-

Macron hails 'good' US decision on Ukraine missiles

Macron hails 'good' US decision on Ukraine missiles

-

Italy eliminate Swiatek's Poland to reach BJK Cup final

-

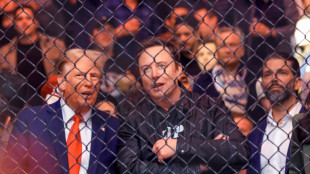

Trump expected to attend next Starship rocket launch: reports

Trump expected to attend next Starship rocket launch: reports

-

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

-

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

-

Thousands march to New Zealand's parliament in Maori rights protest

-

China's Xi urges G20 to help 'cool' Ukraine crisis

China's Xi urges G20 to help 'cool' Ukraine crisis

-

Church and state clash over entry fee for Paris's Notre Dame

-

Holders Spain strike late to beat Switzerland in Nations League

Holders Spain strike late to beat Switzerland in Nations League

-

Stocks, dollar hesitant as traders brace for Nvidia earnings

-

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

-

Biden in 'historic' pledge for poor nations ahead of Trump return

-

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

-

Five dead in new Israeli strike on Beirut's centre

-

Where's Joe? G20 leaders have group photo without Biden

Where's Joe? G20 leaders have group photo without Biden

-

US permission to fire missiles on Russia no game-changer: experts

-

Tropical storm Sara kills four in Honduras and Nicaragua

Tropical storm Sara kills four in Honduras and Nicaragua

-

Germany, Finland warn of 'hybrid warfare' after sea cable cut

-

Spanish resort to ban new holiday flats in 43 neighbourhoods

Spanish resort to ban new holiday flats in 43 neighbourhoods

-

Hong Kong to sentence dozens of democracy campaigners

-

Russian extradited to US from SKorea to face ransomware charges

Russian extradited to US from SKorea to face ransomware charges

-

Phone documentary details Afghan women's struggle under Taliban govt

-

G20 wrestles with wars, 'turbulence' in run-up to Trump

G20 wrestles with wars, 'turbulence' in run-up to Trump

-

Kane hoping to extend England career beyond 2026 World Cup

-

Gazans rebuild homes from rubble in preparation for winter

Gazans rebuild homes from rubble in preparation for winter

-

'Vague' net zero rules threaten climate targets, scientists warn

-

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

-

G20 wrestles with wars, climate in run-up to Trump

-

'Agriculture is dying': French farmers protest EU-Mercosur deal

'Agriculture is dying': French farmers protest EU-Mercosur deal

-

Beyonce to headline halftime during NFL Christmas game

-

Rescuers struggle to reach dozens missing after north Gaza strike

Rescuers struggle to reach dozens missing after north Gaza strike

-

Russia vetoes Sudan ceasefire resolution at UN

-

G20 host Brazil launches alliance to end 'scourge' of hunger

G20 host Brazil launches alliance to end 'scourge' of hunger

-

Stocks, dollar hesitant as traders scale back US rate cut bets

-

Trump confirms plan to use military for mass deportation

Trump confirms plan to use military for mass deportation

-

Schools closed in Beirut after deadly Israeli air raid

-

Anger, pain in Turkey as 'newborn deaths gang' trial opens

Anger, pain in Turkey as 'newborn deaths gang' trial opens

-

Kremlin says Biden 'fuelling' war as Russian strikes rock Odesa

-

UN climate chief at deadlocked COP29: 'Cut the theatrics'

UN climate chief at deadlocked COP29: 'Cut the theatrics'

-

G20 leaders gather to discuss wars, climate, Trump comeback

-

Stocks, dollar mixed as traders scale back US rate cut bets

Stocks, dollar mixed as traders scale back US rate cut bets

-

Stoinis lets rip as Australia crush Pakistan for T20 series whitewash

-

Bentancur banned for seven games over alleged racial slur

Bentancur banned for seven games over alleged racial slur

-

Kremlin says Biden 'fuelling' tensions with Kyiv missile decision

-

COP host Azerbaijan jailed activists over 'critical opinions': rights body

COP host Azerbaijan jailed activists over 'critical opinions': rights body

-

Composer of Piaf's 'Non, je ne regrette rien' dies aged 95

-

South African trio nominated for World Rugby player of year

South African trio nominated for World Rugby player of year

-

'Not here for retiring': Nadal insists focus on Davis Cup

-

Tractor-driving French farmers protest EU-Mercosur deal

Tractor-driving French farmers protest EU-Mercosur deal

-

Floods hit northern Philippines after typhoon forces dam release

Asian markets extend gains after Wall St rally

Asian markets extended gains Wednesday, tracking a rally in New York, on optimism that the Federal Reserve's plan to hike interest rates will help bring inflation under control.

While there remains plenty of concern about the war in Ukraine, analysts said some confidence had seeped back into trading floors as investors bet on consumer resilience as economies continue to reopen.

Fed boss Jerome Powell said Monday that the central bank was prepared to act more aggressively on lifting borrowing costs if inflation -- already at a 40-year high -- does not fall quickly enough.

Officials lifted rates last week by a quarter of a point but some have advocated hikes of half a point, a view Powell suggested he was open to, adding that he was happy the economy was strong enough to withstand such a move.

While the faster and steeper rate of hikes would make it costlier for investors to borrow, commentators said the Fed's stance gave them confidence it could get a grip on prices.

"We are positive for equities for this year," Seema Shah, of Principal Global Investors, told Bloomberg Television.

She added that while the near-term outlook would be challenging with recession risks rising, "we still think the US economy is pretty good fundamentally".

"Faster hikes are clearly going to help inflation come down," which may reduce the need for a longer tightening campaign.

All three main indexes on Wall Street rallied Tuesday, with the Nasdaq piling on two percent.

And Asia took up the baton in early trade, with Tokyo jumping more than two percent and Hong Kong continuing to bask in a tech rally fuelled by China's pledge of support for markets.

Shanghai, Seoul, Sydney, Singapore, Taipei and Jakarta were also on the front foot, though Manila and Wellington dipped.

"The market appears to be unfazed by the risks that have haunted it for the first quarter and appear ready to grind higher with conviction," said market strategist Louis Navellier.

"It appears that the long-awaited reopening trade has finally begun in earnest, despite the baggage of Ukraine and surprisingly high inflation, and may soon draw in a lot of money off the sidelines."

Still, investors continue to keep an eye on developments in the Ukraine war, which is keeping oil prices elevated though they remain stuck just below $120 a barrel.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 2.7 percent at 27,947.26 (break)

Hong Kong - Hang Seng Index: UP 1.7 percent at 22,265.81

Shanghai - Composite: UP 0.3 percent at 3,269.76

Brent North Sea crude: UP 0.9 percent at $116.57 per barrel

West Texas Intermediate: DOWN 0.8 percent at $110.15 per barrel

Dollar/yen: UP at 121.11 yen from 120.82 yen late Tuesday

Euro/dollar: DOWN at $1.1028 from $1.1033

Pound/dollar: UP at $1.3287 from $1.3260

Euro/pound: DOWN at 83.00 pence from 83.16 pence

New York - DOW: UP 0.7 percent at 34,807.46 (close)

London - FTSE 100: UP 0.5 percent at 7,476.72 (close)

A.Anderson--AT