-

Home hero Cameron Smith desperate for first win of 2024 at Australian PGA

Home hero Cameron Smith desperate for first win of 2024 at Australian PGA

-

Team Trump assails Biden decision on missiles for Ukraine

-

Hong Kong court jails 45 democracy campaigners on subversion charges

Hong Kong court jails 45 democracy campaigners on subversion charges

-

Several children injured in car crash at central China school

-

Urban mosquito sparks malaria surge in East Africa

Urban mosquito sparks malaria surge in East Africa

-

Djibouti experiments with GM mosquito against malaria

-

Pulisic at the double as USA cruise past Jamaica

Pulisic at the double as USA cruise past Jamaica

-

Many children injured after car crashes at central China school: state media

-

Asian markets rally after US bounce as Nvidia comes into focus

Asian markets rally after US bounce as Nvidia comes into focus

-

Tens of thousands march in New Zealand Maori rights protest

-

Five takeaways from the G20 summit in Rio

Five takeaways from the G20 summit in Rio

-

China, Russia ministers discuss Korea tensions at G20: state media

-

Kohli form, opening woes dog India ahead of Australia Test series

Kohli form, opening woes dog India ahead of Australia Test series

-

Parts of Great Barrier Reef suffer highest coral mortality on record

-

Defiant Lebanese harvest olives in the shadow of war

Defiant Lebanese harvest olives in the shadow of war

-

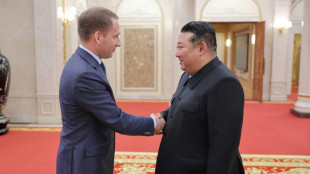

Russian delegations visit Pyongyang as Ukraine war deepens ties

-

S.Africa offers a lesson on how not to shut down a coal plant

S.Africa offers a lesson on how not to shut down a coal plant

-

Italy beat Swiatek's Poland to reach BJK Cup final

-

Japan, UK to hold regular economic security talks

Japan, UK to hold regular economic security talks

-

Divided G20 fails to agree on climate, Ukraine

-

Can the Trump-Musk 'bromance' last?

Can the Trump-Musk 'bromance' last?

-

US to call for Google to sell Chrome browser: report

-

Macron hails 'good' US decision on Ukraine missiles

Macron hails 'good' US decision on Ukraine missiles

-

Italy eliminate Swiatek's Poland to reach BJK Cup final

-

Trump expected to attend next Starship rocket launch: reports

Trump expected to attend next Starship rocket launch: reports

-

Israeli strike on Beirut kills 5 as deadly rocket fire hits Israel

-

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

Gvardiol steals in to ensure Croatia reach Nations League quarter-finals

-

Thousands march to New Zealand's parliament in Maori rights protest

-

China's Xi urges G20 to help 'cool' Ukraine crisis

China's Xi urges G20 to help 'cool' Ukraine crisis

-

Church and state clash over entry fee for Paris's Notre Dame

-

Holders Spain strike late to beat Switzerland in Nations League

Holders Spain strike late to beat Switzerland in Nations League

-

Stocks, dollar hesitant as traders brace for Nvidia earnings

-

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

Swiatek saves Poland against Italy in BJK Cup semi, forces doubles decider

-

Biden in 'historic' pledge for poor nations ahead of Trump return

-

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

Sudan, Benin qualify, heartbreak for Rwanda after shocking Nigeria

-

Five dead in new Israeli strike on Beirut's centre

-

Where's Joe? G20 leaders have group photo without Biden

Where's Joe? G20 leaders have group photo without Biden

-

US permission to fire missiles on Russia no game-changer: experts

-

Tropical storm Sara kills four in Honduras and Nicaragua

Tropical storm Sara kills four in Honduras and Nicaragua

-

Germany, Finland warn of 'hybrid warfare' after sea cable cut

-

Spanish resort to ban new holiday flats in 43 neighbourhoods

Spanish resort to ban new holiday flats in 43 neighbourhoods

-

Hong Kong to sentence dozens of democracy campaigners

-

Russian extradited to US from SKorea to face ransomware charges

Russian extradited to US from SKorea to face ransomware charges

-

Phone documentary details Afghan women's struggle under Taliban govt

-

G20 wrestles with wars, 'turbulence' in run-up to Trump

G20 wrestles with wars, 'turbulence' in run-up to Trump

-

Kane hoping to extend England career beyond 2026 World Cup

-

Gazans rebuild homes from rubble in preparation for winter

Gazans rebuild homes from rubble in preparation for winter

-

'Vague' net zero rules threaten climate targets, scientists warn

-

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

Stocks, dollar hesitant as traders eye US rate outlook, Nvidia

-

G20 wrestles with wars, climate in run-up to Trump

Global stocks mixed after fresh China stimulus

Stock markets diverged and oil prices fell on Wednesday as China's latest measure to bolster its economy, the world's second-largest, failed to spark another global rally.

Shanghai closed up 1.2 percent and Hong Kong advanced 0.7 percent after both markets surged more than four percent on Tuesday following a slew of Chinese interest-rate cuts this week.

Wall Street's main indexes moved in different directions in morning deals, with the Dow falling while the tech-heavy Nasdaq gained and broad-based S&500 edged higher.

Both the Dow and S&P 500 finished at records on Tuesday.

London, Paris and Frankfurt stock markets dipped in afternoon trading.

Oil prices retreated after strong gains Tuesday.

"We've had consecutive days of a run-up and I think it's expected that the market takes a bit of a pause here," said Peter Cardillo of Spartan Capital.

China's central bank on Wednesday announced a cut to its medium-term lending facility, the interest for one-year loans to financial institutions.

That came one day after the country unveiled some of its boldest measures in years to support an economy battered by a long-running debt crisis in the property sector and weak consumer spending.

"The problem is, the stimulus measures will take time to show in the economic data," said Ipek Ozkardeskaya, senior analyst at Swissquote Bank, adding that the actions "won't do much to fix the country's deepest issues" including a heavy debt burden.

Separately, the OECD called Wednesday for higher property taxes to fight an indebted global economy, which it said should grow slightly stronger than expected this year.

Traders were awaiting the release Friday of the US personal consumption expenditures index -- the Federal Reserve's preferred inflation metric -- hoping for an idea about its next move on interest rates.

The Fed's jumbo rate cut last week ramped up hopes that it would embark on a series of reductions as prices rise at a less heated pace and the American jobs market slows.

Officials are expected to continue easing policy to 2026, according to the US central bank's "dot plot" guidance on rates released last week.

The prospect of more cuts helped haven investment gold hit a new peak of $2,670.57 an ounce Wednesday, with the precious metal gaining also on geopolitical unrest, notably in the Middle East, according to analysts.

- Key figures around 1400 GMT -

New York - Dow: DOWN 0.2 percent at 42,136.02 points

New York - S&P 500: UP 0.1 percent at 5,737.84

New York - Nasdaq Composite: UP 0.3 percent at 18.128.45

London - FTSE 100: DOWN 0.2 percent at 8,262.73

Paris - CAC 40: DOWN 0.6 percent at 7,557.54

Frankfurt - DAX: DOWN 0.5 percent at 18,905.86

Tokyo - Nikkei 225: DOWN 0.2 percent at 37,870.26 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 19,129.10 (close)

Shanghai - Composite: UP 1.2 percent at 2,896.31 (close)

New York - Dow: UP 0.2 percent at 42,208.22 (close)

Euro/dollar: UP at $1.1185 from $1.1181 on Tuesday

Pound/dollar: DOWN at $1.3393 from $1.3412

Dollar/yen: UP at 144.19 yen from 143.18 yen

Euro/pound: UP at 83.52 pence from 83.33 pence

Brent North Sea Crude: DOWN 0.9 percent at $73.79 per barrel

West Texas Intermediate: DOWN 1.2 percent at $70.70 per barrel

D.Lopez--AT