-

Take two: Biden makes it into G20 leaders' photo

Take two: Biden makes it into G20 leaders' photo

-

Russia vows response after Ukraine fires long-range US missiles

-

Spain's Nadal loses in Davis Cup quarter-finals singles opener

Spain's Nadal loses in Davis Cup quarter-finals singles opener

-

Four elite Brazil officers arrested over alleged 2022 Lula murder plot

-

SpaceX set for Starship's next flight -- with Trump watching

SpaceX set for Starship's next flight -- with Trump watching

-

Trump ally seeks to block trans lawmaker from women's restrooms

-

Slovakia oust Britain to meet Italy in BJK Cup title match

Slovakia oust Britain to meet Italy in BJK Cup title match

-

Top-selling daily French daily Ouest-France stops posting on X

-

Russian invasion toll on environment $71 billion, Ukraine says

Russian invasion toll on environment $71 billion, Ukraine says

-

'Sabotage' suspected after two Baltic Sea cables cut

-

'You will die in lies!': daughter clashes with father at French rape trial

'You will die in lies!': daughter clashes with father at French rape trial

-

Spain Women drop veterans Paredes and World Cup kiss victim Hermoso

-

Stocks diverge on fears of Ukraine-Russia escalation

Stocks diverge on fears of Ukraine-Russia escalation

-

New Botswana leader eyes cannabis, sunshine to lift economy

-

'Operation Night Watch': Rembrandt classic gets makeover

'Operation Night Watch': Rembrandt classic gets makeover

-

Haiti police, civilians kill 28 gang members: authorities

-

Taxing the richest: what the G20 decided

Taxing the richest: what the G20 decided

-

'Minecraft' to come to life in UK and US under theme park deal

-

IMF, Ukraine, reach agreement on $1.1 bn loan disbursement

IMF, Ukraine, reach agreement on $1.1 bn loan disbursement

-

Japan on cusp of World Cup as Son scores in Palestine draw

-

Chelsea condemn 'hateful' homophobic abuse towards Kerr, Mewis

Chelsea condemn 'hateful' homophobic abuse towards Kerr, Mewis

-

Hamilton to race final three grands prix of Mercedes career

-

Gatland has not become a 'bad coach' says Springboks' Erasmus

Gatland has not become a 'bad coach' says Springboks' Erasmus

-

Slovakia take Britain to doubles decider in BJK Cup semis

-

Brazil arrests soldiers over alleged 2022 Lula assassination plot

Brazil arrests soldiers over alleged 2022 Lula assassination plot

-

Ukraine war and climate stalemate loom over G20 summit

-

Ukraine fires first US long-range missiles into Russia

Ukraine fires first US long-range missiles into Russia

-

Retiring Nadal to play singles for Spain against Netherlands in Davis Cup

-

Rain ruins Sri Lanka's final ODI against New Zealand

Rain ruins Sri Lanka's final ODI against New Zealand

-

Stocks sink on fears of Ukraine-Russia escalation

-

Hendrikse brothers start for South Africa against Wales

Hendrikse brothers start for South Africa against Wales

-

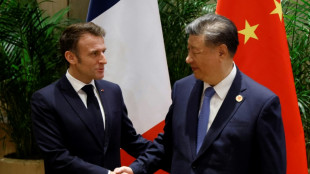

Macron tells Xi he shares desire for 'durable peace' in Ukraine

-

Ruthless Japan beat China to move to brink of World Cup qualification

Ruthless Japan beat China to move to brink of World Cup qualification

-

French farmers threaten 'chaos' over proposed EU-Mercosur deal

-

Brazil arrests G20 guards over alleged 2022 Lula assassination plot

Brazil arrests G20 guards over alleged 2022 Lula assassination plot

-

China's Xi urges 'strategic' ties in talks with Germany's Scholz

-

Raducanu gives Britain lead on Slovakia in BJK Cup semis

Raducanu gives Britain lead on Slovakia in BJK Cup semis

-

Russia says Ukraine fired first US-long range missiles

-

COP29 negotiators strive for deal after G20 'marching orders'

COP29 negotiators strive for deal after G20 'marching orders'

-

Walmart lifts full-year forecast after strong Q3

-

British farmers protest in London over inheritance tax change

British farmers protest in London over inheritance tax change

-

NATO holds large Arctic exercises in Russia's backyard

-

Trouble brews in India's Manipur state

Trouble brews in India's Manipur state

-

Son of Norwegian princess arrested on suspicion of rape

-

Romanian court says 'irregularities' in influencer Andrew Tate's indictment

Romanian court says 'irregularities' in influencer Andrew Tate's indictment

-

Iran faces fresh censure over lack of cooperation at UN nuclear meeting

-

Despondency and defiance as 45 Hong Kong campaigners jailed

Despondency and defiance as 45 Hong Kong campaigners jailed

-

Scholar, lawmakers and journalist among Hong Kongers jailed

-

European stocks slide on fears of Russia-Ukraine escalation

European stocks slide on fears of Russia-Ukraine escalation

-

Police break up Georgia vote protest as president mounts court challenge

Tech stocks tumble on Nvidia rout, weak US data

Tech firms led a plunge across equity markets Wednesday after a rout on Wall Street fuelled by a collapse in chip titan Nvidia and disappointing data on US factory activity that revived recession fears and pushed the dollar lower.

The sight of investors running to the hills sparked memories of the brief but tumultuous sell-off at the start of August that was partly fuelled by a big miss on US jobs creation.

All three leading indexes in New York ended sharply lower Tuesday, with the Nasdaq the main casualty -- diving more than three percent -- as traders dumped big-name tech firms including Apple, Alphabet and Amazon.

But the biggest loser was AI chip leader Nvidia, shedding almost $280 billion of its value, on fears that the surge in firms linked to artificial intelligence may have run too far.

"When risk reduction takes hold, the most crowded trades tend to bear the brunt, and that's precisely what we saw in Nvidia, which tumbled 9.5 percent as global growth jitters intensified," noted independent analyst Stephen Innes.

Adding to the pain, it emerged after Wall Street closed that US authorities had issued Nvidia and other firms subpoenas as it probes claims they violated antitrust laws.

The selling filtered through to Asia, where tech and chip firms took the brunt of it. Europe, with a smaller number of major tech firms, saw smaller losses across its main indices.

In Japan, Advantest stock plunged 7.7 percent and Tokyo Electron more than eight percent, while Sony lost three percent.

TSMC shed more than five percent in Taipei, with SK hynix dumping eight percent in Seoul and Samsung more than three percent off.

Tokyo and Taipei each dived more than four percent overall, while Seoul was 3.2 percent lower.

Elsewhere, oil prices rebounded slightly after Tuesday's heavy selling sparked by demand worries linked to a weak Chinese economy and questions over the US outlook, while OPEC's consideration of output hikes added to the pain, analysts said.

Worries about the US economy burst back onto the scene after figures showed a marginal improvement in factory activity in August but it still remained in contraction for a fifth successive month.

The figures come days before a closely watched report on non-farm payrolls, which could have a big impact on Federal Reserve officials' decision-making going into next week's policy meeting.

The bank is expected to cut interest rates but the debate surrounds how big it will go, with most tipping a 25-basis-point reduction but a below-forecast reading seen boosting the chances of a 50-point move.

- Key figures around 1030 GMT -

London - FTSE 100: DOWN 0.6 percent at 8,248.57 points

Paris - CAC 40: DOWN 0.9 percent at 7,505.94

Frankfurt - DAX: DOWN 0.7 percent at 18,617.28

EURO STOXX 50: DOWN 1.1 percent at 4,859.14

Tokyo - Nikkei 225: DOWN 4.2 percent at 37,047.61 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 17,457.34 (close)

Shanghai - Composite: DOWN 0.7 percent at 2,784.28 (close)

New York - Dow: DOWN 1.5 percent at 40,936.93 (close)

Dollar/yen: DOWN at 145.11 yen from 145.46 yen on Tuesday

Euro/dollar: UP at $1.1055 from $1.1047

Pound/dollar: UP at $1.3118 from $1.3111

Euro/pound: UP at 84.29 pence from 84.17 pence

Brent North Sea Crude: UP 0.4 percent at $74.02 per barrel

West Texas Intermediate: UP 1.1 percent at $71.09 per barrel

M.White--AT