-

Trump ally seeks to block trans lawmaker from women's restrooms

Trump ally seeks to block trans lawmaker from women's restrooms

-

Slovakia oust Britain to meet Italy in BJK Cup title match

-

Top-selling daily French daily Ouest-France stops posting on X

Top-selling daily French daily Ouest-France stops posting on X

-

Russian invasion toll on environment $71 billion, Ukraine says

-

'Sabotage' suspected after two Baltic Sea cables cut

'Sabotage' suspected after two Baltic Sea cables cut

-

'You will die in lies!': daughter clashes with father at French rape trial

-

Spain Women drop veterans Paredes and World Cup kiss victim Hermoso

Spain Women drop veterans Paredes and World Cup kiss victim Hermoso

-

Stocks diverge on fears of Ukraine-Russia escalation

-

New Botswana leader eyes cannabis, sunshine to lift economy

New Botswana leader eyes cannabis, sunshine to lift economy

-

'Operation Night Watch': Rembrandt classic gets makeover

-

Haiti police, civilians kill 28 gang members: authorities

Haiti police, civilians kill 28 gang members: authorities

-

Taxing the richest: what the G20 decided

-

'Minecraft' to come to life in UK and US under theme park deal

'Minecraft' to come to life in UK and US under theme park deal

-

IMF, Ukraine, reach agreement on $1.1 bn loan disbursement

-

Japan on cusp of World Cup as Son scores in Palestine draw

Japan on cusp of World Cup as Son scores in Palestine draw

-

Chelsea condemn 'hateful' homophobic abuse towards Kerr, Mewis

-

Hamilton to race final three grands prix of Mercedes career

Hamilton to race final three grands prix of Mercedes career

-

Gatland has not become a 'bad coach' says Springboks' Erasmus

-

Slovakia take Britain to doubles decider in BJK Cup semis

Slovakia take Britain to doubles decider in BJK Cup semis

-

Brazil arrests soldiers over alleged 2022 Lula assassination plot

-

Ukraine war and climate stalemate loom over G20 summit

Ukraine war and climate stalemate loom over G20 summit

-

Ukraine fires first US long-range missiles into Russia

-

Retiring Nadal to play singles for Spain against Netherlands in Davis Cup

Retiring Nadal to play singles for Spain against Netherlands in Davis Cup

-

Rain ruins Sri Lanka's final ODI against New Zealand

-

Stocks sink on fears of Ukraine-Russia escalation

Stocks sink on fears of Ukraine-Russia escalation

-

Hendrikse brothers start for South Africa against Wales

-

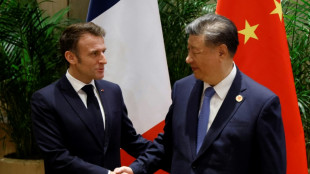

Macron tells Xi he shares desire for 'durable peace' in Ukraine

Macron tells Xi he shares desire for 'durable peace' in Ukraine

-

Ruthless Japan beat China to move to brink of World Cup qualification

-

French farmers threaten 'chaos' over proposed EU-Mercosur deal

French farmers threaten 'chaos' over proposed EU-Mercosur deal

-

Brazil arrests G20 guards over alleged 2022 Lula assassination plot

-

China's Xi urges 'strategic' ties in talks with Germany's Scholz

China's Xi urges 'strategic' ties in talks with Germany's Scholz

-

Raducanu gives Britain lead on Slovakia in BJK Cup semis

-

Russia says Ukraine fired first US-long range missiles

Russia says Ukraine fired first US-long range missiles

-

COP29 negotiators strive for deal after G20 'marching orders'

-

Walmart lifts full-year forecast after strong Q3

Walmart lifts full-year forecast after strong Q3

-

British farmers protest in London over inheritance tax change

-

NATO holds large Arctic exercises in Russia's backyard

NATO holds large Arctic exercises in Russia's backyard

-

Trouble brews in India's Manipur state

-

Son of Norwegian princess arrested on suspicion of rape

Son of Norwegian princess arrested on suspicion of rape

-

Romanian court says 'irregularities' in influencer Andrew Tate's indictment

-

Iran faces fresh censure over lack of cooperation at UN nuclear meeting

Iran faces fresh censure over lack of cooperation at UN nuclear meeting

-

Despondency and defiance as 45 Hong Kong campaigners jailed

-

Scholar, lawmakers and journalist among Hong Kongers jailed

Scholar, lawmakers and journalist among Hong Kongers jailed

-

European stocks slide on fears of Russia-Ukraine escalation

-

Police break up Georgia vote protest as president mounts court challenge

Police break up Georgia vote protest as president mounts court challenge

-

Spain royals visit flood epicentre after chaotic trip

-

France's Gisele Pelicot says 'macho' society must change attitude on rape

France's Gisele Pelicot says 'macho' society must change attitude on rape

-

G20 leaders talk climate, wars -- and brace for Trump's return

-

US lawmaker accuses Azerbaijan in near 'assault' at COP29

US lawmaker accuses Azerbaijan in near 'assault' at COP29

-

Tuchel's England have 'tools' to win World Cup, says Carsley

| RBGPF | -0.74% | 59.75 | $ | |

| RYCEF | -2.24% | 6.7 | $ | |

| CMSC | -0.06% | 24.61 | $ | |

| GSK | -0.64% | 33.475 | $ | |

| RIO | 0.08% | 62.17 | $ | |

| NGG | 1.02% | 63.545 | $ | |

| CMSD | -0.08% | 24.37 | $ | |

| RELX | 0.41% | 45.225 | $ | |

| BTI | 0.52% | 36.87 | $ | |

| SCS | -0.88% | 13.085 | $ | |

| BCC | -2.55% | 138.025 | $ | |

| VOD | -0.56% | 8.87 | $ | |

| AZN | 0.76% | 63.875 | $ | |

| BP | -1.43% | 29.005 | $ | |

| BCE | 0.46% | 27.355 | $ | |

| JRI | -0.08% | 13.22 | $ |

Stocks edge higher on solid US jobs data, oil prices retreat

Wall Street stocks finished modestly higher Friday as solid US jobs data boosted expectations for more Federal Reserve interest rate hikes, while oil prices retreated after US allies agreed to tap their emergency stockpiles.

The government jobs report for March showed US employers adding 431,000 positions and the unemployment rate falling to 3.6 percent, a hair above where it was before the pandemic.

The data showed progress in the US economic recovery, but also raised expectations of an aggressive Federal Reserve interest rate hike to tame runaway inflation.

"Given the strength of the labor market and inflation well above target, the probability that the Fed raises rates by 50 (basis points) at its next meeting in May -- which is our baseline -- is rising," Daniel Vernazza of UniCredit Bank said in a note.

However, the Institute for Supply Management reported the US manufacturing sector's expansion slowed last month amid a spike in energy prices following Russia's invasion of Ukraine.

After a choppy session, all three major US indices finished modestly higher with the S&P 500 up 0.3 percent, lifting the index narrowly into positive territory for the week.

European equities also climbed, despite data showing eurozone inflation surged by a record 7.5 percent last month.

Analysts said soaring inflation will pressure the European Central Bank, which has thus far been reluctant to follow the Federal Reserve's lead and lift interest rates.

"With euro-zone inflation rising even further above the ECB's forecast, and likely to remain very high for the rest of the year, we think it won't be long before the Bank starts raising interest rates," said Jack Allen-Reynolds at Capital Economics.

Oil prices, meanwhile, retreated, with the US benchmark WTI contract dipping under $100 a barrel.

In a bid to ease oil prices, the 31-nation International Energy Agency agreed to tap emergency oil reserves again at an emergency ministerial meeting following a pledge to release over 60 million barrels.

The IEA, whose members include the United States, European countries, Japan and other nations allied to Washington, said it would make the new amount public early next week.

The move came a day after Biden announced a record release of oil onto the market -- one million barrels of US government oil every day for six months in a bid to ease prices.

Biden described the move as a "wartime" measure that will defuse Russia's leverage as an energy power.

Washington has pressed the OPEC+ group of oil producing countries, led by Saudi Arabia and Russia, to boost its output but the group on Thursday agreed on another modest increase instead.

The war has driven oil prices to near record heights over concerns about supplies as Russia is the world's second biggest exporter of crude after Saudi Arabia.

- Key figures around 2100 GMT -

New York - Dow: UP 0.4 percent at 34,818.27 (close)

New York - S&P 500: UP 0.3 percent at 4,545.86 (close)

New York - Nasdaq: UP 0.3 percent at 14,261.50 (close)

London - FTSE 100: UP 0.3 percent at 7,537.90 (close)

Frankfurt - DAX: UP 0.2 percent at 14,446.48 (close)

Paris - CAC 40: UP 0.4 percent at 6,684.31 (close)

EURO STOXX 50: UP 0.4 percent at 3,918.68 (close)

Tokyo - Nikkei 225: DOWN 0.6 percent at 27,665.98 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 22,039.55 (close)

Shanghai - Composite: UP 0.9 percent at 3,282.72 (close)

Brent North Sea crude: DOWN 0.3 percent at $104.39 per barrel

West Texas Intermediate: DOWN 1.0 percent at $99.27 per barrel

Euro/dollar: DOWN at $1.1049 from $1.1067 late Thursday

Pound/dollar: DOWN at $1.3118 from $1.3138

Euro/pound: FLAT at 84.24 pence

Dollar/yen: UP at 122.49 yen from 121.70 yen

S.Jackson--AT