-

Djokovic faces Zverev semi-final test in pursuit of 25th Slam title

Djokovic faces Zverev semi-final test in pursuit of 25th Slam title

-

Trump says will demand interest rates drop 'immediately'

-

Man Utd should never get used to losing, says Fernandes

Man Utd should never get used to losing, says Fernandes

-

Colombia asks Venezuela to help quell border violence

-

Wembanyama dazzles Paris crowd as he leads Spurs to easy win

Wembanyama dazzles Paris crowd as he leads Spurs to easy win

-

Trump Davos address lifts S&P 500 to record, dents oil prices

-

Man Utd, Spurs enjoy Europa League boost

Man Utd, Spurs enjoy Europa League boost

-

Fernandes hands Man Utd dramatic victory over Rangers

-

Director of apocalyptic Sundance film lost home in LA fires

Director of apocalyptic Sundance film lost home in LA fires

-

Trump orders release of last JFK, RFK, King assassination files

-

Wembanyama delights Paris crowd as he leads Spurs to easy win

Wembanyama delights Paris crowd as he leads Spurs to easy win

-

US lawmakers advance forest management bill as fires scorch LA

-

Trump declassifies JFK, RFK, Martin Luther King Jr assassination files

Trump declassifies JFK, RFK, Martin Luther King Jr assassination files

-

World champion Neuville holds slim lead in Monte Carlo Rally

-

Indonesia, France to sign deal to transfer Frenchman on death row

Indonesia, France to sign deal to transfer Frenchman on death row

-

Gaza hostage families conflicted over those not on release list

-

Rivals Bills and Chiefs clash again with Super Bowl on the line

Rivals Bills and Chiefs clash again with Super Bowl on the line

-

Ainslie no longer with INEOS Britannia after America's Cup defeat

-

Between laughs and 'disaster', Trump divides Davos

Between laughs and 'disaster', Trump divides Davos

-

New Zealand star Wood signs new two-year deal with Nottingham Forest

-

Son helps Spurs hold off Hoffenheim in Europa League

Son helps Spurs hold off Hoffenheim in Europa League

-

Federal judge blocks Trump bid to restrict birthright citizenship

-

Berlin gallery shows artworks evacuated from war-torn Ukraine

Berlin gallery shows artworks evacuated from war-torn Ukraine

-

'Evil' UK child stabbing spree killer jailed for life

-

Araujo extends Barcelona contract to 2031

Araujo extends Barcelona contract to 2031

-

Hundreds of people protest ahead of Swiss Davos meeting

-

Saudi crown prince promises Trump $600 bn trade, investment boost

Saudi crown prince promises Trump $600 bn trade, investment boost

-

English rugby boss vows to stay on despite pay row

-

US falling behind on wind power, think tank warns

US falling behind on wind power, think tank warns

-

US news giant CNN eyes 200 job cuts, streaming overhaul

-

Sacklers, Purdue to pay $7.4 bn over opioid crisis: NY state

Sacklers, Purdue to pay $7.4 bn over opioid crisis: NY state

-

Rubio chooses Central America for first trip amid Panama Canal pressure

-

Germany knife attack on children reignites pre-vote migrant debate

Germany knife attack on children reignites pre-vote migrant debate

-

AC Milan defender Emerson facing two-month injury layoff

-

'Shattered souls': tears as UK child killer sentenced to life

'Shattered souls': tears as UK child killer sentenced to life

-

China's Shenzhen to host Billie Jean King Cup Finals

-

Wall Street's AI-fuelled rally falters, oil slumps

Wall Street's AI-fuelled rally falters, oil slumps

-

Trump tells Davos elites: produce in US or pay tariffs

-

Progressive politics and nepo 'babies': five Oscar takeaways

Progressive politics and nepo 'babies': five Oscar takeaways

-

American Airlines shares fall on lackluster 2025 profit outlook

-

Sudan's army, paramilitaries trade blame over oil refinery attack

Sudan's army, paramilitaries trade blame over oil refinery attack

-

France to introduce new sex education guidelines in schools

-

'Brave' Keys deserves to be in Melbourne final, says Swiatek

'Brave' Keys deserves to be in Melbourne final, says Swiatek

-

'Shattered souls': tears as horror of stabbing spree retold at UK court

-

'Emilia Perez' lauded in Hollywood but criticized in Mexico

'Emilia Perez' lauded in Hollywood but criticized in Mexico

-

Bayern's Davies ruled out 'for time being' with hamstring tear

-

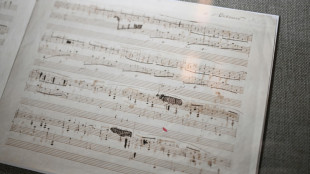

Poland says purchased rare 'treasure' Chopin manuscript

Poland says purchased rare 'treasure' Chopin manuscript

-

Calls for calm, Pope on AI, Milei on Musk: What happened at Davos Thursday

-

Ukraine orders children to evacuate from northeastern towns

Ukraine orders children to evacuate from northeastern towns

-

Hibatullah Akhundzada: Afghanistan's reclusive Taliban leader

TaxBandits Strengthens Fraud Prevention and Security Measures to Identity Theft and Tax Frauds for the 2024 Tax Year

ROCK HILL, SC / ACCESS Newswire / January 23, 2025 / With the January 31, 2025, tax filing deadline on the horizon, TaxBandits, an IRS-authorized e-file service provider, underscores its steadfast commitment to safeguarding tax professionals and their clients from identity theft and fraud. In alignment with the stringent measures implemented by the IRS, Social Security Administration (SSA), and state tax agencies, TaxBandits has robust fraud prevention measures and security systems already in place to ensure secure and compliant tax filing.

TaxBandits Approach to Fraud Prevention

TaxBandits provides a platform that not only simplifies tax form filing - covering 1099s, W-2s, 940s, 941s, and ACA forms - but also prioritizes user data protection through industry-leading practices.

Recognizing that fraud risks typically escalate during the peak filing season, TaxBandits has rolled out many proactive measures to ensure secure and efficient tax filing processes.

Key Fraud Prevention Measures Implemented by TaxBandits

Proactive Measures to Mitigate Potential Audit Issues

As part of its commitment to fraud prevention, TaxBandits implements advanced measures to identify discrepancies that may trigger potential audits or raise compliance concerns with the IRS, SSA, or other relevant government agencies. When data reported on 1099 and W-2 forms deviate from IRS/SSA or state guidelines-such as unusually high withholding rates-the platform flags these issues for review.

Additionally, when discrepancies are flagged, clients are provided with clear guidance on the required documentation to support the reported data. These proactive measures strengthen compliance efforts while minimizing the risk of delays or complications.

Artificial Intelligence-Powered Fraud Prevention: TaxBandits uses an advanced AI engine to actively monitor user activity and identify any signs of suspicious or fraudulent behavior. The platform can quickly recognize potential threats and take immediate action by implementing AI-driven detection, ensuring a secure tax filing experience while protecting sensitive information.

Comprehensive Identity Verification Measures: TaxBandits implements rigorous identity verification procedures to ensure that only authorized people with verified identities can access and submit tax forms. This essential security step establishes a secure foundation for the entire tax filing process, significantly reducing the risk of unauthorized access and potential fraud.

Privacy Control for Enhanced Data Protection: TaxBandits offers tax professionals comprehensive privacy controls, allowing them to customize data-sharing preferences based on their needs. These controls enable them to:

Specify who can access their tax information

Limit the type of information shared

Revoke access at any time

By providing these privacy settings, TaxBandits ensures that tax professionals maintain complete control over their personal and financial data, fostering greater confidence in data security.

TIN Matching and Real-Time Validations

TaxBandits integrates an enhanced Taxpayer Identification Number (TIN) matching process to verify the accuracy of tax filings and reduce discrepancies. Real-time validations ensure that filings are accurate and compliant, minimizing errors that could lead to delays or fraud.

Layered Security Protection: TaxBandits employs a multi-tiered security approach to keep the client's data protected from unauthorized access through various measures, including:

IP Tracking: TaxBandits tracks and logs IP addresses associated with business and tax professional activities to identify the origin of suspicious behavior. This feature helps detect and address potential security breaches in real-time.

Activity Logs: Tax professionals can access detailed activity logs, which provide transparency and enable them to monitor their accounts for unusual actions. These logs empower them to take control of their tax filing security.

Advanced Security Measures

TaxBandits prioritizes the security of the tax filing process by implementing robust security measures.

Two-factor Authentication (2FA): TaxBandits prioritize the security of sensitive information by offering Two-Factor Authentication (2FA) options to strengthen security further. Tax professionals can enhance their account protection by enabling 2FA using various methods, such as:

Phone number verification

Authentication apps, including Google Authenticator, Microsoft Authenticator, Authy, and LastPass

Recovery codes for emergency access

The 'Remember this Device' feature temporarily allows trusted devices to bypass 2FA, ensuring convenience during this tax season.

Continuous System Monitoring and Auditing: TaxBandits monitors and audits its systems to proactively detect and resolve potential vulnerabilities. This vigilant approach ensures the platform remains at the forefront of security, providing individuals, businesses, and tax professionals with a safe and reliable tax filing experience.

Protection Against Phishing Threats: To combat phishing scams and fraudulent activities, TaxBandits has implemented stringent security protocols to protect user data. It is important to note that TaxBandits will never request sensitive information such as SSN, EIN, credit card details, or bank account information via email or any other communication channel.

SOC 2 Compliance for Data Security: As a SOC 2-certified e-file provider, TaxBandits adheres to stringent security standards established by the American Institute of CPAs (AICPA). Regular audits ensure compliance with strict controls and procedures to maintain client data's confidentiality, integrity, and availability. This certification demonstrates TaxBandits determined commitment to protecting sensitive information.

About TaxBandits

TaxBandits is an IRS-authorized e-file provider specializing in various tax forms, such as Form 941, Form 940, Form 1099, Form W-2, Form 1095-C, Form 1095-B, and Form W-9. Serving businesses, service providers, and tax professionals of every size, TaxBandits offers a complete solution that fulfills all filing needs.

TaxBandits provides another advantage for high-volume filers and software providers. TaxBandits API enables seamless preparation and e-filing of 1099, W-2, 941, 940, and ACA 1095 forms and BOI reporting. Use the developer filing 1099 API to request W-9 and automate the filing efficiently.

About SPAN Enterprises

SPAN Enterprises, headquartered in Rock Hill, South Carolina, has created cutting-edge software solutions for e-filing and business management for over ten years. The company's suite of products includes TaxBandits, Tax990, TaxExemptBonds, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Charles Hardy, VP of Operations at [email protected]

###

SOURCE: TaxBandits

View the original press release on ACCESS Newswire

M.O.Allen--AT