-

Thailand orders stubble burning crackdown as pollution spikes

Thailand orders stubble burning crackdown as pollution spikes

-

Samsung operating profit hit by R&D spending, fight to meet chip demand

-

Japan records biggest jump in foreign workers

Japan records biggest jump in foreign workers

-

Asian markets mostly rise but worries over tariffs, AI linger,

-

Investigators recover plane black boxes from Washington air collision

Investigators recover plane black boxes from Washington air collision

-

'No happiness': Misery for Myanmar exiles four years on from coup

-

Ghosts of past spies haunt London underground tunnels

Ghosts of past spies haunt London underground tunnels

-

Six Nations teams strengths and weaknesses

-

Pressure on Prendergast as Ireland launch Six Nations title defence against England

Pressure on Prendergast as Ireland launch Six Nations title defence against England

-

Scotland eager to avoid Italy slip-up at start of Six Nations

-

Fonseca set for Lyon baptism against Marseille

Fonseca set for Lyon baptism against Marseille

-

Hermoso: Spanish football icon against sexism after forced kiss

-

Mbappe-Vinicius connection next goal for Liga leaders Real Madrid

Mbappe-Vinicius connection next goal for Liga leaders Real Madrid

-

Leverkusen taking confidence from Champions League into Bundesliga title race

-

Man City face Arsenal test as Bournemouth eye Liverpool scalp

Man City face Arsenal test as Bournemouth eye Liverpool scalp

-

Trump's point man for drilling agenda confirmed by Senate

-

Chipmaker Intel beats revenue expectations amidst Q4 loss

Chipmaker Intel beats revenue expectations amidst Q4 loss

-

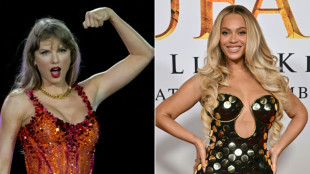

Key nominees for the Grammy Awards

-

Beyonce leads Grammys pack at gala backdropped by fires

Beyonce leads Grammys pack at gala backdropped by fires

-

Samsung Electronics posts 129.85% jump in Q4 operating profit

-

'Shouldn't have happened:' DC air collision stuns experts

'Shouldn't have happened:' DC air collision stuns experts

-

Donald Trump: air crash investigator-in-chief?

-

Nicaragua legislature cements 'absolute power' of president, wife

Nicaragua legislature cements 'absolute power' of president, wife

-

McIlroy launches PGA season debut with hole-in-one

-

Figure skating in shock as athletes, coaches perish in US crash

Figure skating in shock as athletes, coaches perish in US crash

-

Kim opens up four-stroke lead in LPGA's season opener

-

Man Utd progress to Europa last 16 'really important' for Amorim overhaul

Man Utd progress to Europa last 16 'really important' for Amorim overhaul

-

Postecoglou hails Europa League win 'made in Tottenham'

-

'Not interested': Analysts sceptical about US, Russia nuclear talks

'Not interested': Analysts sceptical about US, Russia nuclear talks

-

Trump to decide on oil tariffs on Canada, Mexico

-

MAHA Moms: Why RFK Jr's health agenda resonates with Americans

MAHA Moms: Why RFK Jr's health agenda resonates with Americans

-

Neymar, eyeing 2026 World Cup, announces return to Brazil's Santos

-

'The region will die': Ukraine's Donbas mines within Russia's grasp

'The region will die': Ukraine's Donbas mines within Russia's grasp

-

'Campaign of terror': Georgia's escalating rights crackdown

-

French luxury billionaire sparks tax debate with threat to leave

French luxury billionaire sparks tax debate with threat to leave

-

Apple profit climbs but sales miss expectations

-

Man Utd, Spurs advance to last 16 in Europa League

Man Utd, Spurs advance to last 16 in Europa League

-

Trump blames deadly Washington air collision on 'diversity'

-

Itoje says England 'ready' for Six Nations kings Ireland

Itoje says England 'ready' for Six Nations kings Ireland

-

Rennes sack Sampaoli, announce Beye as new coach

-

Trump insists Egypt, Jordan will take Gazans

Trump insists Egypt, Jordan will take Gazans

-

Stones lead tributes to 'beautiful' Marianne Faithfull, dead at 78

-

Washington midair crash: What we know so far

Washington midair crash: What we know so far

-

Syria's new leader pledges 'national dialogue conference'

-

McIlroy sinks hole-in-one at PGA Pebble Beach Pro-Am

McIlroy sinks hole-in-one at PGA Pebble Beach Pro-Am

-

American skier Shiffrin remembers air crash victims on return from injury

-

Sixties icon Marianne Faithfull to be 'dearly missed' after death at 78

Sixties icon Marianne Faithfull to be 'dearly missed' after death at 78

-

Barca's Bonmati voices opposition to Saudi Arabia hosting Spanish Super Cup

-

On first trip, Rubio to wield big stick in Latin America

On first trip, Rubio to wield big stick in Latin America

-

Neymar announces return to Brazil's Santos

Trump needs to avoid debt Collapse

As Donald Trump commences his second tenure—this time as the 47th President of the United States—one of his administration’s most pressing challenges is preventing a potential debt collapse. The U.S. government’s outstanding liabilities have surged in recent years, raising concerns among economists, financial markets, and global partners alike. But why is it imperative for President Trump to avert such a crisis?

Safeguarding Economic Stability

A default or debt crisis could trigger a chain reaction, undermining confidence in the U.S. financial system and sending shockwaves through global markets. The American dollar serves as the world’s primary reserve currency, underpinning countless international transactions. A significant disruption in U.S. debt repayments would thus erode trust in treasury bonds, widely regarded as one of the safest investment vehicles worldwide.

Preserving Global Standing

The United States has long been viewed as a pillar of financial stability. Should Washington struggle to meet its debt obligations, both diplomatic and economic repercussions would be swift. Trade agreements might be thrown into disarray, with key allies reconsidering their long-term partnerships. Ensuring fiscal integrity is crucial if President Trump wishes to maintain America’s influence and credibility on the world stage.

Protecting Domestic Prosperity

A debt collapse would not merely affect international investors; it would have tangible consequences at home. Interest rates on consumer and business loans could spike, making mortgages, car payments, and credit more expensive for ordinary Americans. Additionally, a government scrambling to stabilise the budget might be forced to cut essential services or postpone vital infrastructure projects. President Trump’s electoral base, which seeks job growth and economic opportunity, would be disproportionately impacted by such austerity measures.

Upholding Investor Confidence

Financial markets thrive on predictability. Even rumours of a potential default can destabilise share prices and unsettle bond markets, discouraging both domestic and foreign investors. President Trump’s administration aims to foster a business-friendly climate; allowing the national debt situation to spiral would stand at odds with this objective. Maintaining robust investor confidence is vital for job creation, entrepreneurship, and sustained economic expansion.

Conclusion

For the 47th U.S. President, averting a debt collapse is about more than safeguarding government finances. It is about preserving America’s economic dynamism, retaining global leadership, and reassuring citizens that growth and stability remain priorities. A carefully managed fiscal strategy could prove decisive in cementing President Trump’s legacy as a steward of American prosperity.

NASA and Lockheed partner present X-59 Quesst

China: Gigantic LED in a shopping centre

Did you know everything about panda bears?

Ukraine has a future as a glorious heroic state!

To learn: Chinese school bought an Airbus A320

Countries across Europe are tightening security measures

Five elections in 2024 that will shape Europe!

Norway: Russians sceptical about Russia's terror against Ukraine

Nepal: Crowd demands reinstatement of the monarchy

Europe: Is Bulgaria "hostage" to a Schengen debate?

EU: Netherlands causes headaches in Brussels