courchevel

Shiffrin set for World Cup skiing return at Courchevel

-

'No conversation needed' for Farrell about Lions tour selection

-

Wall Street's AI-fuelled rally falters

Wall Street's AI-fuelled rally falters

-

Drinking water in many French cities contaminated: study

-

West Africa juntas tighten screws on foreign mining firms

West Africa juntas tighten screws on foreign mining firms

-

Spain govt to cover full cost of repairing flood-damaged buildings

-

PSG loan France forward Kolo Muani to Juventus

PSG loan France forward Kolo Muani to Juventus

-

'Emilia Perez' tops Oscar nominations in fire-hit Hollywood

-

Tears, gasps as UK court hears horrific details of stabbing spree

Tears, gasps as UK court hears horrific details of stabbing spree

-

St Andrews to host 2027 British Open

-

S.African anti-apartheid activists sue govt over lack of justice

S.African anti-apartheid activists sue govt over lack of justice

-

Cocaine seizures in Rotterdam down sharply

-

Keys shocks Swiatek to set up Sabalenka Australian Open final

Keys shocks Swiatek to set up Sabalenka Australian Open final

-

Formula One drivers face new sanctions for swearing

-

UK to make case to Trump against whisky tariff: finance minister

UK to make case to Trump against whisky tariff: finance minister

-

After Musk gesture, activists project 'Heil' on Tesla plant

-

Career-high 54 for Gilgeous-Alexander as Oklahoma City roll Utah

Career-high 54 for Gilgeous-Alexander as Oklahoma City roll Utah

-

ICC prosecutor seeks arrest of Taliban leaders over persecution of women

-

Syria's economy reborn after being freed from Assad

Syria's economy reborn after being freed from Assad

-

Shoppers unaware as Roman tower lurks under French supermarket

-

PSG finally click and fire warning shot to European rivals

PSG finally click and fire warning shot to European rivals

-

Saudi crown prince promises Trump $600bn trade, investment boost

-

Unstoppable Sabalenka playing 'PlayStation tennis' says Badosa

Unstoppable Sabalenka playing 'PlayStation tennis' says Badosa

-

Sabalenka to take Badosa shopping after Melbourne rout - and pay

-

Man City step up rebuild with signing of Marmoush for £59 million

Man City step up rebuild with signing of Marmoush for £59 million

-

Stocks mainly rise after Wall Street's AI-fuelled rally

-

Palestinian official says hundreds leave Jenin as Israel presses raid

Palestinian official says hundreds leave Jenin as Israel presses raid

-

Sabalenka beats Badosa to make third straight Australian Open final

Putting out the fire: Fed set to hike rates to tame inflation

Surging prices for fuel, food and housing have sent US inflation to the highest in four decades, and the Russian invasion of Ukraine has made the situation worse, so the Federal Reserve is preparing to take action this week.

But the central bank's efforts to put out the inflation fires will be complicated by the prospect the war and wide-ranging sanctions imposed on Russia will disrupt trade flows and undermine the US economic recovery.

The policy-setting Federal Open Market Committee holds its two-day policy meeting this week, with an announcement set for Wednesday when it is poised to begin raising the benchmark lending rate that was cut to zero at the start of the Covid-19 pandemic in March 2020.

That would be the first in a series of rate hikes, but amid the rising uncertainty, some economists think policymakers may move less aggressively than previously expected as they weigh the competing forces on the economy.

"The Fed is being tugged in two different directions by the massive increase in energy prices that's taken place over the last few weeks," David Wilcox, a former senior advisor to three successive Fed chairs, told AFP.

While higher inflation justifies the tightening moves, "the reduction in purchasing power that households are experiencing ... would call for a more accommodative stance of policy, a more cautious approach," said Wilcox, now with the Peterson Institute for International Economics and Bloomberg Economics.

Markets are pricing in about six rate hikes this year, but Grant Thornton Chief Economist Diane Swonk expects seven, while Wells Fargo raised their forecast from five to six -- which would still leave the policy rate below two percent.

- 'Thunderstruck' -

Prior to Russia's invasion of Ukraine, some economists -- and even some Fed officials -- said the first move in the tightening cycle could be a half point increase to send a strong signal to markets that the central bank was committed to keeping inflation from raging out of control.

But Fed Chair Jerome Powell last week declared his intention to call for a quarter-point increase -- a stunningly direct comment from a central bank chief, who typically keeps their plans close to the vest.

Wilcox said he was "thunderstruck" by the statement which tamped down speculation of a more aggressive move.

While Wilcox remains cautiously optimistic that inflation will come down, he stressed that the Fed will have to be "absolutely clear" that it will act as forcefully as necessary should price pressures accelerate.

And in the short term, economists warn that things will get worse before they get better.

"The disruptions we are seeing are adding fuel to a well kindled inflation fire that goes well beyond the energy sector and could touch much more of our daily lives," Swonk said.

"The timing couldn't be worse for the Federal Reserve, which is already chasing inflation for the first time since the 1980s."

Supply chain snarls caused shortages of key products as the global economy was returning to normal from the pandemic, and while the increases initially were driven by cars and housing, energy prices have spiked as well, especially in the past month.

The annual consumer price index in February hit 7.9 percent.

"Just about everything that makes up inflation is going bonkers to the upside," Adam Sarhan of 50 Park Investment told AFP, adding he fears it's the kind of rapid increase that can lead to a recession.

The IMF last week warned that the fallout from the war will slow global growth, but the US economy enters the latest crisis in strong position with low unemployment after expanding by 5.7 percent last year.

H.Romero--AT