-

Five takeaways from the G20 summit in Rio

Five takeaways from the G20 summit in Rio

-

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

Defiant Lebanese harvest olives in the shadow of war

-

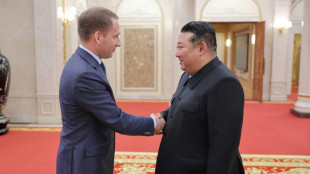

Russian delegations visit Pyongyang as Ukraine war deepens ties

-

S.Africa offers a lesson on how not to shut down a coal plant

S.Africa offers a lesson on how not to shut down a coal plant

-

Italy beat Swiatek's Poland to reach BJK Cup final

-

Japan, UK to hold regular economic security talks

Japan, UK to hold regular economic security talks

-

Divided G20 fails to agree on climate, Ukraine

-

Can the Trump-Musk 'bromance' last?

Can the Trump-Musk 'bromance' last?

-

US to call for Google to sell Chrome browser: report

-

Macron hails 'good' US decision on Ukraine missiles

Macron hails 'good' US decision on Ukraine missiles

-

Italy eliminate Swiatek's Poland to reach BJK Cup final

-

Trump expected to attend next Starship rocket launch: reports

Trump expected to attend next Starship rocket launch: reports

-

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

-

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

-

Thousands march to New Zealand's parliament in Maori rights protest

-

China's Xi urges G20 to help 'cool' Ukraine crisis

China's Xi urges G20 to help 'cool' Ukraine crisis

-

Church and state clash over entry fee for Paris's Notre Dame

-

Holders Spain strike late to beat Switzerland in Nations League

Holders Spain strike late to beat Switzerland in Nations League

-

Stocks, dollar hesitant as traders brace for Nvidia earnings

-

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

-

Biden in 'historic' pledge for poor nations ahead of Trump return

-

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

-

Five dead in new Israeli strike on Beirut's centre

-

Where's Joe? G20 leaders have group photo without Biden

Where's Joe? G20 leaders have group photo without Biden

-

US permission to fire missiles on Russia no game-changer: experts

-

Tropical storm Sara kills four in Honduras and Nicaragua

Tropical storm Sara kills four in Honduras and Nicaragua

-

Germany, Finland warn of 'hybrid warfare' after sea cable cut

-

Spanish resort to ban new holiday flats in 43 neighbourhoods

Spanish resort to ban new holiday flats in 43 neighbourhoods

-

Hong Kong to sentence dozens of democracy campaigners

-

Russian extradited to US from SKorea to face ransomware charges

Russian extradited to US from SKorea to face ransomware charges

-

Phone documentary details Afghan women's struggle under Taliban govt

-

G20 wrestles with wars, 'turbulence' in run-up to Trump

G20 wrestles with wars, 'turbulence' in run-up to Trump

-

Kane hoping to extend England career beyond 2026 World Cup

-

Gazans rebuild homes from rubble in preparation for winter

Gazans rebuild homes from rubble in preparation for winter

-

'Vague' net zero rules threaten climate targets, scientists warn

-

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

-

G20 wrestles with wars, climate in run-up to Trump

-

'Agriculture is dying': French farmers protest EU-Mercosur deal

'Agriculture is dying': French farmers protest EU-Mercosur deal

-

Beyonce to headline halftime during NFL Christmas game

-

Rescuers struggle to reach dozens missing after north Gaza strike

Rescuers struggle to reach dozens missing after north Gaza strike

-

Russia vetoes Sudan ceasefire resolution at UN

-

G20 host Brazil launches alliance to end 'scourge' of hunger

G20 host Brazil launches alliance to end 'scourge' of hunger

-

Stocks, dollar hesitant as traders scale back US rate cut bets

-

Trump confirms plan to use military for mass deportation

Trump confirms plan to use military for mass deportation

-

Schools closed in Beirut after deadly Israeli air raid

-

Anger, pain in Turkey as 'newborn deaths gang' trial opens

Anger, pain in Turkey as 'newborn deaths gang' trial opens

-

Kremlin says Biden 'fuelling' war as Russian strikes rock Odesa

Moscow stock market partially reopens after month-long closure

The Moscow Stock Exchange resumed trading of some shares Thursday, the second stage in a phased re-opening after being suspended for a month due to Russia's military operation in Ukraine.

Trading renewed for only 33 of the largest companies that make up the ruble-denominated MOEX Russia Index, which saw gains of 10 percent at opening but closed at 4.4 percent.

The RTS Index, which is calculated in US dollars, was down 9.0 percent as markets closed.

The companies trading on Thursday include Russian energy giants Gazprom and Rosneft, and the country's largest banks Sberbank and VTB, which are under US sanctions.

Other companies trading on the market included metals giants Nornickel and Rusal, several private companies and Russia's flag-carrier airline Aeroflot.

The Moscow exchange suspended trading hours after President Vladimir Putin sent thousands of troops into pro-Western Ukraine on February 24.

It started a phased re-opening on Monday with trading in federal government bonds, after the longest hiatus since the fall of the Soviet Union.

Russia's central bank said Wednesday that trading would be limited to just over four hours and short selling would be banned in an effort to prevent speculative deals.

Foreigners are not allowed to sell their shares, as part of measures taken by Russia to stem the flight of foreign currency and capital.

Timothy Ash, an emerging markets strategist at BlueBay Asset Management, said Russian authorities have made a "concerted effort" to stabilise the domestic market and "ease the feeling of panic which came with the market collapse" after the initial sanctions.

But he said this "deeply managed" reopening is "really only window dressing" as the sanctions are "proving really painful".

While the "Russian financial markets might stabilise in the short term," few foreigners will want to invest there, he said, since "Putin has made Russia like toxic waste".

Russia has been hit by Western sanctions that have pummelled the ruble and threatened to cause the government to default on its foreign debt.

- US sees 'charade' -

For analyst Mikhail Ganelin of investment company Aton, the gradual re-opening of the markets is an opportunity for Russians to protect their savings and hedge them against galloping inflation.

"Using the market as a long-term investment is the right thing to do," Ganelin told AFP, adding that "markets will recover sooner or later, sooner or later there will be some kind of political stabilisation."

"There are not many savings opportunities now. The stock market is one good tool for saving investments."

To aid recovery, the Russian government has pledged the equivalent of $10 billion to buy up shares of Russian companies and Putin said Wednesday Moscow will now only accept ruble payments from Europe for deliveries of Russian gas.

"What we're seeing is a charade: a Potemkin market opening," US Deputy National Security Advisor Daleep Singh said in a statement Thursday.

He said Russia will "only allow 15 percent of listed shares to trade".

"Russia has made it clear they are going to pour government resources into artificially propping up the shares of companies that are trading," he added.

In a bid to stabilise the ruble, the central bank last month more than doubled its key interest rate to 20 percent.

The sanctions also sparked an exodus of foreign companies from Russia, including H&M, McDonald's and IKEA.

Officials in Moscow have sought to downplay the gravity of the Western penalties, promising that Russia will adapt. Putin has said that the country will emerge stronger from the crisis.

D.Lopez--AT