-

Asian markets mostly rise but worries over tariffs, AI linger,

Asian markets mostly rise but worries over tariffs, AI linger,

-

Investigators recover plane black boxes from Washington air collision

-

'No happiness': Misery for Myanmar exiles four years on from coup

'No happiness': Misery for Myanmar exiles four years on from coup

-

Ghosts of past spies haunt London underground tunnels

-

Six Nations teams strengths and weaknesses

Six Nations teams strengths and weaknesses

-

Pressure on Prendergast as Ireland launch Six Nations title defence against England

-

Scotland eager to avoid Italy slip-up at start of Six Nations

Scotland eager to avoid Italy slip-up at start of Six Nations

-

Fonseca set for Lyon baptism against Marseille

-

Hermoso: Spanish football icon against sexism after forced kiss

Hermoso: Spanish football icon against sexism after forced kiss

-

Mbappe-Vinicius connection next goal for Liga leaders Real Madrid

-

Leverkusen taking confidence from Champions League into Bundesliga title race

Leverkusen taking confidence from Champions League into Bundesliga title race

-

Man City face Arsenal test as Bournemouth eye Liverpool scalp

-

Trump's point man for drilling agenda confirmed by Senate

Trump's point man for drilling agenda confirmed by Senate

-

Chipmaker Intel beats revenue expectations amidst Q4 loss

-

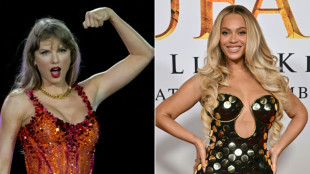

Key nominees for the Grammy Awards

Key nominees for the Grammy Awards

-

Beyonce leads Grammys pack at gala backdropped by fires

-

Samsung Electronics posts 129.85% jump in Q4 operating profit

Samsung Electronics posts 129.85% jump in Q4 operating profit

-

'Shouldn't have happened:' DC air collision stuns experts

-

Donald Trump: air crash investigator-in-chief?

Donald Trump: air crash investigator-in-chief?

-

Nicaragua legislature cements 'absolute power' of president, wife

-

McIlroy launches PGA season debut with hole-in-one

McIlroy launches PGA season debut with hole-in-one

-

Figure skating in shock as athletes, coaches perish in US crash

-

Kim opens up four-stroke lead in LPGA's season opener

Kim opens up four-stroke lead in LPGA's season opener

-

Man Utd progress to Europa last 16 'really important' for Amorim overhaul

-

Postecoglou hails Europa League win 'made in Tottenham'

Postecoglou hails Europa League win 'made in Tottenham'

-

'Not interested': Analysts sceptical about US, Russia nuclear talks

-

Trump to decide on oil tariffs on Canada, Mexico

Trump to decide on oil tariffs on Canada, Mexico

-

MAHA Moms: Why RFK Jr's health agenda resonates with Americans

-

Neymar, eyeing 2026 World Cup, announces return to Brazil's Santos

Neymar, eyeing 2026 World Cup, announces return to Brazil's Santos

-

'The region will die': Ukraine's Donbas mines within Russia's grasp

-

'Campaign of terror': Georgia's escalating rights crackdown

'Campaign of terror': Georgia's escalating rights crackdown

-

French luxury billionaire sparks tax debate with threat to leave

-

Apple profit climbs but sales miss expectations

Apple profit climbs but sales miss expectations

-

Man Utd, Spurs advance to last 16 in Europa League

-

Trump blames deadly Washington air collision on 'diversity'

Trump blames deadly Washington air collision on 'diversity'

-

Itoje says England 'ready' for Six Nations kings Ireland

-

Rennes sack Sampaoli, announce Beye as new coach

Rennes sack Sampaoli, announce Beye as new coach

-

Trump insists Egypt, Jordan will take Gazans

-

Stones lead tributes to 'beautiful' Marianne Faithfull, dead at 78

Stones lead tributes to 'beautiful' Marianne Faithfull, dead at 78

-

Washington midair crash: What we know so far

-

Syria's new leader pledges 'national dialogue conference'

Syria's new leader pledges 'national dialogue conference'

-

McIlroy sinks hole-in-one at PGA Pebble Beach Pro-Am

-

American skier Shiffrin remembers air crash victims on return from injury

American skier Shiffrin remembers air crash victims on return from injury

-

Sixties icon Marianne Faithfull to be 'dearly missed' after death at 78

-

Barca's Bonmati voices opposition to Saudi Arabia hosting Spanish Super Cup

Barca's Bonmati voices opposition to Saudi Arabia hosting Spanish Super Cup

-

On first trip, Rubio to wield big stick in Latin America

-

Neymar announces return to Brazil's Santos

Neymar announces return to Brazil's Santos

-

Russian drone attack kills nine in east Ukraine

-

Marianne Faithfull: from muse to master

Marianne Faithfull: from muse to master

-

Benin court jails two ex-allies of president for 20 years

Vior Announces "Best Efforts" Private Placement

[NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES]

MONTREAL, QC / ACCESS Newswire / January 30, 2025 / VIOR INC. ("Vior" or the "Corporation") (TSXV:VIO)(FRA:VL51) is pleased to announce that it has entered into an agreement with Stifel Nicolaus Canada Inc. and Desjardins Capital Markets, to act as co-lead agents (together, "Co-Lead Agents") and joint bookrunners (together with a syndicate of agents, the "Agents") in connection with a "best efforts" private placement offering by the Corporation of securities for aggregate proceeds of up to C$40,000,000, and consisting of (i) hard dollar units of the Corporation (the "Hard Dollar Units") and, (ii) charity flow-through units of the Corporation (the "Charity FT Units" and, together with the Hard Dollar Units, the "Offered Securities") (together, the "Offering"). The price of the Offered Securities will be C$0.20 for each Hard Dollar Unit and C$0.35 for each Charity FT Unit (individually, the "Offering Price"). It is expected that approximately C$30,000,000 will be raised from Hard Dollar Units and C$10,000,000 from Charity FT Units.

The Corporation has granted the Co-Lead Agents an option to sell up to an additional 15% of the aggregate amount of the Offered Securities (the "Over-Allotment Option"), on the same terms and conditions. The Over-Allotment Option will be exercisable, in whole or in part, at any time up until 48 hours prior to the closing of the Offering.

Each Hard Dollar Unit will consist of one (1) common share of the Corporation (a "Share") plus one (1) common share purchase warrant (each whole common share purchase warrant, a "Warrant"). Each Charity FT Unit will consist of one Share of the Corporation that qualifies as a "flow-through share" (within the meaning of subsection 66(15) of the Income Tax Act (Canada) and section 359.1 of the Taxation Act (Québec)) and one (1) Warrant. Each Warrant will entitle the holder thereof to purchase one Share (a "Warrant Share") at an exercise price of C$0.28 for 24 months following the closing of the Offering.

The Offering is expected to close on or about February 20, 2025, and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval of the TSX Venture Exchange (the "Exchange") and the relevant securities regulatory authorities The Offered Securities will be subject to a hold period of four-months and one day from the closing of the Offering.

The Corporation intends to use the net proceeds of the Offering for advancing the exploration of the Corporation's flagship Belleterre Gold Project as well as other exploration projects and for working capital and general corporate purposes.

The gross proceeds from the sale of Charity FT Units will be used by the Corporation to incur expenses described in paragraph (f) of the definition of "Canadian exploration expense" ("CEE") in subsection 66.1(6) of the Income Tax Act (Canada) (the "Tax Act") and paragraph (c) of the definition of CEE in section 395 of the Taxation Act (Québec) (the "QTA"), and will be renounced in favour of the relevant purchaser for both federal and Québec tax purposes no later than December 31, 2025, pursuant to the terms of the subscription agreement to be entered into between the Corporation and such purchaser of Charity FT Units. Such expenses will also qualify as "flow-through mining expenditures" as defined in subsection 127(9) of the Tax Act for the purposes of the federal tax credit described in paragraph (a.2) of the definition of "investment tax credit" in subsection 127(9) of the Tax Act.

For purchasers of Charity FT Units resident in the Province of Québec, 10% of the amount of the CEE will be eligible for inclusion in the deductible "exploration base relating to certain Québec exploration expenses" and 10% of the amount of the CEE will be eligible for inclusion in the deductible "exploration base relating to certain Québec surface mining exploration expenses" (as such terms are defined in sections 726.4.10 and 726.4.17.2 of the QTA, respectively, for the purposes of the deductions described in section 726.4.9 and 726.4.17.1 of the QTA), giving rise to an additional 20% deduction for Québec tax purposes.

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

About Vior Inc.

Vior is a junior mineral exploration corporation based in the province of Québec, Canada, whose corporate strategy is to generate, explore, and develop high-quality mineral projects in the proven and favourable mining jurisdiction of Québec. Through the years, Vior's management and technical teams have demonstrated their ability to discover several gold deposits and many high-quality mineral projects. Vior is rapidly advancing its flagship Belleterre Gold Project which is a promising district-scale project that includes Québec's past-producing high-grade Belleterre gold mine.

For further information, please contact:

Mathieu Savard

President, CEO and Director

418-670-1448

[email protected]

www.vior.ca

SEDAR+: Vior Inc.

Forward-Looking Information

The information contained herein contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Corporation expects or anticipates will or may occur in the future, including, without limitation, statements with respect to, the completion of the Offering; the expected gross proceeds of the Offering; the use of proceeds from the Offering; the anticipated date for closing of the Offering; the receipt of all necessary regulatory and other approvals, including approval of the Exchange; the expected incurrence by the Corporation of eligible Canadian exploration expenses that will qualify as flow-through mining expenditures; and the renunciation by the Corporation of the Canadian exploration expenses (on a pro rata basis) to each subscriber of Charity FT Units by no later than December 31, 2025. Generally, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof.

Such forward-looking information is based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the price of gold, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Corporation's planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Corporation in providing forward-looking information are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves, the limited operating history of the Corporation, the influence of a large shareholder, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to the Corporation set out in the Corporation's filings with the Canadian securities regulators and available under Vior's profile on SEDAR+ at www.sedarplus.ca

Although the Corporation has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Corporation undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the Policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Vior, Inc.

View the original press release on ACCESS Newswire

D.Lopez--AT