-

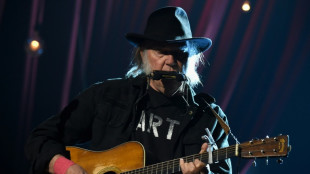

Neil Young dumps Glastonbury alleging 'BBC control'

Neil Young dumps Glastonbury alleging 'BBC control'

-

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

-

Swiatek battles back to take Poland into United Cup semis

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

-

Stock markets begin new year with losses

Stock markets begin new year with losses

-

Rival South Korea camps face off as president holds out

-

French downhill ace Sarrazin out of intensive care

French downhill ace Sarrazin out of intensive care

-

Djokovic cruises past Monfils as rising stars impress in Brisbane

-

Montenegro mourns after gunman kills 12

Montenegro mourns after gunman kills 12

-

Sales surge in 2024 for Chinese EV giant BYD

-

Agnes Keleti, world's oldest Olympic champion, dies at 103

Agnes Keleti, world's oldest Olympic champion, dies at 103

-

Asian stocks begin year on cautious note

-

Andreeva, Mpetshi Perricard showcase Australian Open potential

Andreeva, Mpetshi Perricard showcase Australian Open potential

-

South Korea police raid Jeju Air, airport over fatal crash

-

Perera's 46-ball ton gives Sri Lanka consolation T20 win over New Zealand

Perera's 46-ball ton gives Sri Lanka consolation T20 win over New Zealand

-

Afghan refugees suffer 'like prisoners' in Pakistan crackdown

-

Coach tight-lipped on whether Rohit will play in final Australia Test

Coach tight-lipped on whether Rohit will play in final Australia Test

-

Blooming hard: Taiwan's persimmon growers struggle

-

South Korea's impeached president resists arrest over martial law bid

South Korea's impeached president resists arrest over martial law bid

-

Knicks roll to ninth straight NBA win, Ivey hurt in Pistons victory

-

'Numb' New Orleans grapples with horror of deadly truck attack

'Numb' New Orleans grapples with horror of deadly truck attack

-

Asia stocks begin year on cautious note

-

FBI probes 'terrorist' links in New Orleans truck-ramming that killed 15

FBI probes 'terrorist' links in New Orleans truck-ramming that killed 15

-

2024 was China's hottest year on record: weather agency

-

Perera smashes 46-ball ton as Sri Lanka pile up 218-5 in 3rd NZ T20

Perera smashes 46-ball ton as Sri Lanka pile up 218-5 in 3rd NZ T20

-

South Korea police raid Muan airport over Jeju Air crash that killed 179

-

South Korea's Yoon resists arrest over martial law bid

South Korea's Yoon resists arrest over martial law bid

-

Sainz set to step out of comfort zone to defend Dakar Rally title

-

New Year's fireworks accidents kill five in Germany

New Year's fireworks accidents kill five in Germany

-

'I'm Still Here': an ode to Brazil resistance

-

New Orleans attack suspect was US-born army veteran

New Orleans attack suspect was US-born army veteran

-

Australia axe Marsh, call-up Webster for fifth India Test

-

Aeluma Joins AIM Photonics as Full Industry Member to Accelerate Quantum Dot Laser Technology for Silicon Photonics

Aeluma Joins AIM Photonics as Full Industry Member to Accelerate Quantum Dot Laser Technology for Silicon Photonics

-

Mosaic Announces Closing of Share Purchase and Subscription Agreement with Ma'aden

-

Scientists and Community Unite to Address Climate Change at NYC Climate Awareness Event

Scientists and Community Unite to Address Climate Change at NYC Climate Awareness Event

-

Tribeca Lawsuit Loans To Provide Legal Funding To Transferred FCI Dublin Prisoners

-

Terrorism suspected in New Orleans truck-ramming that killed 15

Terrorism suspected in New Orleans truck-ramming that killed 15

-

At least 10 killed in Montenegro shooting spree

-

Jets quarterback Rodgers ponders NFL future ahead of season finale

Jets quarterback Rodgers ponders NFL future ahead of season finale

-

Eagles' Barkley likely to sit out season finale, ending rushing record bid

-

Syria FM hopes first foreign visit to Saudi opens 'new, bright page'

Syria FM hopes first foreign visit to Saudi opens 'new, bright page'

-

Leeds and Burnley held to draws as Sunderland blunt Blades

-

At least 10 dead in Montenegro restaurant shooting: minister

At least 10 dead in Montenegro restaurant shooting: minister

-

Arteta reveals Arsenal hit by virus before vital win at Brentford

-

Palestinian Authority suspends Al Jazeera broadcasts

Palestinian Authority suspends Al Jazeera broadcasts

-

Terrorism suspected in New Orleans truck-ramming that killed 10

-

Terrorism suspected in New Orleans truck-ramming that kills 10, injures dozens

Terrorism suspected in New Orleans truck-ramming that kills 10, injures dozens

-

Arsenal close gap on Liverpool as Jesus stars again

-

Zverev injured as holders Germany crash at United Cup, USA advance

Zverev injured as holders Germany crash at United Cup, USA advance

-

Witnesses describe 'war zone' left in wake of New Orleans attack

United States Antimony Corporation Announces Second Contract for International Supply of Antimony, Filing of $100 Million Universal Shelf Registration Statement on Form S-3

"The Critical Minerals and ZEO Company"

"The Critical Minerals and ZEO Company"

United States Antimony Corporation ("USAC", or the "Company"), (NYSE American:UAMY) announced today that it has entered into a second definitive agreement for an additional international new supply of antimony. The initial new inbound international shipments will come from Thailand and will consist of 50 wet metric tons or two full containers. The containers are currently anticipated to arrive at the Mexican west coast port of Manzanillo beginning in March 2025 and will be delivered in order to be processed at the Company's Madero Smelter also located in Mexico.

On Friday, December 27, 2024, the Company filed a new universal shelf registration statement on Form S-3 with the United States Securities and Exchange Commission ("SEC"), which will replace its existing $25 million universal shelf registration statement that will expire in January 2025. The registration statement is intended to provide USAC with maximum flexibility to access the public capital markets in order to respond to financing and business opportunities in the future. Although the registration statement relating to these securities has been filed with the SEC, it has not yet become effective.

At the present time, USAC has no specific plans to issue securities under the registration statement. If and when the registration statement is declared effective by the SEC, the Company will be able to offer and sell, from time to time, up to $100 million of securities such as senior subordinated or convertible debt securities, warrants, units, common and preferred stock, or any combination thereof.

Commenting on these announcements today, Mr. Gary C. Evans, Chairman & CEO stated, "We believe the quantities of antimony ore from this second international party will increase significantly over the ensuing months. Obtaining quality antimony supply to feed USAC's existing smelters has been a top priority for management. In combination with the prior announcement on December 20, 2024 regarding new antimony supply from Australia, we are accomplishing this goal and setting up fiscal 2025 to be an exceptional year from a financial perspective for the benefit of our shareholders. Additionally, if and when deemed necessary, we have prepared ourselves for having the capability of entering the capital markets over the next several years due to our significant growth objectives. Having optionality in accessing capital is a necessary ingredient for success."

Following the effectiveness of the shelf registration statement, USAC may periodically offer one or more of the registered securities in amounts, at prices, and on terms to be announced when, and if, the securities are offered. The terms of any securities offered under the registration statement, and the intended use of the net proceeds resulting therefrom, will be established at the times of the offerings and will be described in prospectus supplements filed with the SEC at the times of the offerings.

These securities may not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective. This press release is not an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About USAC:

United States Antimony Corporation and its subsidiaries in the U.S. and Mexico ("USAC", the "Company", "Our", "Us", or "We") sell processed antimony, zeolite, and precious metals products in the U.S. and Canada. The Company processes antimony ore primarily into antimony oxide, antimony metal, and antimony trisulfide. Our antimony oxide is used to form a flame-retardant system for plastics, rubber, fiberglass, textile goods, paints, coatings and paper, as a color fastener in paint, and as a phosphorescent agent in fluorescent light bulbs. Our antimony metal is used in bearings, storage batteries, and ordnance. Our antimony trisulfide is used as a primer in ammunition. In its operations in Idaho, the Company mines and processes zeolite, a group of industrial minerals used in soil amendment and fertilizer, water filtration, sewage treatment, nuclear waste and other environmental cleanup, odor control, gas separation, animal nutrition, and other miscellaneous applications. We recover certain amounts of precious metals, primarily gold and silver, at our plant in Montana from antimony concentrates.

Forward-Looking Statements:

Readers should note that, in addition to the historical information contained herein, this press release may contain forward-looking statements within the meaning of, and intended to be covered by, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based upon current expectations and beliefs concerning future developments and their potential effects on the Company including matters related to the Company's operations, pending contracts and future revenues, financial performance, and profitability, ability to execute on its increased production and installation schedules for planned capital expenditures, and the size of forecasted deposits. Although the Company believes that the expectations reflected in the forward-looking statements and the assumptions upon which they are based are reasonable, it can give no assurance that such expectations and assumptions will prove to have been correct. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties. In addition, other factors that could cause actual results to differ materially are discussed in the Company's most recent filings, including Form 10-K and Form 10-Q with the Securities and Exchange Commission.

Forward-looking statements are typically identified by words such as "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "pro forma" and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance.

Contact:

United States Antimony Corp.

PO Box 540308

Dallas, TX 75354

Jonathan Miller, Vice President - IR

E-Mail: [email protected]

Phone: 406-606-4117

SOURCE: United States Antimony Corp.

W.Stewart--AT