-

Son of Norwegian princess arrested on suspicion of rape

Son of Norwegian princess arrested on suspicion of rape

-

Romanian court says 'irregularities' in influencer Andrew Tate's indictment

-

Iran faces fresh censure over lack of cooperation at UN nuclear meeting

Iran faces fresh censure over lack of cooperation at UN nuclear meeting

-

Despondency and defiance as 45 Hong Kong campaigners jailed

-

Scholar, lawmakers and journalist among Hong Kongers jailed

Scholar, lawmakers and journalist among Hong Kongers jailed

-

European stocks slide on fears of Russia-Ukraine escalation

-

Police break up Georgia vote protest as president mounts court challenge

Police break up Georgia vote protest as president mounts court challenge

-

Spain royals visit flood epicentre after chaotic trip

-

France's Gisele Pelicot says 'macho' society must change attitude on rape

France's Gisele Pelicot says 'macho' society must change attitude on rape

-

G20 leaders talk climate, wars -- and brace for Trump's return

-

US lawmaker accuses Azerbaijan in near 'assault' at COP29

US lawmaker accuses Azerbaijan in near 'assault' at COP29

-

Tuchel's England have 'tools' to win World Cup, says Carsley

-

Federer hails 'historic' Nadal ahead of imminent retirement

Federer hails 'historic' Nadal ahead of imminent retirement

-

Ukraine vows no surrender, Kremlin issues nuke threat on 1,000th day of war

-

Novo Nordisk's obesity drug Wegovy goes on sale in China

Novo Nordisk's obesity drug Wegovy goes on sale in China

-

Spain royals to visit flood epicentre after chaotic trip: media

-

French farmers step up protests against EU-Mercosur deal

French farmers step up protests against EU-Mercosur deal

-

Rose says Europe Ryder Cup stars play 'for the badge' not money

-

Negotiators seek to break COP29 impasse after G20 'marching orders'

Negotiators seek to break COP29 impasse after G20 'marching orders'

-

Burst dike leaves Filipino farmers under water

-

Markets rally after US bounce as Nvidia comes into focus

Markets rally after US bounce as Nvidia comes into focus

-

Crisis-hit Thyssenkrupp books another hefty annual loss

-

US envoy in Lebanon for talks on halting Israel-Hezbollah war

US envoy in Lebanon for talks on halting Israel-Hezbollah war

-

India to send 5,000 extra troops to quell Manipur unrest

-

Sex, drugs and gritty reality on Prague's underworld tours

Sex, drugs and gritty reality on Prague's underworld tours

-

Farmers descend on London to overturn inheritance tax change

-

Clippers upset Warriors, Lillard saves Bucks

Clippers upset Warriors, Lillard saves Bucks

-

Acquitted 'Hong Kong 47' defendant sees freedom as responsibility

-

Floods strike thousands of houses in northern Philippines

Floods strike thousands of houses in northern Philippines

-

Illegal farm fires fuel Indian capital's smog misery

-

SpaceX set for Starship's next flight, Trump expected to attend

SpaceX set for Starship's next flight, Trump expected to attend

-

Texans cruise as Cowboys crisis deepens

-

Do the Donald! Trump dance takes US sport by storm

Do the Donald! Trump dance takes US sport by storm

-

Home hero Cameron Smith desperate for first win of 2024 at Australian PGA

-

Team Trump assails Biden decision on missiles for Ukraine

Team Trump assails Biden decision on missiles for Ukraine

-

Hong Kong court jails 45 democracy campaigners on subversion charges

-

Several children injured in car crash at central China school

Several children injured in car crash at central China school

-

Urban mosquito sparks malaria surge in East Africa

-

Djibouti experiments with GM mosquito against malaria

Djibouti experiments with GM mosquito against malaria

-

Pulisic at the double as USA cruise past Jamaica

-

Many children injured after car crashes at central China school: state media

Many children injured after car crashes at central China school: state media

-

Asian markets rally after US bounce as Nvidia comes into focus

-

Tens of thousands march in New Zealand Maori rights protest

Tens of thousands march in New Zealand Maori rights protest

-

Five takeaways from the G20 summit in Rio

-

China, Russia ministers discuss Korea tensions at G20: state media

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

-

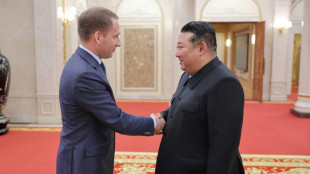

Russian delegations visit Pyongyang as Ukraine war deepens ties

Russian delegations visit Pyongyang as Ukraine war deepens ties

-

S.Africa offers a lesson on how not to shut down a coal plant

Eurozone stocks slide, as Germany slashes growth outlook

Eurozone stock markets slid Wednesday after strong gains the previous session, as Russia downplayed hopes of a breakthrough in peace talks with Ukraine and Germany's growth outlook darkened.

Outside the eurozone, London's main stocks index flattened after a mixed showing in Asia.

Surging oil prices, which have been a driver of decades-high inflation, were up more than 1.5 percent on lingering supply worries caused by the Ukraine war.

Analysts said there was an expectation that OPEC and other major producers including Russia would decide against lifting output at their monthly meeting Thursday.

"Hopes of a speedy resolution to the Russia-Ukraine conflict have been dashed again, with scepticism surrounding the latest reports of a slowdown of the Russian aggression," noted Richard Hunter, head of markets at Interactive Investor.

"The oil price has therefore risen once more."

Russia's pledge to "radically" wind down military activity around two cities including Kyiv, had sparked Tuesday a rally on US and European markets while sending oil prices tumbling.

The excitement has been tempered after world leaders greeted the news with scepticism, with US President Joe Biden saying he wanted to see if Moscow would "follow through" on a promise to de-escalate.

Moscow on Wednesday played down hopes of a breakthrough following the talks in Istanbul.

"We cannot state that there was anything too promising or any breakthroughs," Kremlin spokesman Dmitry Peskov told reporters. "There is a lot of work to be done."

- German outlook worsens 'drastically' -

Tuesday's strong gains on Wall Street and in Europe were largely matched in Asia on Wednesday.

Frankfurt though lost 1.5 percent, as Germany slashed its economic growth forecast for 2022, warning that the war in Ukraine and soaring energy prices would take a toll on Europe's biggest economy.

The German government's economic advisers said it expected gross domestic product to expand 1.8 percent year-on-year, down from a forecast of 4.6 percent.

"Russia's war of aggression against Ukraine and energy prices are drastically worsening the economic outlook," said the German Council of Economic Experts.

Inflation in eurozone member Spain has surged to a near 37-year high, official data showed Wednesday.

The rate jumped to 9.8 percent in March from 7.6 percent in February, its highest level since 1985.

Traders were looking ahead also to the release of US jobs data Friday for a fresh snapshot of the world's top economy.

A strong reading could spur the Federal Reserve to act more aggressively to fight inflation, with some commentators predicting several half-point US interest rate hikes this year.

- Key figures around 1115 GMT -

London - FTSE 100: FLAT at 7,536.73 points

Frankfurt - DAX: DOWN 1.5 percent at 14,606.12

Paris - CAC 40: DOWN 1.0 percent at 6,725.49

EURO STOXX 50: DOWN 1.0 percent at 3,960.42

Tokyo - Nikkei 225: DOWN 0.8 percent at 28,027.25 (close)

Hong Kong - Hang Seng Index: UP 1.4 percent at 22,232.03 (close)

Shanghai - Composite: UP 2.0 percent at 3,266.60 (close)

New York - DOW: UP 1.0 percent at 35,294.19 (close)

Brent North Sea crude: UP 1.6 percent at $111.97 per barrel

West Texas Intermediate: UP 1.9 percent at $106.17 per barrel

Euro/dollar: UP at $1.1131 from $1.1090 late Tuesday

Pound/dollar: UP at $1.3146 from $1.3094

Euro/pound: UP at 84.68 pence from 84.66 pence

Dollar/yen: DOWN at 121.91 yen from 122.77 yen

H.Thompson--AT