-

China, Russia ministers discuss Korea tensions at G20: state media

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

-

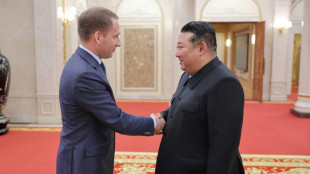

Russian delegations visit Pyongyang as Ukraine war deepens ties

Russian delegations visit Pyongyang as Ukraine war deepens ties

-

S.Africa offers a lesson on how not to shut down a coal plant

-

Italy beat Swiatek's Poland to reach BJK Cup final

Italy beat Swiatek's Poland to reach BJK Cup final

-

Japan, UK to hold regular economic security talks

-

Divided G20 fails to agree on climate, Ukraine

Divided G20 fails to agree on climate, Ukraine

-

Can the Trump-Musk 'bromance' last?

-

US to call for Google to sell Chrome browser: report

US to call for Google to sell Chrome browser: report

-

Macron hails 'good' US decision on Ukraine missiles

-

Italy eliminate Swiatek's Poland to reach BJK Cup final

Italy eliminate Swiatek's Poland to reach BJK Cup final

-

Trump expected to attend next Starship rocket launch: reports

-

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

-

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

-

Thousands march to New Zealand's parliament in Maori rights protest

Thousands march to New Zealand's parliament in Maori rights protest

-

China's Xi urges G20 to help 'cool' Ukraine crisis

-

Church and state clash over entry fee for Paris's Notre Dame

Church and state clash over entry fee for Paris's Notre Dame

-

Holders Spain strike late to beat Switzerland in Nations League

-

Stocks, dollar hesitant as traders brace for Nvidia earnings

Stocks, dollar hesitant as traders brace for Nvidia earnings

-

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

-

Biden in 'historic' pledge for poor nations ahead of Trump return

Biden in 'historic' pledge for poor nations ahead of Trump return

-

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

-

Five dead in new Israeli strike on Beirut's centre

Five dead in new Israeli strike on Beirut's centre

-

Where's Joe? G20 leaders have group photo without Biden

-

US permission to fire missiles on Russia no game-changer: experts

US permission to fire missiles on Russia no game-changer: experts

-

Tropical storm Sara kills four in Honduras and Nicaragua

-

Germany, Finland warn of 'hybrid warfare' after sea cable cut

Germany, Finland warn of 'hybrid warfare' after sea cable cut

-

Spanish resort to ban new holiday flats in 43 neighbourhoods

-

Hong Kong to sentence dozens of democracy campaigners

Hong Kong to sentence dozens of democracy campaigners

-

Russian extradited to US from SKorea to face ransomware charges

-

Phone documentary details Afghan women's struggle under Taliban govt

Phone documentary details Afghan women's struggle under Taliban govt

-

G20 wrestles with wars, 'turbulence' in run-up to Trump

-

Kane hoping to extend England career beyond 2026 World Cup

Kane hoping to extend England career beyond 2026 World Cup

-

Gazans rebuild homes from rubble in preparation for winter

-

'Vague' net zero rules threaten climate targets, scientists warn

'Vague' net zero rules threaten climate targets, scientists warn

-

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

-

G20 wrestles with wars, climate in run-up to Trump

G20 wrestles with wars, climate in run-up to Trump

-

'Agriculture is dying': French farmers protest EU-Mercosur deal

-

Beyonce to headline halftime during NFL Christmas game

Beyonce to headline halftime during NFL Christmas game

-

Rescuers struggle to reach dozens missing after north Gaza strike

-

Russia vetoes Sudan ceasefire resolution at UN

Russia vetoes Sudan ceasefire resolution at UN

-

G20 host Brazil launches alliance to end 'scourge' of hunger

-

Stocks, dollar hesitant as traders scale back US rate cut bets

Stocks, dollar hesitant as traders scale back US rate cut bets

-

Trump confirms plan to use military for mass deportation

-

Schools closed in Beirut after deadly Israeli air raid

Schools closed in Beirut after deadly Israeli air raid

-

Anger, pain in Turkey as 'newborn deaths gang' trial opens

-

Kremlin says Biden 'fuelling' war as Russian strikes rock Odesa

Kremlin says Biden 'fuelling' war as Russian strikes rock Odesa

-

UN climate chief at deadlocked COP29: 'Cut the theatrics'

Oil prices, stock markets steady after recent volatility

Oil prices and stock markets steadied Thursday, as Western leaders gathered for emergency summits in Brussels triggered by Russia's invasion of Ukraine.

NATO, G7 and European Union gatherings were taking place as the EU debates a possible embargo on Russian oil.

"After a period of sharp volatility, the oil market is enjoying a moment of calm," noted Victoria Scholar, head of investment at Interactive Investor.

The recent surge in oil prices on tight supply fears has fanned already sky-high inflation, causing central banks around the world to hike interest rates, in turn threatening economic recovery.

"We may see volatility increase further regarding multiple 50 basis point (US) hikes and even emergency rate hikes in the near term," said SPI Asset Management's Stephen Innes, referring to the Federal Reserve chief Jerome Powell's warning that the next increase could be higher than a quarter point.

But the European Central Bank is sitting tight on rates for the time being, as it reacts also to weak growth in the eurozone.

Business activity in the single currency bloc slowed in March, according to a closely watched survey Thursday, as high prices and a gloomy outlook raised fears the Ukraine war could snuff out economic recovery.

The S&P purchase managers' index slipped one point this month to 54.5. A figure above 50 indicates growth.

The survey underscores the "immediate and material impact" of the war on the economy and "highlights the risk of the eurozone falling into decline in the second quarter", said S&P's chief business economist, Chris Williamson.

- Gold reserves -

Elsewhere Thursday, the Moscow Stock Exchange resumed trading of some shares, the second stage in a phased re-opening.

The Moscow exchange suspended trading hours after President Vladimir Putin sent thousands of troops into pro-Western Ukraine on February 24.

Trading resumed for only around 30 of the largest companies that make up the ruble-denominated MOEX Russia Index, which saw early gains of more than 10 percent.

Britain has meanwhile slapped sanctions on 59 more Russian individuals and entities, as well as six Belarusian enterprises.

It comes as British Prime Minister Boris Johnson called for the world to prevent Russia using its gold reserves.

"The more we do that now, the more pressure we apply now, particularly on things like gold, ... I believe the more we can shorten the war, shorten the slaughter in Ukraine," he said.

- Key figures around 1200 GMT -

London - FTSE 100: UP 0.2 percent at 7,476.70 points

Frankfurt - DAX: DOWN 0.2 percent at 14,261.99

Paris - CAC 40: FLAT at 6,579.96

EURO STOXX 50: DOWN 0.1 percent at 3,865.22

Tokyo - Nikkei 225: UP 0.3 percent at 28,110.39 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 21,945.95 (close)

Shanghai - Composite: DOWN 0.6 percent at 3,250.26 (close)

New York - DOW: DOWN 1.3 percent at 34,358.50 (close)

Brent North Sea crude: DOWN 0.2 percent at $121.37 per barrel

West Texas Intermediate: UP 0.1 percent at $115.06 per barrel

Euro/dollar: DOWN at $1.1000 from $1.1013 late Wednesday

Pound/dollar: UNCHANGED at $1.3204

Euro/pound: DOWN at 83.30 pence from 83.36 pence

Dollar/yen: UP at 121.56 yen from 121.12 yen

A.Taylor--AT