-

Team Trump assails Biden decision on missiles for Ukraine

Team Trump assails Biden decision on missiles for Ukraine

-

Hong Kong court jails 45 democracy campaigners on subversion charges

-

Several children injured in car crash at central China school

Several children injured in car crash at central China school

-

Urban mosquito sparks malaria surge in East Africa

-

Djibouti experiments with GM mosquito against malaria

Djibouti experiments with GM mosquito against malaria

-

Pulisic at the double as USA cruise past Jamaica

-

Many children injured after car crashes at central China school: state media

Many children injured after car crashes at central China school: state media

-

Asian markets rally after US bounce as Nvidia comes into focus

-

Tens of thousands march in New Zealand Maori rights protest

Tens of thousands march in New Zealand Maori rights protest

-

Five takeaways from the G20 summit in Rio

-

China, Russia ministers discuss Korea tensions at G20: state media

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

-

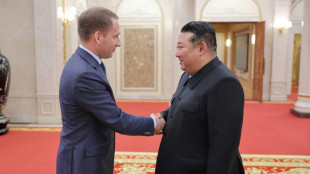

Russian delegations visit Pyongyang as Ukraine war deepens ties

Russian delegations visit Pyongyang as Ukraine war deepens ties

-

S.Africa offers a lesson on how not to shut down a coal plant

-

Italy beat Swiatek's Poland to reach BJK Cup final

Italy beat Swiatek's Poland to reach BJK Cup final

-

Japan, UK to hold regular economic security talks

-

Divided G20 fails to agree on climate, Ukraine

Divided G20 fails to agree on climate, Ukraine

-

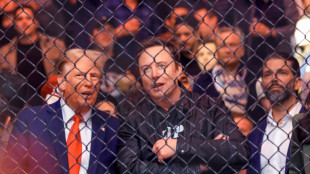

Can the Trump-Musk 'bromance' last?

-

US to call for Google to sell Chrome browser: report

US to call for Google to sell Chrome browser: report

-

Macron hails 'good' US decision on Ukraine missiles

-

Italy eliminate Swiatek's Poland to reach BJK Cup final

Italy eliminate Swiatek's Poland to reach BJK Cup final

-

Trump expected to attend next Starship rocket launch: reports

-

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

-

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

-

Thousands march to New Zealand's parliament in Maori rights protest

Thousands march to New Zealand's parliament in Maori rights protest

-

China's Xi urges G20 to help 'cool' Ukraine crisis

-

Church and state clash over entry fee for Paris's Notre Dame

Church and state clash over entry fee for Paris's Notre Dame

-

Holders Spain strike late to beat Switzerland in Nations League

-

Stocks, dollar hesitant as traders brace for Nvidia earnings

Stocks, dollar hesitant as traders brace for Nvidia earnings

-

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

-

Biden in 'historic' pledge for poor nations ahead of Trump return

Biden in 'historic' pledge for poor nations ahead of Trump return

-

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

-

Five dead in new Israeli strike on Beirut's centre

Five dead in new Israeli strike on Beirut's centre

-

Where's Joe? G20 leaders have group photo without Biden

-

US permission to fire missiles on Russia no game-changer: experts

US permission to fire missiles on Russia no game-changer: experts

-

Tropical storm Sara kills four in Honduras and Nicaragua

-

Germany, Finland warn of 'hybrid warfare' after sea cable cut

Germany, Finland warn of 'hybrid warfare' after sea cable cut

-

Spanish resort to ban new holiday flats in 43 neighbourhoods

-

Hong Kong to sentence dozens of democracy campaigners

Hong Kong to sentence dozens of democracy campaigners

-

Russian extradited to US from SKorea to face ransomware charges

-

Phone documentary details Afghan women's struggle under Taliban govt

Phone documentary details Afghan women's struggle under Taliban govt

-

G20 wrestles with wars, 'turbulence' in run-up to Trump

-

Kane hoping to extend England career beyond 2026 World Cup

Kane hoping to extend England career beyond 2026 World Cup

-

Gazans rebuild homes from rubble in preparation for winter

-

'Vague' net zero rules threaten climate targets, scientists warn

'Vague' net zero rules threaten climate targets, scientists warn

-

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

-

G20 wrestles with wars, climate in run-up to Trump

G20 wrestles with wars, climate in run-up to Trump

-

'Agriculture is dying': French farmers protest EU-Mercosur deal

Oil prices higher, stocks mixed as EU snubs Russia ban

Oil prices were higher Friday, and stock markets were mixed after European countries decided against a ban on Russian oil imports over its Ukraine invasion -- but Germany said it would drastically slash its energy purchases from Moscow.

European stocks, which had been firmly higher earlier in the session, ended the day with only modest gains, and Wall Street was mixed as analysts said investors would remain cautious over the economic impact of the war in Ukraine, now entering its second month.

"We appear to have hit a point in which the initial shock of the Ukraine invasion has passed and markets have corrected back to a point where the economic risks are deemed to be priced in," said OANDA analyst Craig Erlam.

"In the absence of any significant developments, equity markets have come to a relative standstill and could remain that way until we see some progress."

Volatility in the prices of commodities such as oil were nevertheless keeping stock markets volatile, the expert said.

"Higher commodity prices mean a further squeeze on the global economy this year and more inflation at a time when central banks are already accelerating tightening plans after falling behind the curve," Erlam said.

The United States and EU have announced a drive to wean Europe off Russian gas imports and so choke off the billions in revenues that are fuelling Moscow's ruinous war.

Europe's biggest economy, Germany, said its own Russian oil imports would be halved by June and coal deliveries stopped by the autumn of this year.

"Anxieties about the increasingly entrenched conflict in Ukraine are" holding back share price gains, said Hargreaves Lansdown analyst Susannah Streeter.

Russia launched its assault on Ukraine on February 24, sending shockwaves across global markets that continue to reverberate.

The business climate in Germany worsened in March, the Ifo business confidence index showed, amid fears over soaring energy prices and deepening supply-chain woes.

The crisis in eastern Europe has forced investors to reassess their outlook for the global economy owing to an expected surge in already soaring prices, which some commentators now warn could lead to recession.

Bitcoin rose above $45,000, boosted by talk that the Kremlin could accept the world's biggest cryptocurrency in exchange for Russian gas.

- Key figures around 1645 GMT -

Brent North Sea crude: UP 1.4 percent at $116.90 per barrel

West Texas Intermediate: UP 1.1 percent at $113.56 per barrel

London - FTSE 100: UP 0.2 percent at 7,483.35 points (close)

Frankfurt - DAX: UP 0.2 percent at 14,305.76 (close)

Paris - CAC 40: DOWN 0.03 percent at 6,553.68 (close)

EURO STOXX 50: UP 0.1 percent at 3,867.73

New York - DOW: DOWN 0.1 percent at 34,667.53

Tokyo - Nikkei 225: UP 0.1 percent at 28,149.84 (close)

Hong Kong - Hang Seng Index: DOWN 2.5 percent at 21,404.88 (close)

Shanghai - Composite: DOWN 1.2 percent at 3,212.24 (close)

Euro/dollar: DOWN at $1.0985 from $1.0997 late Thursday

Pound/dollar: UP at $1.3188 from $1.3187

Euro/pound: DOWN at 83.30 pence from 83.39 pence

Dollar/yen: DOWN at 122.05 yen from 122.35 yen

burs/spm/har

P.A.Mendoza--AT