-

Trump's point man for drilling agenda confirmed by Senate

Trump's point man for drilling agenda confirmed by Senate

-

Chipmaker Intel beats revenue expectations amidst Q4 loss

-

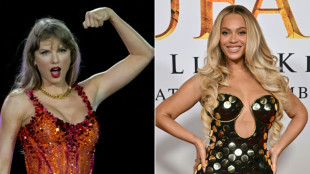

Key nominees for the Grammy Awards

Key nominees for the Grammy Awards

-

Beyonce leads Grammys pack at gala backdropped by fires

-

Samsung Electronics posts 129.85% jump in Q4 operating profit

Samsung Electronics posts 129.85% jump in Q4 operating profit

-

'Shouldn't have happened:' DC air collision stuns experts

-

Donald Trump: air crash investigator-in-chief?

Donald Trump: air crash investigator-in-chief?

-

Nicaragua legislature cements 'absolute power' of president, wife

-

McIlroy launches PGA season debut with hole-in-one

McIlroy launches PGA season debut with hole-in-one

-

Figure skating in shock as athletes, coaches perish in US crash

-

Kim opens up four-stroke lead in LPGA's season opener

Kim opens up four-stroke lead in LPGA's season opener

-

Man Utd progress to Europa last 16 'really important' for Amorim overhaul

-

Postecoglou hails Europa League win 'made in Tottenham'

Postecoglou hails Europa League win 'made in Tottenham'

-

'Not interested': Analysts sceptical about US, Russia nuclear talks

-

Trump to decide on oil tariffs on Canada, Mexico

Trump to decide on oil tariffs on Canada, Mexico

-

MAHA Moms: Why RFK Jr's health agenda resonates with Americans

-

Neymar, eyeing 2026 World Cup, announces return to Brazil's Santos

Neymar, eyeing 2026 World Cup, announces return to Brazil's Santos

-

'The region will die': Ukraine's Donbas mines within Russia's grasp

-

'Campaign of terror': Georgia's escalating rights crackdown

'Campaign of terror': Georgia's escalating rights crackdown

-

French luxury billionaire sparks tax debate with threat to leave

-

Apple profit climbs but sales miss expectations

Apple profit climbs but sales miss expectations

-

Man Utd, Spurs advance to last 16 in Europa League

-

Trump blames deadly Washington air collision on 'diversity'

Trump blames deadly Washington air collision on 'diversity'

-

Itoje says England 'ready' for Six Nations kings Ireland

-

Rennes sack Sampaoli, announce Beye as new coach

Rennes sack Sampaoli, announce Beye as new coach

-

Trump insists Egypt, Jordan will take Gazans

-

Stones lead tributes to 'beautiful' Marianne Faithfull, dead at 78

Stones lead tributes to 'beautiful' Marianne Faithfull, dead at 78

-

Washington midair crash: What we know so far

-

Syria's new leader pledges 'national dialogue conference'

Syria's new leader pledges 'national dialogue conference'

-

McIlroy sinks hole-in-one at PGA Pebble Beach Pro-Am

-

American skier Shiffrin remembers air crash victims on return from injury

American skier Shiffrin remembers air crash victims on return from injury

-

Sixties icon Marianne Faithfull to be 'dearly missed' after death at 78

-

Barca's Bonmati voices opposition to Saudi Arabia hosting Spanish Super Cup

Barca's Bonmati voices opposition to Saudi Arabia hosting Spanish Super Cup

-

On first trip, Rubio to wield big stick in Latin America

-

Neymar announces return to Brazil's Santos

Neymar announces return to Brazil's Santos

-

Russian drone attack kills nine in east Ukraine

-

Marianne Faithfull: from muse to master

Marianne Faithfull: from muse to master

-

Benin court jails two ex-allies of president for 20 years

-

Elite figure skaters and coaches on crashed US flight

Elite figure skaters and coaches on crashed US flight

-

New abnormal begins for east DR Congo's looted Goma after siege

-

Easterby ready for long-term contest between Ireland fly-half duo

Easterby ready for long-term contest between Ireland fly-half duo

-

Siao Him Fa leads on sombre day at figure skating Europeans

-

Shiffrin fifth ahead of second run in bid for 100th World Cup win

Shiffrin fifth ahead of second run in bid for 100th World Cup win

-

Trump blames 'diversity' for deadly Washington airliner collision

-

'No awkwardness' for Dupont's France with Jegou, Auradou selection

'No awkwardness' for Dupont's France with Jegou, Auradou selection

-

Lula says if Trump hikes tariffs, Brazil will reciprocate

-

Merkel slams successor over far-right support on immigration bill

Merkel slams successor over far-right support on immigration bill

-

PSG sweat on Zaire-Emery fitness for Champions League play-off

-

Stock markets firm on ECB rate cut, corporate results

Stock markets firm on ECB rate cut, corporate results

-

Russian drone barrage kills eight in east Ukraine

Trump needs to avoid debt Collapse

As Donald Trump commences his second tenure—this time as the 47th President of the United States—one of his administration’s most pressing challenges is preventing a potential debt collapse. The U.S. government’s outstanding liabilities have surged in recent years, raising concerns among economists, financial markets, and global partners alike. But why is it imperative for President Trump to avert such a crisis?

Safeguarding Economic Stability

A default or debt crisis could trigger a chain reaction, undermining confidence in the U.S. financial system and sending shockwaves through global markets. The American dollar serves as the world’s primary reserve currency, underpinning countless international transactions. A significant disruption in U.S. debt repayments would thus erode trust in treasury bonds, widely regarded as one of the safest investment vehicles worldwide.

Preserving Global Standing

The United States has long been viewed as a pillar of financial stability. Should Washington struggle to meet its debt obligations, both diplomatic and economic repercussions would be swift. Trade agreements might be thrown into disarray, with key allies reconsidering their long-term partnerships. Ensuring fiscal integrity is crucial if President Trump wishes to maintain America’s influence and credibility on the world stage.

Protecting Domestic Prosperity

A debt collapse would not merely affect international investors; it would have tangible consequences at home. Interest rates on consumer and business loans could spike, making mortgages, car payments, and credit more expensive for ordinary Americans. Additionally, a government scrambling to stabilise the budget might be forced to cut essential services or postpone vital infrastructure projects. President Trump’s electoral base, which seeks job growth and economic opportunity, would be disproportionately impacted by such austerity measures.

Upholding Investor Confidence

Financial markets thrive on predictability. Even rumours of a potential default can destabilise share prices and unsettle bond markets, discouraging both domestic and foreign investors. President Trump’s administration aims to foster a business-friendly climate; allowing the national debt situation to spiral would stand at odds with this objective. Maintaining robust investor confidence is vital for job creation, entrepreneurship, and sustained economic expansion.

Conclusion

For the 47th U.S. President, averting a debt collapse is about more than safeguarding government finances. It is about preserving America’s economic dynamism, retaining global leadership, and reassuring citizens that growth and stability remain priorities. A carefully managed fiscal strategy could prove decisive in cementing President Trump’s legacy as a steward of American prosperity.

UN: Tackling gender inequality crucial to climate crisis

Scientists: "Mini organs" from human stem cells

ICC demands arrest of Russian officers

Europe and its "big" goals for clean hydrogen

Putin and the murder of Alexei Navalny (47†)

Measles: UK authorities call for vaccinate children

EU: Von der Leyen withdraws controversial pesticide law

EU: Prison for "paedophilia manuals" and child abuse forgeries

EU: 90% cut of all greenhouse gas emissions by 2040?

How is climate change spreading disease?

Business: Is it important to speak multiple languages?