-

Markets rally after US bounce as Nvidia comes into focus

Markets rally after US bounce as Nvidia comes into focus

-

Crisis-hit Thyssenkrupp books another hefty annual loss

-

US envoy in Lebanon for talks on halting Israel-Hezbollah war

US envoy in Lebanon for talks on halting Israel-Hezbollah war

-

India to send 5,000 extra troops to quell Manipur unrest

-

Sex, drugs and gritty reality on Prague's underworld tours

Sex, drugs and gritty reality on Prague's underworld tours

-

Farmers descend on London to overturn inheritance tax change

-

Clippers upset Warriors, Lillard saves Bucks

Clippers upset Warriors, Lillard saves Bucks

-

Acquitted 'Hong Kong 47' defendant sees freedom as responsibility

-

Floods strike thousands of houses in northern Philippines

Floods strike thousands of houses in northern Philippines

-

Illegal farm fires fuel Indian capital's smog misery

-

SpaceX set for Starship's next flight, Trump expected to attend

SpaceX set for Starship's next flight, Trump expected to attend

-

Texans cruise as Cowboys crisis deepens

-

Do the Donald! Trump dance takes US sport by storm

Do the Donald! Trump dance takes US sport by storm

-

Home hero Cameron Smith desperate for first win of 2024 at Australian PGA

-

Team Trump assails Biden decision on missiles for Ukraine

Team Trump assails Biden decision on missiles for Ukraine

-

Hong Kong court jails 45 democracy campaigners on subversion charges

-

Several children injured in car crash at central China school

Several children injured in car crash at central China school

-

Urban mosquito sparks malaria surge in East Africa

-

Djibouti experiments with GM mosquito against malaria

Djibouti experiments with GM mosquito against malaria

-

Pulisic at the double as USA cruise past Jamaica

-

Many children injured after car crashes at central China school: state media

Many children injured after car crashes at central China school: state media

-

Asian markets rally after US bounce as Nvidia comes into focus

-

Tens of thousands march in New Zealand Maori rights protest

Tens of thousands march in New Zealand Maori rights protest

-

Five takeaways from the G20 summit in Rio

-

China, Russia ministers discuss Korea tensions at G20: state media

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

-

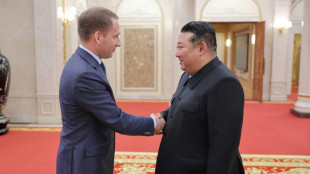

Russian delegations visit Pyongyang as Ukraine war deepens ties

Russian delegations visit Pyongyang as Ukraine war deepens ties

-

S.Africa offers a lesson on how not to shut down a coal plant

-

Italy beat Swiatek's Poland to reach BJK Cup final

Italy beat Swiatek's Poland to reach BJK Cup final

-

Japan, UK to hold regular economic security talks

-

Divided G20 fails to agree on climate, Ukraine

Divided G20 fails to agree on climate, Ukraine

-

Can the Trump-Musk 'bromance' last?

-

US to call for Google to sell Chrome browser: report

US to call for Google to sell Chrome browser: report

-

Macron hails 'good' US decision on Ukraine missiles

-

Italy eliminate Swiatek's Poland to reach BJK Cup final

Italy eliminate Swiatek's Poland to reach BJK Cup final

-

Trump expected to attend next Starship rocket launch: reports

-

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

-

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

-

Thousands march to New Zealand's parliament in Maori rights protest

Thousands march to New Zealand's parliament in Maori rights protest

-

China's Xi urges G20 to help 'cool' Ukraine crisis

-

Church and state clash over entry fee for Paris's Notre Dame

Church and state clash over entry fee for Paris's Notre Dame

-

Holders Spain strike late to beat Switzerland in Nations League

-

Stocks, dollar hesitant as traders brace for Nvidia earnings

Stocks, dollar hesitant as traders brace for Nvidia earnings

-

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

-

Biden in 'historic' pledge for poor nations ahead of Trump return

Biden in 'historic' pledge for poor nations ahead of Trump return

-

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

-

Five dead in new Israeli strike on Beirut's centre

Five dead in new Israeli strike on Beirut's centre

-

Where's Joe? G20 leaders have group photo without Biden

Hong Kong, Shanghai lead markets rally after China stimulus

Hong Kong and Shanghai stocks led gains across Asia and Europe on Tuesday after China unveiled fresh stimulus measures as the country's leaders struggle to kickstart growth in the world's number two economy.

After a string of weak data that has fanned worries about the financial health of the country, the central bank said it would make it easier for lenders and lower a key interest rate.

The decision came as traders were already upbeat after the Federal Reserve last week lowered borrowing costs for the first time since 2020 and indicated more were in the pipeline through to 2026.

The world's second-largest economy has yet to achieve a post-pandemic recovery owing to a prolonged property sector debt crisis, deflationary pressure and high unemployment.

While Beijing has resisted calls to unveil a so-called bazooka stimulus similar to that seen during the global financial crisis, it has pushed through a series of piecemeal measures that appear to have done little to turn things around.

People's Bank of China chief Pan Gongsheng told a news conference that "the reserve requirement ratio will be cut by 0.5 percentage points in the near future to provide long-term liquidity to the financial market of about one trillion yuan ($141.7 billion)".

It will also "lower the interest rates of existing mortgage loans and unify the down payment ratios for mortgage loans", he added.

Hong Kong and Shanghai stocks rallied around four percent.

There were gains in Tokyo as dealers returned from a long weekend, while Singapore, Seoul, Taipei, Manila, Mumbai, Bangkok and Jakarta also rose, but Sydney and Wellington retreated.

London, Paris and Frankfurt all rallied at the open.

The moves represent "the most significant... stimulus package since the early days of the pandemic", said Julian Evans-Pritchard, head of China economics at Capital Economics.

But he warned "it may not be enough", adding a full economic recovery would "require more substantial fiscal support than the modest pick-up in government spending that's currently in the pipeline".

And Moody's Analytics' Greater China analyst Heron Lim said: "We were expecting these after a weak run of economic data in July and August putting China off the pace to reach its 'around five percent' target. But this is hardly a bazooka stimulus.

"It might be slightly on the larger end of what the PBoC does, but all these measures have been actions that have been done before.

"In fact, the Fed's start of the easing earlier last week likely helped the PBoC see more perceived space to ease its own monetary cycle further without resulting in exchange rate instability."

The advances came after a positive day on Wall Street, where the Dow and S&P 500 ended at record highs.

Traders are awaiting the release Friday of the personal consumption expenditures index -- the Fed's preferred inflation metric -- hoping for an idea about its next rate move.

After Wednesday's bumper 50-basis-point cut, debate is now swirling about how big monetary policymakers will go at their next meeting.

Minneapolis Fed boss Neel Kashkari said he was for another big reduction owing to weakness in the labour market, while his Chicago counterpart Austan Goolsbee added that slowing jobs growth would likely mean there were many more cuts to come.

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: UP 0.6 percent to 37,940.59 (close)

Hong Kong - Hang Seng Index: UP 3.9 percent to 18,963.77

Shanghai - Composite: UP 4.2 percent to 2,863.13 (close)

London - FTSE 100: UP 0.5 percent at 8,299.05

Euro/dollar: UP at $1.1117 from $1.1113 on Monday

Pound/dollar: UP at $1.3364 from $1.3345

Dollar/yen: UP at 144.41 yen from 143.57 yen

Euro/pound: DOWN at 83.20 pence from 83.27 pence

West Texas Intermediate: UP 1.2 percent at $71.23 per barrel

Brent North Sea Crude: UP 1.0 percent at $74.65 per barrel

New York - Dow: UP 0.2 percent at 42,124.65 points (close)

J.Gomez--AT