-

Trouble brews in India's Manipur state

Trouble brews in India's Manipur state

-

Son of Norwegian princess arrested on suspicion of rape

-

Romanian court says 'irregularities' in influencer Andrew Tate's indictment

Romanian court says 'irregularities' in influencer Andrew Tate's indictment

-

Iran faces fresh censure over lack of cooperation at UN nuclear meeting

-

Despondency and defiance as 45 Hong Kong campaigners jailed

Despondency and defiance as 45 Hong Kong campaigners jailed

-

Scholar, lawmakers and journalist among Hong Kongers jailed

-

European stocks slide on fears of Russia-Ukraine escalation

European stocks slide on fears of Russia-Ukraine escalation

-

Police break up Georgia vote protest as president mounts court challenge

-

Spain royals visit flood epicentre after chaotic trip

Spain royals visit flood epicentre after chaotic trip

-

France's Gisele Pelicot says 'macho' society must change attitude on rape

-

G20 leaders talk climate, wars -- and brace for Trump's return

G20 leaders talk climate, wars -- and brace for Trump's return

-

US lawmaker accuses Azerbaijan in near 'assault' at COP29

-

Tuchel's England have 'tools' to win World Cup, says Carsley

Tuchel's England have 'tools' to win World Cup, says Carsley

-

Federer hails 'historic' Nadal ahead of imminent retirement

-

Ukraine vows no surrender, Kremlin issues nuke threat on 1,000th day of war

Ukraine vows no surrender, Kremlin issues nuke threat on 1,000th day of war

-

Novo Nordisk's obesity drug Wegovy goes on sale in China

-

Spain royals to visit flood epicentre after chaotic trip: media

Spain royals to visit flood epicentre after chaotic trip: media

-

French farmers step up protests against EU-Mercosur deal

-

Rose says Europe Ryder Cup stars play 'for the badge' not money

Rose says Europe Ryder Cup stars play 'for the badge' not money

-

Negotiators seek to break COP29 impasse after G20 'marching orders'

-

Burst dike leaves Filipino farmers under water

Burst dike leaves Filipino farmers under water

-

Markets rally after US bounce as Nvidia comes into focus

-

Crisis-hit Thyssenkrupp books another hefty annual loss

Crisis-hit Thyssenkrupp books another hefty annual loss

-

US envoy in Lebanon for talks on halting Israel-Hezbollah war

-

India to send 5,000 extra troops to quell Manipur unrest

India to send 5,000 extra troops to quell Manipur unrest

-

Sex, drugs and gritty reality on Prague's underworld tours

-

Farmers descend on London to overturn inheritance tax change

Farmers descend on London to overturn inheritance tax change

-

Clippers upset Warriors, Lillard saves Bucks

-

Acquitted 'Hong Kong 47' defendant sees freedom as responsibility

Acquitted 'Hong Kong 47' defendant sees freedom as responsibility

-

Floods strike thousands of houses in northern Philippines

-

Illegal farm fires fuel Indian capital's smog misery

Illegal farm fires fuel Indian capital's smog misery

-

SpaceX set for Starship's next flight, Trump expected to attend

-

Texans cruise as Cowboys crisis deepens

Texans cruise as Cowboys crisis deepens

-

Do the Donald! Trump dance takes US sport by storm

-

Home hero Cameron Smith desperate for first win of 2024 at Australian PGA

Home hero Cameron Smith desperate for first win of 2024 at Australian PGA

-

Team Trump assails Biden decision on missiles for Ukraine

-

Hong Kong court jails 45 democracy campaigners on subversion charges

Hong Kong court jails 45 democracy campaigners on subversion charges

-

Several children injured in car crash at central China school

-

Urban mosquito sparks malaria surge in East Africa

Urban mosquito sparks malaria surge in East Africa

-

Djibouti experiments with GM mosquito against malaria

-

Pulisic at the double as USA cruise past Jamaica

Pulisic at the double as USA cruise past Jamaica

-

Many children injured after car crashes at central China school: state media

-

Asian markets rally after US bounce as Nvidia comes into focus

Asian markets rally after US bounce as Nvidia comes into focus

-

Tens of thousands march in New Zealand Maori rights protest

-

Five takeaways from the G20 summit in Rio

Five takeaways from the G20 summit in Rio

-

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

Defiant Lebanese harvest olives in the shadow of war

-

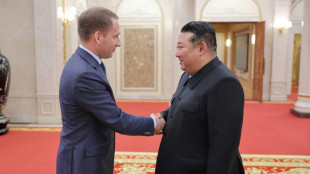

Russian delegations visit Pyongyang as Ukraine war deepens ties

US regulators tighten rules on deals with shell companies

US securities regulators proposed Wednesday new rules for shell investment companies, tightening a pathway for businesses to go public that has been criticized for skimping on investor protections.

The new rules seek to place firms that are set up with the sole purpose of merging with another entity, known as special purpose acquisition companies (SPACs), on an equal plane with companies participating in traditional initial public offerings (IPOs).

The move comes after a surge of SPAC deals in 2020 and 2021 and with well-known companies ranging from Virgin Galactic and WeWork to several celebrity-linked ventures employing the tactic.

The new rules require additional disclosures about SPAC sponsors, conflicts of interest and sources of equity dilution, said the Securities and Exchange Commission, which will launch a public comment period on its 372-page proposal.

The proposal also removes a SPAC advantage that granted such firms protection from lawsuits if their forecasts are not met -- a feature not available to traditional IPOs.

The shift reflects the fact that such projections "may lack a reasonable basis," the SEC said in a fact sheet.

The new measures on SPACs aim to "ensure that investors in these vehicles get protections similar to those when investing in traditional initial public offerings," said SEC Chair Gary Gensler.

"Investors deserve the protections they receive from traditional IPOs, with respect to information asymmetries, fraud, and conflicts, and when it comes to disclosure, marketing practices, gatekeepers, and issuers," he said.

The pace of SPAC offerings has slowed so far in 2022, with 53 deals involving US-listed firms which raised $9.8 billion, according to Dealogic.

In 2021, there were more than 600 transactions raising $162.6 billion, according to Dealogic.

A.Ruiz--AT