-

Myanmar quake toll passes 2,700, nation halts to honour victims

Myanmar quake toll passes 2,700, nation halts to honour victims

-

Turkish fans, artists urge Muse to cancel Istanbul gig

-

US seeks death penalty for accused killer of insurance CEO

US seeks death penalty for accused killer of insurance CEO

-

UK govt moves to block sentencing guidelines for minority defendants

-

Trump puts world on edge as 'Liberation Day' tariffs loom

Trump puts world on edge as 'Liberation Day' tariffs loom

-

Swedish journalist jailed in Turkey kept 'isolated': employer

-

Stock markets advance ahead of Trump tariffs deadline

Stock markets advance ahead of Trump tariffs deadline

-

Gulf between Everton and Liverpool has never been bigger, says Moyes

-

Finland to withdraw from anti-personnel mine ban treaty

Finland to withdraw from anti-personnel mine ban treaty

-

UK vows £20 million to boost drone and 'flying taxi' services

-

Ford's US auto sales dip in first quarter as tariffs loom

Ford's US auto sales dip in first quarter as tariffs loom

-

Digging for box office gold, 'A Minecraft Movie' hits cinemas

-

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

Southampton boss Juric desperate to avoid Premier League 'worst team' tag

-

Thailand rescue dogs double as emotional support

-

Five takeaways from Marine Le Pen verdict

Five takeaways from Marine Le Pen verdict

-

Stock markets split ahead of Trump tariffs deadline

-

Turkish fans, artists urge Muse to cancel Istanbul gig over protest dispute

Turkish fans, artists urge Muse to cancel Istanbul gig over protest dispute

-

Former captain Edwards named new England women's cricket coach

-

Haaland ruled out for up to seven weeks: Man City boss Guardiola

Haaland ruled out for up to seven weeks: Man City boss Guardiola

-

UK Supreme Court opens car loans hearing as banks risk huge bill

-

Haaland ruled out for up to seven weeks: Guardiola

Haaland ruled out for up to seven weeks: Guardiola

-

Trophies are what count: Barca's Flick before Atletico cup clash

-

Trump signs executive order targeting ticket scalping

Trump signs executive order targeting ticket scalping

-

Eurozone inflation eases in March as tariff threat looms

-

Howe targets 'game-changing' Champions League return for Newcastle

Howe targets 'game-changing' Champions League return for Newcastle

-

Chinese developer under scrutiny over Bangkok tower quake collapse

-

Sirens wail and families cry at Myanmar disaster site

Sirens wail and families cry at Myanmar disaster site

-

Three things on Australia's former Russian tennis star Daria Kasatkina

-

Stock markets rise ahead of Trump tariffs deadline

Stock markets rise ahead of Trump tariffs deadline

-

Facing US tariffs, Canadians hunt for business in Europe

-

Trumpets, guns, horses: northern Nigeria's Durbar ends Ramadan in style

Trumpets, guns, horses: northern Nigeria's Durbar ends Ramadan in style

-

Defiant French far right insists 'we will win' despite Le Pen ban

-

Hezbollah official among four dead in Israeli strike on Beirut

Hezbollah official among four dead in Israeli strike on Beirut

-

Liverpool's Slot unfazed by Alexander-Arnold Real Madrid links

-

Hezbollah official targeted in deadly Israeli strike on Beirut

Hezbollah official targeted in deadly Israeli strike on Beirut

-

Israel PM drops security chief nominee under fire from Trump ally

-

Stock markets edge up but Trump tariff fears dampen mood

Stock markets edge up but Trump tariff fears dampen mood

-

South Korea court to rule Friday on president impeachment

-

'Can collapse anytime': Mandalay quake victims seek respite outdoors

'Can collapse anytime': Mandalay quake victims seek respite outdoors

-

Stock markets edge back but Trump tariff fears dampen mood

-

Myanmar holds minute of silence for more than 2,000 quake dead

Myanmar holds minute of silence for more than 2,000 quake dead

-

Kenya president still handing cash to churches despite his own ban

-

Israeli strike on Beirut kills three

Israeli strike on Beirut kills three

-

Russia-born Kasatkina says 'didn't have much choice' after Australia switch

-

Carmakers face doubts and jolts over US tariffs

Carmakers face doubts and jolts over US tariffs

-

China holds large-scale military drills around Taiwan

-

'Heartbreaking' floods swamp Australia's cattle country

'Heartbreaking' floods swamp Australia's cattle country

-

South Korean baseball put on hold after fan killed at stadium

-

Celtics, Thunder power toward NBA playoffs, Lakers shoot down Rockets

Celtics, Thunder power toward NBA playoffs, Lakers shoot down Rockets

-

French prosecutors demand Volkswagen face fresh Dieselgate trial

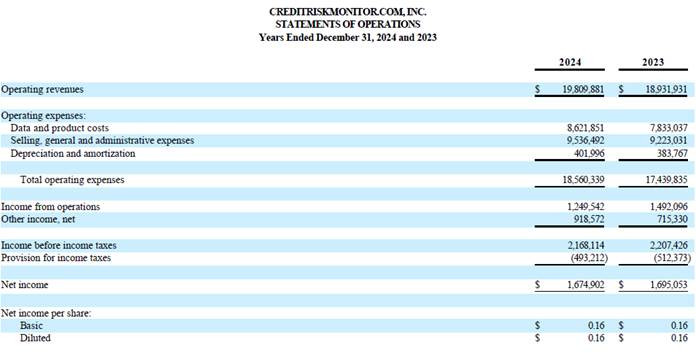

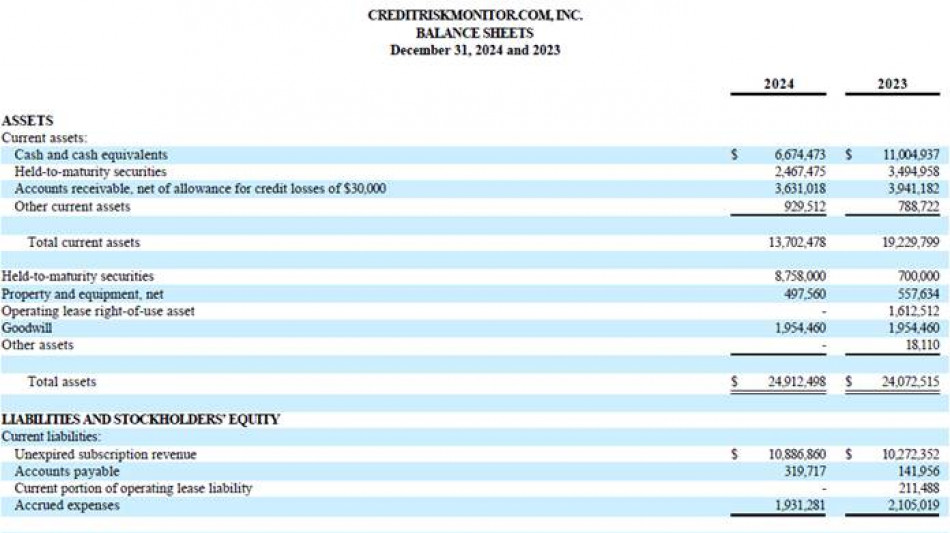

CreditRiskMonitor Announces 2024 Results

VALLEY COTTAGE, NY / ACCESS Newswire / March 20, 2025 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported revenues of $19.8 million, an increase of approximately $878 thousand or 5%, for the year ended December 31, 2024, as compared to 2023. The Company reported operating income of approximately $1.25 million, a decrease of approximately $243 thousand for 2024 as compared to 2023. The decrease in operating income was primarily due to increased data and product costs associated with higher employee expenses and third-party content costs. The Company reported net income of approximately $1.67 million, a decrease of approximately $20 thousand for 2024 as compared to 2023.

Mike Flum, CEO, said, "We remain committed to achieving higher efficiency for our teams, knowing it will require increased investment in technical human capital and systems. We continue refining our management team with an emphasis on improved performance and accountability. While we still expect to show lower profitability in the short-to-medium term due to this higher spending on data, technology, and skilled employees, the results of these investments will set up the Company for profitable growth in the long term.

To that end, we are happy to welcome Shyarsh Desai as our new Chief Operating Officer effective March 19, 2025. Shyarsh brings a wealth of experience in the risk, credit, and technology spaces from his time as the Chief Executive Officer at SMYYTH + CARIXA, a credit-to-cash company, and Credit2B, an AI-innovator in B2B credit decision automation, until its sale to Billtrust, where he served as Group President. He has also held management positions at Navex, Dun & Bradstreet, and IBM. We are excited to have Shyarsh on the team and help us drive for greater efficiency, performance, and accountability at CreditRiskMonitor.com.

On the customer satisfaction front, the Company surveyed clients between late 2024 and early 2025 to baseline our Net Promoter Score ("NPS"), Product Quality, and Customer Support. We achieved high marks in all categories including an excellent-level 77 for NPS as well as 4.6 out of 5 for both Product Quality and Customer Service. We are immensely proud of these results and applaud our teams for developing products and experiences that garner this much positive feedback.

On the product front, we are seeing mounting interest in our CreditRiskMonitor® and SupplyChainMonitor™ products due to increased bankruptcies and recessionary risks. The U.S. bankruptcy rates in the first quarter are higher in 2025 versus 2024, and 2024's full-year level was the highest since 2010. If these trends continue, we expect to see improved growth rates like those experienced during the Great Recession and the COVID-19 pandemic; however, there is a risk that this correction could negatively impact our clients enough to offset this growth. SupplyChainMonitor™ should also benefit from turmoil in global trade and supplier relationships caused by the unfolding tariff escalation as businesses search for alternative suppliers with less geopolitical exposure.

We are working to expand our worldwide coverage using novel scoring methods and expanded data partnerships. The Company is also increasing the functionality of our Confidential Financial Statements Solution to process more document types and support foreign languages so our customers can receive more scores on their private company counterparties. Our use of AI continues to evolve within financial risk scoring, data acquisition, data processing, quality assurance, and products. We are exploring ways to leverage AI for improved customer experience and workflow optimization by getting quality information to customers in easy-to-digest formats. Our over twenty-five-year commitment to maintaining high-quality data has been prescient as these AI systems directly reflect the quality of the input data. While these investments can be costly and involve iteration to get right, we believe these AI systems will make significant contributions to our operations.

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor.com, Inc. (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. Our primary SaaS subscription products for analyzing commercial financial risk are CreditRiskMonitor® and SupplyChainMonitor™. These products help corporate credit and procurement professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively. Our subscribers include nearly 40% of the Fortune 1000 and well over a thousand other large corporations worldwide.

To help subscribers prioritize and monitor counterparty financial risk, our SaaS platforms offer the proprietary FRISK® and PAYCE® scores, the well-known Altman Z"-score, agency ratings from key Nationally Recognized Statistical Rating Organizations ("NRSROs"), curated news, and detailed financial spreads & ratios. Our FRISK® and PAYCE® scores are financial distress classification models that measure a business's probability of bankruptcy within a year. The FRISK® score also includes a risk signal based on the aggregate research behaviors of our subscribers, who control counterparty access to trade credit at some of the most sophisticated companies in the world. The inclusion of this risk signal boosts the overall accuracy of this bankruptcy analytic by lowering the false positive rate for the riskiest corporations.

Through its Trade Contributor Program, the Company receives monthly confidential accounts receivables data from hundreds of subscribers and non-subscribers, which it parses, processes, aggregates, and reports to summarize the invoice payment behavior of B2B counterparties without disclosing the specific contributors of this information. The size of the Trade Contributor Program's current annualized trade credit transaction data is approximately $3 trillion.

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, Chief Executive Officer

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on ACCESS Newswire

T.Sanchez--AT